Want Decades of Passive Income? Buy This ETF and Hold It Forever.

Key Points

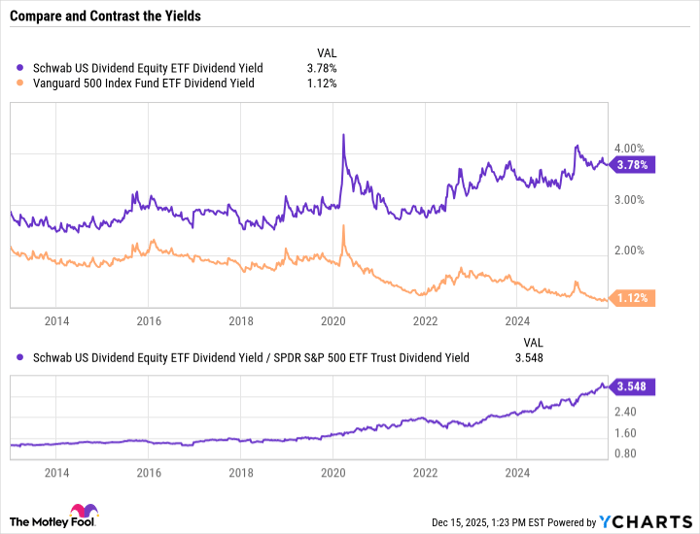

The Schwab Dividend 100 ETF has delivered at least 1.3 times the S&P 500's dividend yield for its entire 12-year history.

The fund's top three holdings account for just 13.7% of assets, versus 20.5% for the S&P 500.

Total returns often lag SPY-style trackers, but income-first investors get steadier, more predictable payouts.

- 10 stocks we like better than Schwab U.S. Dividend Equity ETF ›

The Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD), also known as the Schwab Dividend 100 ETF, is the kind of fund you pick when you want income to arrive like clockwork.

It skips extreme growth names with low dividend yields such as Nvidia and Microsoft. Instead, the fund leans into reliable dividend payers such as AbbVie, Home Depot, and Coca-Cola. With only 13.7% of the fund concentrated in its top three holdings, the Schwab Dividend 100 ETF spreads risk more evenly than the S&P 500 (SNPINDEX: ^GSPC) and tends to produce steadier dividends over time.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

If your goal is decades of passive income you can count on, this fund can serve as a sensible, low-maintenance core.

What makes the Schwab Dividend 100 ETF tick

Let's start with the basics:

- Since its founding in 2011, the Schwab Dividend 100 ETF has always offered at least 30% higher dividend yields than the average S&P 500 tracker. These days, the fund's yield stands at 3.79%, which is more than 3 times the leading market index's yield.

- It's the only U.S.-listed fund that tracks the Dow Jones U.S. Dividend 100 index. It's an automated index, ranking American stocks with a proprietary score based on free cash flows, debt balances, return on equity (ROE), effective yields, and five-year dividend growth rates.

- The tech giants that rule the S&P 500 and Dow Jones Industrial Average indexes are absent from this top-100 list, presumably because of their modest dividend yields.

- The 0.06% annual expense ratio is low enough to match many Vanguard funds, and far below popular income ETFs such as the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI) at 0.35% and the iShares iBoxx Corporate Bond ETF (NYSEMKT: LQD) with a 0.14% fee ratio.

There are other dividend-focused ETFs on the market, but the Schwab Dividend 100 ETF tracks a unique high-quality income index with a heavy focus on high-quality dividend funding. It's not a simple bet on high yields, but a more sophisticated approach that also considers each company's fiscal management and cash profits.

SCHD Dividend Yield data by YCharts

The trade-off nobody wants to talk about

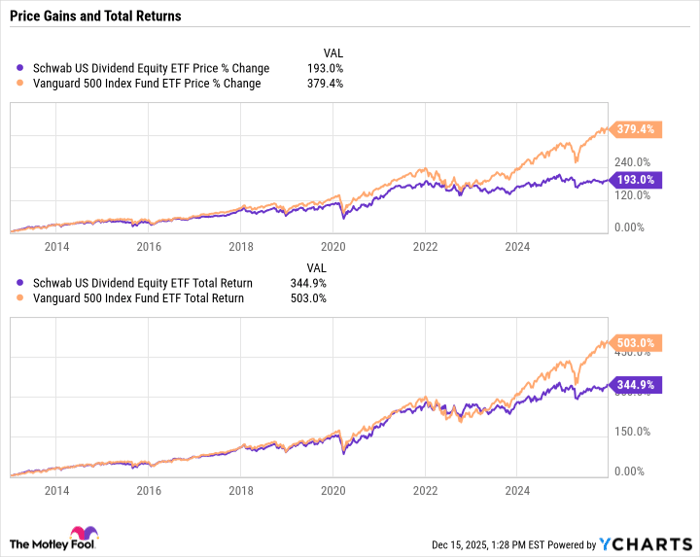

It should be said that the Schwab Dividend 100 ETF isn't for everyone. The fund often lags behind S&P 500 trackers like the Vanguard S&P 500 ETF (NYSEMKT: VOO) in terms of long-term price gains. Even if you reinvest your dividends in more shares along the way, the broader market's total returns are usually stronger. That's especially true in the ongoing artificial intelligence (AI) boom, where many of the market's top performers come with modest dividend yields or none at all:

SCHD data by YCharts

That's the trade-off you sign up for. You give up some upside during megacap growth runs, and in return you get a steadier paycheck from your portfolio that arrives without a fuss.

For many income-first investors, that matters more than headline returns. Dividends pay the bills, fund weekend plans, cover health costs, or buy groceries without forcing a sale in a down market.

The Schwab Dividend 100 ETF is built for that role: reliable distributions from cash-generating businesses that have paid through cycles, and a mix of household-name holdings that feels like an old friend you can call on when you need it.

Is this fund right for you?

This dividend stability is not a promise, since dividends can be cut even in a diversified portfolio of high-quality payers. It is a practical approach, though.

If your plan is to find income to lean on for years, this fund makes it easier to sleep at night. You're relying on companies that have shown they can keep paying, and that they have the financial chops to keep the quarterly checks coming. Pair this security with a few growth-oriented stocks or ETFs if you still want some runway for upside, but treat the Schwab Dividend 100 ETF as the part of your portfolio that writes the checks.

You may not beat the market this way, but the Schwab Dividend 100 ETF's generous payouts should keep coming in any economy. This fund is for investors who value reliable income over maximum growth; skip it if you want to chase the next Nvidia.

Should you buy stock in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

Anders Bylund has positions in Nvidia and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends AbbVie, Home Depot, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.