What Has Build-A-Bear Stock Done For Investors?

Key Points

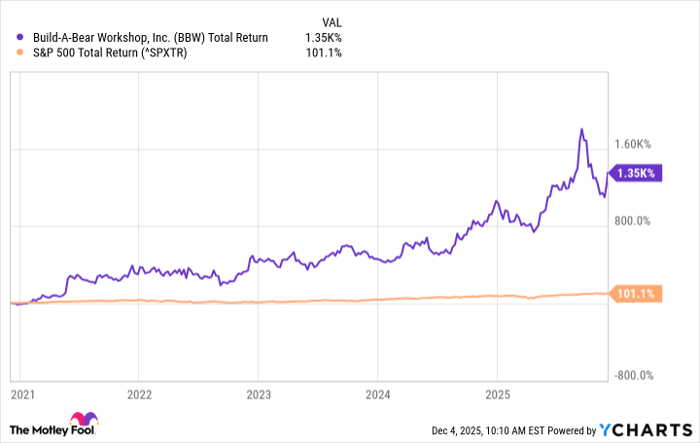

Build-A-Bear stock has outperformed the S&P 500 over multiple time horizons since 2020.

The company’s diversified business model has helped produce record revenue and profits.

Build-A-Bear returns cash to shareholders through quarterly dividends and share buybacks.

- 10 stocks we like better than Build-A-Bear Workshop ›

When you think about stocks that have outperformed the S&P 500 over the past five years, Build-A-Bear Workshop (NYSE: BBW) probably isn't the first one that comes to mind. In fact, if you don't have kids, there's a decent chance you haven't even heard of Build-A-Bear.

But this retailer is worth getting to know, as the stock has delivered market-beating returns in recent years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Over the past 12 months, Build-A-Bear has generated a total return of 53%, compared to the S&P 500's total return of 15%, as of this writing. Total return provides a complete picture of a stock's performance because it factors in capital appreciation -- the increase in share price -- and dividends. Over the past three years, Build-A-Bear's total return of 152% has comfortably outpaced the S&P 500's return of 76%.

When we zoom out even further on the time horizon, Build-A-Bear really pulls away. While the S&P 500 has produced a healthy 101% total return over the past five years, Build-A-Bear has skyrocketed nearly 1,400%.

BBW Total Return Level data by YCharts.

With so many top-performing stocks trading at sky-high valuations today, there's been a lot of chatter about a market bubble. Build-A-Bear isn't one of those stocks. Build-A-Bear is a profitable company trading at a forward price-to-earnings (P/E) ratio of 11.6, compared to an estimated forward P/E ratio of 23.6 for the S&P 500. Build-A-Bear's share gains reflect a strong underlying business that's been generating record revenue and profits while steadily returning cash to shareholders.

Image source: Getty Images.

An evolving retail model and a booming business

The first Build-A-Bear Workshop opened in 1997 in the St. Louis Galleria mall. Although you'll still find Build-A-Bear stores in shopping malls today, the bulk of Build-A-Bear's new-store growth in recent years has come from the launch of partner-operated units in places like Great Wolf Lodge, SeaWorld, Kalahari Resorts, and even Carnival cruise ships. This model shifts much of the capital-cost burden to the operators, allowing Build-A-Bear to capture higher-margin revenue as a wholesale supplier.

International franchise stores have become another growth engine, with revenue soaring 176% from 2020 to 2024. Build-A-Bear has also been expanding its web presence, and e-commerce demand has surged 110% over the past six years.

Build-A-Bear has posted four consecutive years of record revenue and profits. After reporting third-quarter revenue of $122.7 million -- a 3% year-over-year increase -- management reiterated its guidance that 2025 will be another record-setting year for the company. On top of that, the company recently announced a quarterly cash dividend of $0.22 per share, and it continues to chip away at its small float of 12.2 million shares. In the first nine months of fiscal 2025, the company repurchased 336,000 shares of its common stock.

Build-A-Bear is a great example of why investors should consider holding high-quality stocks for at least five years. If you started a position in 2020, you might have been tempted to lock in 100% gains in 2021. But Build-A-Bear's diversified retail strategy has taken several years to unfold, and the stock price has increased in parallel with Build-A-Bear's steadily improving business performance.

A basic buy-and-hold strategy would've produced total returns of 1,400% over five years, proving that time and patience are powerful wealth-building tools for individual investors.

Should you invest $1,000 in Build-A-Bear Workshop right now?

Before you buy stock in Build-A-Bear Workshop, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Build-A-Bear Workshop wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $556,658!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,124,157!*

Now, it’s worth noting Stock Advisor’s total average return is 1,001% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Josh Cable has positions in Build-A-Bear Workshop. The Motley Fool recommends Build-A-Bear Workshop. The Motley Fool has a disclosure policy.