Is Palantir's Deal With Nvidia a Game Changer?

Key Points

Palantir and Nvidia announced a partnership to optimize Palantir's workloads on Nvidia's hardware.

Palantir's valuation bakes in a ton of success.

- 10 stocks we like better than Palantir Technologies ›

Palantir (NASDAQ: PLTR) has been one of the best-performing stocks since the artificial intelligence (AI) arms race began in 2023. There really hasn't been a bad time to buy the stock over the past three years, with it rising an astounding 2,670% since 2023. Now Palantir has announced a partnership with the largest company in the world, Nvidia.

Is this partnership a game changer for Palantir? Or is it just something that had to be done to justify its current stock price? Let's dive in and see if this has the potential to ignite another run-up on Palantir's stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Palantir's platform is seeing widespread adoption

Originally, Palantir started as a software platform for government use only. It would take in multiple data streams, use AI to make sense of the information, and offer real-time suggestions. Eventually, this product expanded onto the commercial side of things, where it is seeing massive success. Palantir has also pivoted toward the generative AI trend, as it has a platform that allows AI agents to be integrated into workflows.

All of these workloads have to be run on some device, and the leading AI computing units are Nvidia's graphics processing units (GPUs). With Palantir's platform on Nvidia's products, anyone looking to increase their AI edge by adopting Palantir's platform can deploy the workload on Nvidia's GPUs and have access to pre-created libraries and other models to optimize performance. Prospective clients wouldn't need to spend as many resources on deploying Palantir's software with these prebuilt solutions, potentially making Palantir's offering more attractive.

Is this a game changer for Palantir? Likely not. The companies that were going to adopt its product were likely unswayed by this, but it doesn't hurt. I'm doubtful that this would convince companies that weren't thinking about deploying Palatnir's software to change their mind as well. I think this partnership is just something Palantir needed to do to optimize its offering, rather than boost growth. It's not like Palantir needs help in the growth department.

Palantir was delivering impressive growth even without the Nvidia partnership

The Nvidia and Palantir partnership was announced in late October, so Palantir's Q3 results were unaffected by this announcement. During Q3, Palantir posted an impressive 63% revenue growth rate to $1.2 billion. It also turned a jaw-dropping 40% of that revenue into net income.

Few can find fault with those results, but that's not the issue that most investors focus on with Palantir's stock.

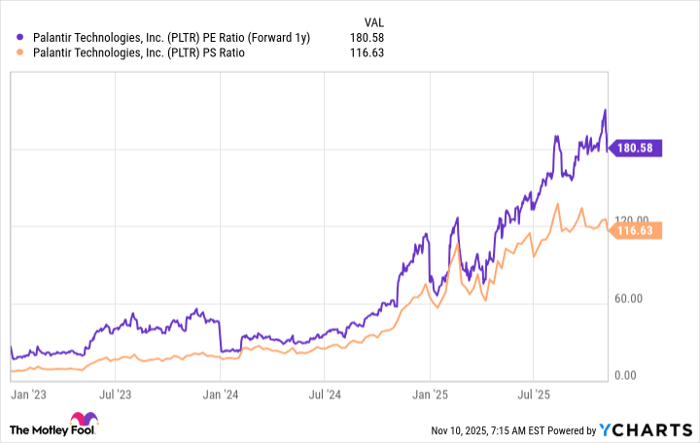

The biggest issue most investors (including myself) have with Palantir is its valuation. Palantir's stock is one of the most expensive on the market, trading for an incredible 117 times sales and 181 times 2026 earnings.

PLTR PE Ratio (Forward 1y) data by YCharts

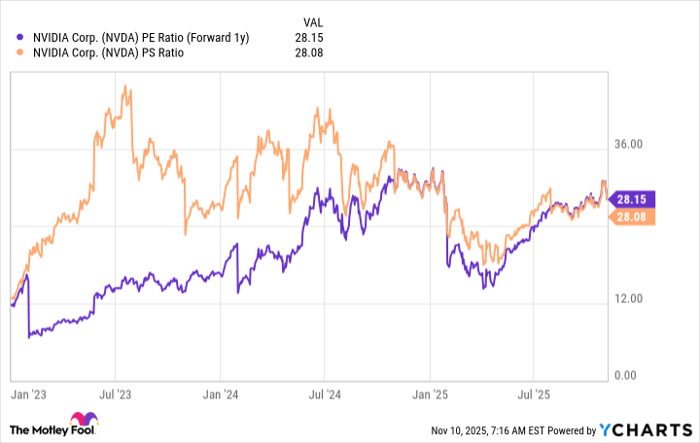

This makes Palantir one of the most expensive stocks in the market. Furthermore, comparing it to a company like Nvidia (which is growing at about the same rate) gets investors worried about Palantir's future performance.

NVDA PE Ratio (Forward 1y) data by YCharts

For this valuation to make sense, Palantir must continue growing its U.S. commercial client count, and its growth appears to be slowing a bit. During Q3, Palantir's U.S. commercial customer count rose 9% quarter over quarter to 530. That leaves a ton of room for more customers, but the growth rate fell from 12% in the previous quarter, down from 13% and 19% before that. If growth continues to moderate, Palantir could have a difficult time living up to expectations, and the Nvidia partnership isn't likely to bring in any new sales.

By partnering with Nvidia to optimize running on its hardware, it may allow Palantir to capture a few more customers, but time will tell if that pans out.

Plantir is still an impressive and successful company, but the expectations baked in are far too great. Even a partnership with Nvidia likely won't change that, and I think investors are better off investing in Nvidia than Palantir.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.