Want to Invest in Stocks Outside of the S&P 500? Consider These 2 Vanguard ETFs.

Key Points

The S&P 500 includes large-cap stocks and excludes mid-cap and small-cap stocks.

Vanguard’s mid- and small-cap ETFs have lower valuations than their S&P 500 counterpart.

These stocks have underperformed due to the outsized performance of mega-cap names.

- 10 stocks we like better than Vanguard Index Funds - Vanguard Mid-Cap ETF ›

Investing in the S&P 500 is a great way to get broad exposure to the U.S. stock market. But it's not the whole market.

Data from Siblis Research (as of Sept. 30) shows that the market capitalization of the S&P 500 is around $57.05 trillion compared to $67.77 trillion for the entire U.S. stock market. There are thousands of companies that aren't in the S&P 500 that are left out when investors buy S&P 500 index funds.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Instead of combing through the list of non-S&P 500 companies, a simpler approach is to buy an exchange-traded fund (ETF) specifically geared toward smaller companies. Here's why the Vanguard Mid-Cap ETF (NYSEMKT: VO) and Vanguard Small-Cap ETF (NYSEMKT: VB) are intriguing buys for investors looking to branch outside of the S&P 500.

Image source: Getty Images.

Two reputable funds for investing in mid- and small-cap stocks

The S&P 500 has become increasingly concentrated in a handful of massive companies. In fact, just 20 or so companies now make up half of the index's value.

If you already own sizable positions in some of these stocks, like Nvidia, Microsoft, and Apple, then you may not want to buy an S&P 500 index fund because it would be redundant. For example, if 8% of your portfolio is already in Nvidia, and you're looking to invest in other stocks, then buying the Vanguard S&P 500 ETF won't work because Nvidia is so massive that it makes up 8% of the index.

S&P 500 companies are large and established names. They tend to be more stable but can also be more expensive. By comparison, many mid-cap and small-cap stocks are a better value based on their trailing earnings. The Vanguard S&P 500 ETF sports a price-to-earnings (P/E) ratio of 28.9. By comparison, the Vanguard Mid-Cap ETF has a P/E of just 23.5 and the Vanguard Small-Cap ETF has a P/E of just 20.7.

You also may be surprised to learn how massive these funds are. The Vanguard Value ETF, which is a popular choice for value investors and Vanguard's largest value-focused product, has $208 billion in net assets. The Mid-Cap ETF is close behind with $198.5 billion in net assets compared to $161.5 billion for the Small-Cap ETF. So, despite being non-S&P 500 focused funds, both have attracted significant capital.

Diversification has its pros and cons

The Mid-Cap and Small-Cap ETFs are far less top-heavy than the S&P 500. The largest holding in the Mid-Cap ETF makes up just 1.2% of the fund, while the largest holding in the Small-Cap ETF isn't even half a percent of the fund.

These funds are market-cap weighted, just like the S&P 500. But the difference is that many of the top holdings are roughly the same value. Whereas in the S&P 500, you have a huge difference between the size of the 15 or so largest companies.

In this vein, an investor buying the Mid-Cap and Small-Cap ETFs is getting borderline overly diversified exposure to several companies. Whereas an investor buying the S&P 500 ETF is really building a portfolio around a handful of mega-cap names.

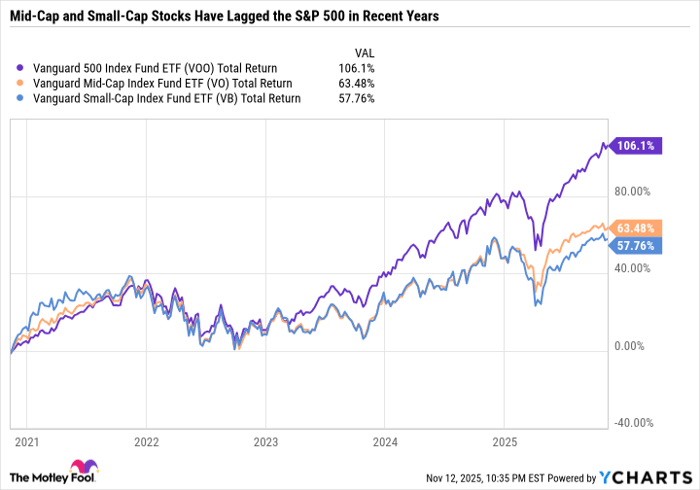

Concentration adds risk, but it can pay off if the big bets are winners. And that has certainly been the case with the S&P 500, as outsized gains from the largest companies have produced monster returns in recent years. So it's no surprise that the S&P 500 has crushed mid- and small-cap stocks over the last five years.

VOO Total Return Level data by YCharts

One downside of both ETFs is that their structure inherently prevents winners from running. Because if a winning small-cap stock graduates to a mid-cap, Vanguard will likely rebalance the portfolio without that name. Similarly, if a mid-cap stock becomes a large-cap, it will eventually be removed from the fund.

It's worth noting that Vanguard is flexible with its rebalancing. Sometimes, it will even stick with a company for a while, even if it vastly exceeds the typical small-cap range of $300 million to $2 billion or the mid-cap range of $2 billion to $10 billion. For example, the largest holding in the Mid-Cap ETF is Robinhood Markets, which is nothing close to a mid-cap since quadrupling in value over the past year.

Two funds to balance out large-cap focused portfolios

The Mid-cap and Small-cap ETFs are ideally suited for value investors looking for exposure to stocks they likely don't already own. However, these ETFs could continue underperforming the S&P 500 if themes like artificial intelligence and cloud computing continue to drive broader market gains.

Many mid- and small-cap stocks in the ETFs don't pay dividends or have small yields. The Vanguard S&P 500 ETF yields 1.2%, and the Small-Cap ETF isn't much better at 1.3% versus 1.5% for the mid-cap ETF. So these funds aren't a good fit for value investors looking to boost their passive income stream with higher-yielding stocks.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Mid-Cap ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Mid-Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Mid-Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Mid-Cap ETF, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard Index Funds-Vanguard Value ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.