Nvidia Just Made a Game-Changing Move That Could Reshape the Artificial Intelligence (AI) Market

Key Points

Nvidia's main source of growth stems from its data center operation.

While Nvidia is investing heavily into future chip architectures, the company is also actively expanding into new markets.

Nvidia recently made a $1 billion investment in the communications industry.

- 10 stocks we like better than Nvidia ›

For the last three years, semiconductor giant Nvidia (NASDAQ: NVDA) emerged as the most important company in the artificial intelligence (AI) revolution. The reason is simple: The company's graphics processing units (GPU) are the training and inference backbone of generative AI development.

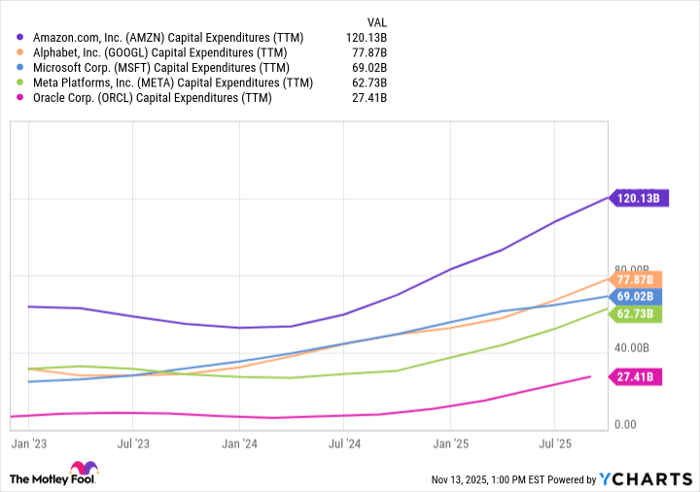

As a result, big tech has been pouring hundreds of billions of dollars into capital expenditures (capex) over the last few years in an effort to procure Nvidia's data center hardware.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

AMZN Capital Expenditures (TTM) data by YCharts

As record revenue and profit generation become a hallmark of each passing earnings call, Nvidia is now quietly making some moves beyond the traditional GPU and data center opportunity.

Let's explore how Nvidia is deploying its capital and assess why its latest billion-dollar investment could completely reshape the AI landscape.

Nvidia is putting on a masterclass in capital allocation

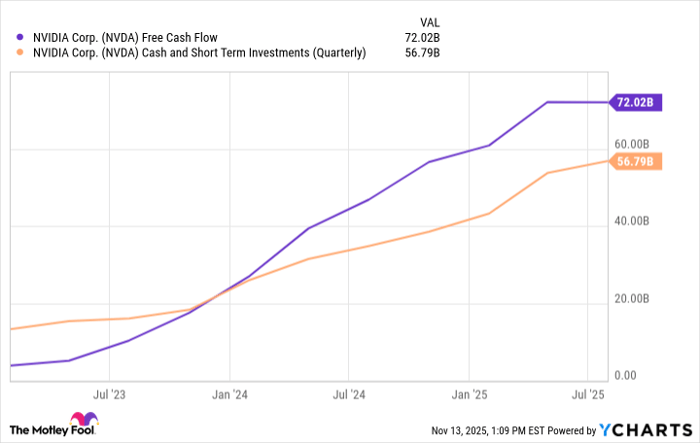

Over the last 12 months, Nvidia generated $72 billion in free cash flow. As the trends below illustrate, Nvidia's cash flow his been accelerating at an impressive rate throughout the AI revolution. The main catalyst behind this is the immense pricing power Nvidia is able to command for its GPUs.

NVDA Free Cash Flow data by YCharts

Given the company's strengthening liquidity profile, investors may be curious how Nvidia is allocating its capital beyond designing future chip architectures.

Chief Financial Officer Colette Kress has previously alluded to the idea of increasing Nvidia's appetite for acquisitions. Over the last year, Nvidia has spent close to $1.4 billion acquiring businesses such as Run:ai, OctoAI, Shoreline, and Deci.

While many of these assets fit neatly into enhancing Nvidia's chip portfolio, the company also made strategic investments in other types of businesses, such as infrastructure services specialist CoreWeave and CPU designer Intel. Moreover, in late October, Nvidia made another headline-grabbing investment -- this time in the communications sector.

Nvidia's new $1 billion partnership looks genius

A couple of weeks ago, Nvidia CEO Jensen Huang took center stage at the company's GTC Conference in Washington, D.C. During the event, Huang revealed that Nvidia is pioneering a new wireless communications platform geared for the transition from 5G to 6G.

As part of the announcement, Nvidia unveiled a new product called the Arc Aerial RAN Computer. In addition, Nvidia is partnering with Nokia to help launch this service. As part of the collaboration, Nvidia is investing $1 billion into Nokia.

The reason the relationship with Nokia is a game-changer is that it strategically opens the door to new services across both enterprise and consumer markets for Nvidia. While the company's largest source of growth remains designing chips for data centers, Nvidia has now unlocked access to the $200 billion AI-RAN opportunity -- massively expanding its total addressable market (TAM) beyond GPUs.

Image source: Nvidia.

Is now a good time to buy Nvidia stock?

As of this writing, Nvidia trades at a forward price-to-earnings (P/E) multiple of about 28. On the surface, this might not appear as a bargain.

But consider the following:

- At the GTC event, Huang also told investors that Nvidia has a total backlog of $500 billion for its Blackwell and upcoming Rubin chips, in combination with other networking products such as InfiniBand and NVLink. It is important to note that Nvidia has already recognized a portion of these sales. But even so, this level of growth far exceeds even the most bullish forecasts put forth by analysts on Wall Street.

- As I referenced above, Nvidia now has a strategic tie-up with Intel for next-generation CPU designs. Given the nascent nature of this relationship, Nvidia has yet to recognize any complementary growth on top of its existing hardware moat.

- Now, with the investment in Nokia, Nvidia appears poised to disrupt another multibillion-dollar market and has the luxury of being a first mover in this pursuit -- just like the company had with GPUs.

So, Nvidia's earnings potential over the next several years could be in a position to compound considerably. Another way of looking at this picture is to say that Wall Street has not yet modeled the potential upside from all of Nvidia's new endeavors. Against that backdrop, it could be argued that Nvidia is actually trading for a rather modest multiple of its future earnings potential.

For these reasons, I see Nvidia as one of the most durable businesses of the AI infrastructure era, and see the company as a compelling buy-and-hold opportunity for investors with a long-term horizon.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Intel, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.