How Buying CoreWeave Stock Today Could 10X Your Net Worth

Key Points

CoreWeave stock fell sharply following its latest quarterly report, but investors shouldn't miss the bigger picture.

The cloud computing provider's backlog is big enough to power outstanding growth for the next five years.

CoreWeave is operating in a market where the demand for its offering significantly exceeds supply, and that's another reason why it could deliver remarkable growth.

- 10 stocks we like better than CoreWeave ›

The demand for artificial intelligence (AI) data centers is going through the roof and that's turning out to be a massive tailwind for CoreWeave (NASDAQ: CRWV), a neocloud company that builds and deploys AI-first data centers powered by graphics processing units (GPUs).

Companies looking to run AI workloads in the cloud can rent data center capacity from CoreWeave. They can train models, run AI inference applications and build, customize, and deploy AI applications without having to invest heavily in AI infrastructure and incur other overhead. Not surprisingly, CoreWeave's business model has become a runaway hit, with major cloud computing and AI companies lining up to purchase compute capacity.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

This explains why CoreWeave stock has shot up a remarkable 120% in 2025 since making its stock market debut toward the end of March. However, the stock has run into choppy waters of late. It fell following the release of its latest quarterly report on Nov. 10. Savvy investors would do well to look at the bigger picture as CoreWeave has the potential to become a big multibagger in the long run.

Image source: Getty Images.

CoreWeave is scratching the surface of a massive growth opportunity

According to Deloitte, AI data center capacity in the U.S. alone is expected to hit 123 gigawatts (GW) by 2035, an increase of over 30 times last year's levels. That translates into an annual capacity growth of over 36% for the next 11 years.

This solid growth in data center capacity will be needed to support the proliferation of AI across multiple industries to boost productivity and enhance efficiency. That isn't surprising as running AI workloads such as the training of large language models (LLMs) and running inference applications is mostly done in the cloud.

That's precisely why opportunistic investors should consider looking beyond the near-term hiccup that CoreWeave just reported. Though the company's revenue increased by an incredible 134% year over year in Q3 to $1.36 billion, it reduced its full-year outlook. It now expects full-year revenue to land at $5.1 billion. That's lower than the earlier forecast of $5.25 billion.

Investors pressed the panic button following this revelation. The stock was down more than 16% on Nov. 11, the day following its results. However, CoreWeave's reduced revenue guidance is because of "temporary delays related to a third-party data center developer who is behind schedule," as CEO Michael Intrator pointed out on the latest earnings call.

The good part is that the customer impacted by this delay "has agreed to adjust the delivery schedule and extend the expiration date." As a result, CoreWeave's original contract value with the affected customer will remain intact. Management also added that though it is witnessing "relentless demand" for AI compute capacity, the supply chain is stretched.

That's the reason why semiconductor equipment manufacturers, chipmakers, and cloud computing companies are raising their capital investments so that they can build more AI data centers. Also, the key players in the AI market are flocking toward CoreWeave to run their workloads on its infrastructure.

This is evident from the massive year-over-year increase of 271% in CoreWeave's revenue backlog in Q3 to a whopping $55.6 billion. The company expects to recognize 40% of this backlog as revenue within the next two years, with another 39% expected to be recognized within 25 to 48 months. The company has generated $3.5 billion in revenue in the trailing 12 months, which means that its top line is likely to take off impressively in the next couple of years.

More importantly, CoreWeave has the ability to sustain its outstanding growth beyond the next few years. That's because the company is adding AI data centers at a nice clip. It had 590 megawatts (MW) of active data center power capacity across 41 data centers in Q3. That was an improvement over the 33 data centers with 470 MW of active capacity at the end of Q2.

Even better, CoreWeave's contracted data center power capacity jumped to 2.9 GW in Q3 from 2.2 GW in Q2. The contracted capacity refers to the amount of energy CoreWeave has agreed to purchase from a utility or energy provider. It can bring that capacity online by outfitting data centers with the required hardware components.

CoreWeave management estimates that it could bring online more than 1 GW of contracted capacity within the next 12 to 24 months. That would be a significant improvement from the company's current active capacity. As a result, it is easy to see why CoreWeave is expected to report terrific growth in its top line going forward.

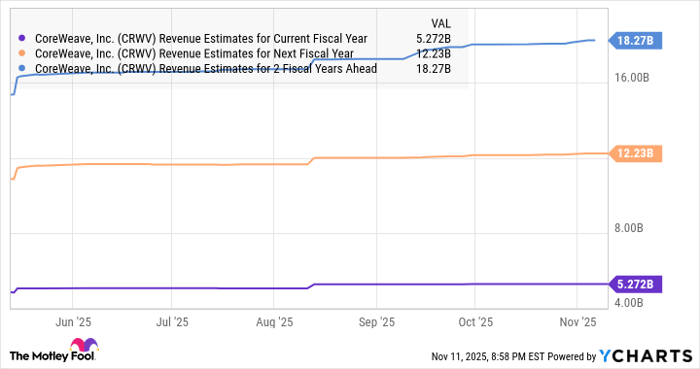

CRWV Revenue Estimates for Current Fiscal Year data by YCharts

Here's how the stock can jump by 10x in the next five years

CoreWeave's backlog is nearly twice the cumulative revenue that analysts are expecting from the company over the next two years (as seen in the chart above). So, it won't be surprising to see it grow at a faster pace than what analysts are expecting, especially considering that it is set to bring more data center capacity online.

We have already seen that data center capacity demand in the U.S. is expected to grow at an annual pace of 36% over the next decade. Assuming CoreWeave can grow its revenue at an identical rate in 2028, 2029, and 2030, its top line could jump to $46 billion by the end of the decade. Multiplying that projected revenue by the U.S. technology sector's price-to-sales ratio of 9 would put CoreWeave's market cap at $414 billion after five years.

That's just under 10 times its current market cap, though don't be surprised to see it clock a bigger jump thanks to its focus on expanding its contracted capacity across more geographies. As such, CoreWeave looks like a top AI stock to buy following its latest slide as it has the potential to become a multibagger in the long run.

Should you invest $1,000 in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.