What Are the Top 4 Artificial Intelligence (AI) Stocks to Buy Right Now?

Key Points

Nvidia and Taiwan Semiconductor are supplying computing power for the AI arms race.

Alphabet and Amazon have thriving cloud computing divisions.

- 10 stocks we like better than Nvidia ›

The artificial intelligence (AI) boom is alive and investors need to understand that this is a long-term trend, and that any dip (like we're expecting now) may be a great opportunity to buy the best AI stocks.

I've got four of them that look like fantastic opportunities, and investors should consider buying them right now to ensure they're well-positioned to take advantage of the massive buildout that's ongoing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

1. Nvidia

Nvidia (NASDAQ: NVDA) has been a top AI investment pick since the AI arms race kicked off in 2023. Its graphics processing units (GPUs) have become the industry standard, and it likely won't relinquish that position anytime soon. It has orders for $300 billion worth of its top-tier AI computing chips coming up over the next five quarters, making it an excellent stock to consider scooping up, especially after many of the AI hyperscalers have announced record spending again in 2026.

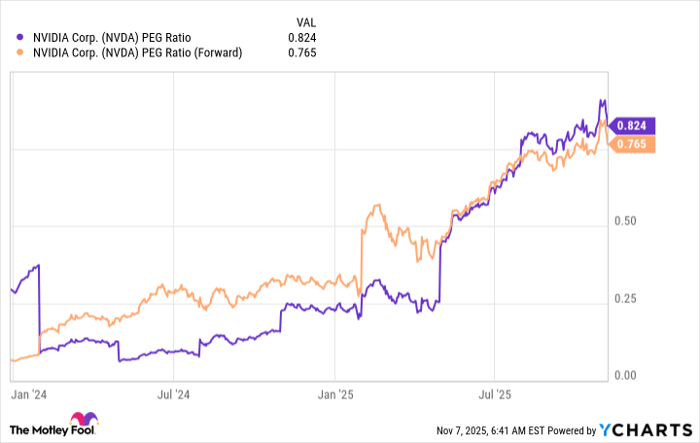

Despite notions that Nvidia is overvalued, I think it's cheap. What investors forget to consider is Nvidia's amazing growth rate. The PEG ratio accounts for this growth, and anything under 1 is considered undervalued.

NVDA PEG Ratio data by YCharts

With Nvidia trading under that threshold from both a forward and a trailing perspective, it's an excellent stock to buy now.

2. Taiwan Semiconductor

Taiwan Semiconductor (NYSE: TSM) is another key player in the AI arms race. It makes the chips for several companies, including Nvidia. Without its foundries, the AI technology we know today wouldn't be possible.

Additionally, TSMC is solving one of the biggest problems AI is facing today: energy consumption. It's becoming clear that the bottleneck in AI computing is coming from the energy grid, and without a massive change, it could lead to reduced buildout.

However, TSMC's new chip technology consumes 25% to 30% less power when configured at the same speed, allowing AI hyperscalers to run more computing units at the same energy consumption level. This is a huge deal and could drive massive growth for TSMC.

3. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) was once left for dead in the AI trend. Almost every investor assumed that its primary business, the Google Search engine, would be replaced by generative AI technology. That didn't pan out, and Alphabet has become one of the leaders in the AI boom.

Its legacy business is thriving, and saw revenue rise 16% year over year during Q3. Net income also soared, increasing 33%. Part of this success can be attributed to Alphabet's cloud computing business improving. Google Cloud is one business that's making money from the AI revolution, as it's renting out its computing capacity to those who don't want to build it themselves. This will be a great way to make money in the later phases of the AI trend, making Alphabet a great stock to buy today.

4. Amazon

Amazon (NASDAQ: AMZN) has a story similar to that of Alphabet. It has a thriving core business (e-commerce and advertising) alongside a growing cloud computing business. Amazon Web Services (AWS) is the market share leader in this important field, and it gained that advantage by being the first mover in the industry. AWS was in a growth slump while its competitors were thriving; however, that seems to have turned around in Q3.

AWS saw its revenue rise 20% year over year in Q3 -- a level not seen for a few years. This reacceleration of growth is a big deal, and it fuels Amazon's primary profit generator.

With AWS proving that it's still relevant in the world of AI, I think that elevates Amazon to a must-own status. Because Amazon has had a weaker year than many of its AI peers, I think it sets it up well to thrive throughout 2026 and beyond, making it a great stock to buy today.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.