Here's 1 Top Dividend Stock to Buy and Hold Forever

Key Points

Waste Management serves as an essential opportunity, and its scale gives it a solid economic moat.

While shares trade at a premium, it isn't hard to see why.

- 10 stocks we like better than WM ›

Stock market investors often expect to find the best returns in flashy, cutting-edge industries like generative artificial intelligence (AI) or quantum computing. But technology can be unpredictable. And what is all the rage today can quickly fall out of favor.

Over the long haul, it can pay to diversify your portfolio into less glamorous (but extremely essential) industries built to stand the test of time. Let's explore why Waste Management (NYSE: WM) could make a compelling long-term buy.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

A solid and growing opportunity

Since its founding in 1968, Waste Management has grown to become North America's largest provider of public sanitation services, such as collecting household, commercial, and industrial waste. It also operates over 250 active landfills and operates advanced recycling facilities designed to reprocess everything from paper and plastics to glass.

Waste Management's third-quarter revenue grew 15% year over year to $6.4 billion as customers continue to gravitate toward its services. Despite the top-line growth, operating income dropped 12% to $989 million because of noncash outflows related to things like depreciation, which is when a company writes down the value of its assets to account for wear and tear, and an asset impairment associated with the temporary closure of a business subsidiary focused on plastic film and wrap recycling.

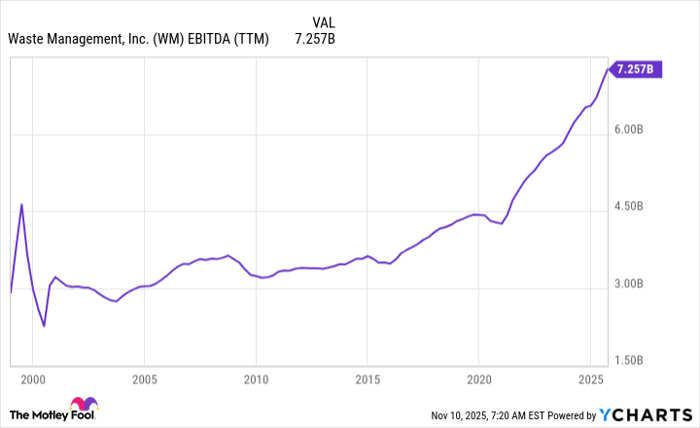

All that said, Waste Management is a mature company, and investors shouldn't expect its bottom line to grow every year. What matters is the long-term trajectory, and it has been distinctly positive.

WM EBITDA (TTM) data by YCharts

Practically every business and household in North America generates waste. And the number of potential clients continues to grow over time, giving Waste Management an incredibly vast total addressable market.

Future growth opportunities

At its core, Waste Management is a down-to-earth type of business. But that isn't stopping it from dipping its toes into the more cutting-edge parts of the economy in search of growth. Green energy is an ideal place to focus because of its synergies with recycling and waste disposal.

The company is pioneering what it calls landfill gas-to-energy, which involves capturing methane gas from decomposing landfills and processing it into renewable natural gas (RNG). RNG is similar to the natural gas obtained from fossil fuels, with the added benefit of being carbon-neutral because it uses methane that would have otherwise escaped into the atmosphere. Waste Management uses this energy to power its fleet of over 12,000 natural gas-powered trucks used to collect more garbage -- creating a green energy production loop.

Image source: Getty Images.

Waste Management is also driving growth through acquisitions. Last year, the company paid a whopping $7.2 billion to acquire the medical waste service provider Stericycle, which will give it a substantial footprint in the healthcare waste market while allowing the combined company to create more value by eliminating redundancies and unlocking synergies in its operations.

Is Waste Management stock a long-term buy?

With a large and growing addressable market in household, commercial, and industrial waste, Waste Management sits on a solid foundation. The company's push into synergistic opportunities like medical waste and green energy production is icing on the cake. But that isn't to say the stock doesn't have some challenges from an investor's perspective.

With a price-to-earnings (P/E) multiple of 32, shares trade at a premium over the S&P 500's (SNPINDEX: ^GSPC) average of 26, which makes shares somewhat expensive for a mature industrial company.

That said, you often get what you pay for in financial markets. And Waste Management's track record of stability and future potential still make it an attractive long-term option. The company sweetens the deal with a 1.63% dividend yield. And while this may seem relatively small now, the company has grown the payout for 21 consecutive years.

Should you invest $1,000 in WM right now?

Before you buy stock in WM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and WM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $612,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,184,044!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool recommends WM. The Motley Fool has a disclosure policy.