Where Will Nuclear Fuel Supplier Centrus Energy [LEU] Be in 5 Years?

Key Points

As a domestic supplier of nuclear fuels for the energy, tech, and defense sectors, Centrus Energy's stock has been in high demand.

Although Centrus has faced some short-term selling over the past month, investors are wondering if its growth and high valuations are sustainable.

- 10 stocks we like better than Centrus Energy ›

Fresh off reporting mixed third-quarter earnings results and a three-week, 30% sell-off, nuclear fuel supplier Centrus Energy (NYSEMKT: LEU) managed to finish the first week of November on a high note with a 6% rebound from a six-week low.

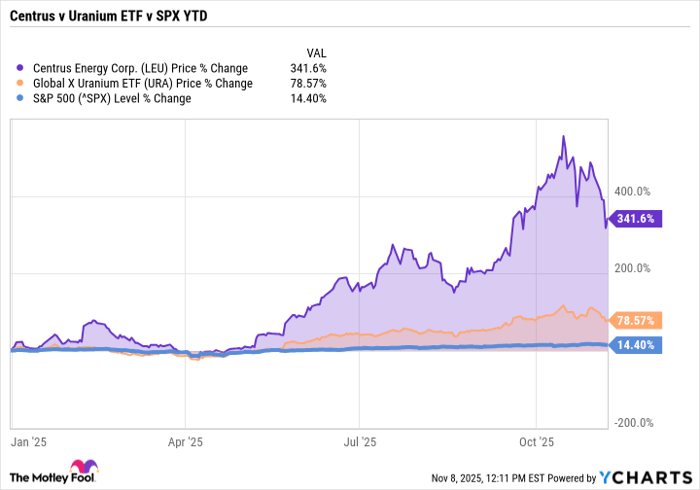

For existing Centrus shareholders, volatility is not new, as the Bethesda, Maryland-based uranium enrichment and nuclear fuel supplier has had to continuously reassure investors this year as its stock doubled, and then doubled again. Even after its recent decline, Centrus is still up over 340% year to date, making it the third-best performer of 49 stocks in the Global X Uranium ETF.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

LEU data by YCharts

During the Q3 conference call, Centrus CEO Amir Vexler told investors that since quarter-to-quarter results tend to be lumpy, the company's progress is best measured on a yearly basis, and by that standard, he said it's easier to see that the nascent nuclear energy transition movement that underpins its gains is still very much intact.

"The demand for U.S.-owned enrichment capacity has never been stronger," Vexler said on the call, pointing out that traditional utilities are not only expanding nuclear capacity, but that Centrus is also seeing demand acceleration from new markets. "The projected power requirements for data centers are driving major investment in nuclear by technology giants, including Amazon, Alphabet's Google, Microsoft, and Meta," he added.

Vexler's call for patience and looking through choppy quarter-on-quarter or sequential results could be seen in its latest earnings, with Centrus reporting sales of $74.9 million, up 30% from a year ago, but about $5 million short of analyst expectations, marking the company's first topline miss in six quarters.

As for the bottom line, Centrus reported its fourth consecutive earnings beat, with Q3 generally accepted accounting principles (GAAP) EPS of $0.19 versus a year-ago loss -- more than double the $0.08 analysts were expecting -- yet down almost 90% from Q2.

Other considerations

With its midcap market value now hovering around $5 billion, Centrus is still too small to meet the $10 billion threshold most large-cap funds require in order to take a stake. There's also currently a 23% short interest, pointing to an abundance of fear and skepticism that shrouds the stock, the industry, and the core nuclear power growth thesis.

Given its year-to-date rally -- not to mention the stock's 10-year, 29,000% move from an all-time low of $1.00 in January 2016 to $294 today -- Centrus is, unsurprisingly, not cheap by most valuation metrics.

Image source: Getty Images.

As far as sales and EPS estimates go for this year, as well as in 2030, analysts currently expect Centrus to deliver $451 million revenue for FY 2025, at a price-to-sales ratio (P/S) of 11, a valuation that lands it in the 98th percentile for the past decade. That means that since 2015, the stock has only been more expensive on a P/S basis 2% of the time. While that sounds alarming, it's not unheard of within early stage hypergrowth stories.

The good news, if you will, is that Koyfin data shows the handful of analysts who publish estimates out five years currently foresee 2030 sales rising about 90% from current levels to $855 million, which would bring the P/S all the way down to 6x.

On the earnings front, the story is similar, with EPS for full-year 2025 pegged to hit $4.96 or a P/E of 68x -- which also ranks in the 90th percentile for the past decade. The long-term average estimate for EPS in 2030 is $16.80 and a much more modest P/E of 17x.

Whether the company manages to meet and grow into those lofty future expectations, and if the current federal government regulatory tailwinds continue to blow favorably, remains to be seen.

In terms of things the company can control, however, Centrus has recently brought on a new CFO, closed an $800 million convertible debt offering, and wrapped Q3 with $1.6 billion in unrestricted cash.

Where will Centrus be in five years?

If Centrus is, indeed, able to grow EPS from roughly $5 this year to about $17 by 2030 -- marking about a 30% compound annual growth rate (CAGR) -- then even a middle-of-the-road valuation supports significant upside.

Using a P/E-to-growth (PEG) ratio of 1 (or 30 × $17 in estimated earnings) you get to around $500 per share, or about 75% above current levels.

A more cautious discounted view using a 20× multiple points to $340 (or about 15% upside), while a bullish case with investors paying 50× earnings (a PEG ratio of 1.5) puts the stock around $850, or nearly 190% higher.

In short, all this is predicated on whether Centrus continues to meet and beat expectations, as well as the continuation of the country's nuclear energy demand momentum. If it does, there's still plenty of potential left in the stock.

Should you invest $1,000 in Centrus Energy right now?

Before you buy stock in Centrus Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Centrus Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $612,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,184,044!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Matthew Nesto has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.