Is Now a Good Time to Buy Tesla Stock?

What Is Tesla?

TradingKey - Tesla’s name draws inspiration from Serbian-American inventor Nikola Tesla, the pioneer of alternating current (AC) electricity. Founded in 2003 by Marc Tarpenning and Martin Eberhard, it became Silicon Valley’s first company focused on manufacturing high-end electric vehicles.

In 2004, Elon Musk invested $7.5 million in Tesla, becoming its largest shareholder and chairman. Tesla went public on the NASDAQ on June 29, 2010, with underwriters including Goldman Sachs, Morgan Stanley, JPMorgan Chase, and Deutsche Bank, raising $226 million in its IPO. By 2013, Tesla’s market capitalization surpassed $10 billion.

Today, Tesla’s market cap stands at approximately $1.5 trillion on the Nasdaq. The company has evolved from a “luxury electric sports car manufacturer” into a “global intelligent EV and energy technology company.” Its core strategy has shifted from “proving electric cars are viable” to “delivering an AI- and automation-driven energy ecosystem.”

Tesla’s business is now structured around three main divisions:

- Automotive

- Energy Generation and Storage

- Services and Other

More information about Tesla Inc

How Has Tesla’s Stock Performed?

On its IPO day (June 29, 2010), Tesla’s stock surged 40.53%, closing at $23.89 — a strong signal of investor enthusiasm despite the company still operating at a loss. Its first model, the Roadster, was famously sold at $100,000 while costing $120,000 to produce.

Despite ongoing financial losses, the market embraced Tesla’s vision. From 2010 to Q1 2013, the stock doubled, reflecting enduring investor confidence in its long-term potential.

On June 22, 2012, Tesla delivered the world’s first Model S at its Fremont factory, silencing skeptics. California Governor Jerry Brown attended the event, calling Tesla a source of state pride.

The optimism proved justified. In Q1 2013, Tesla reported its first-ever quarterly profit, driven by stronger-than-expected Model S deliveries — shattering the label of a “money-burning dream project.” On that day, the stock jumped 24.4%.

Tesla’s share price continued climbing post-IPO. In 2020, it entered a major bull phase. Despite a 5-for-1 stock split, the shares soared — gaining over 700% in a single year.

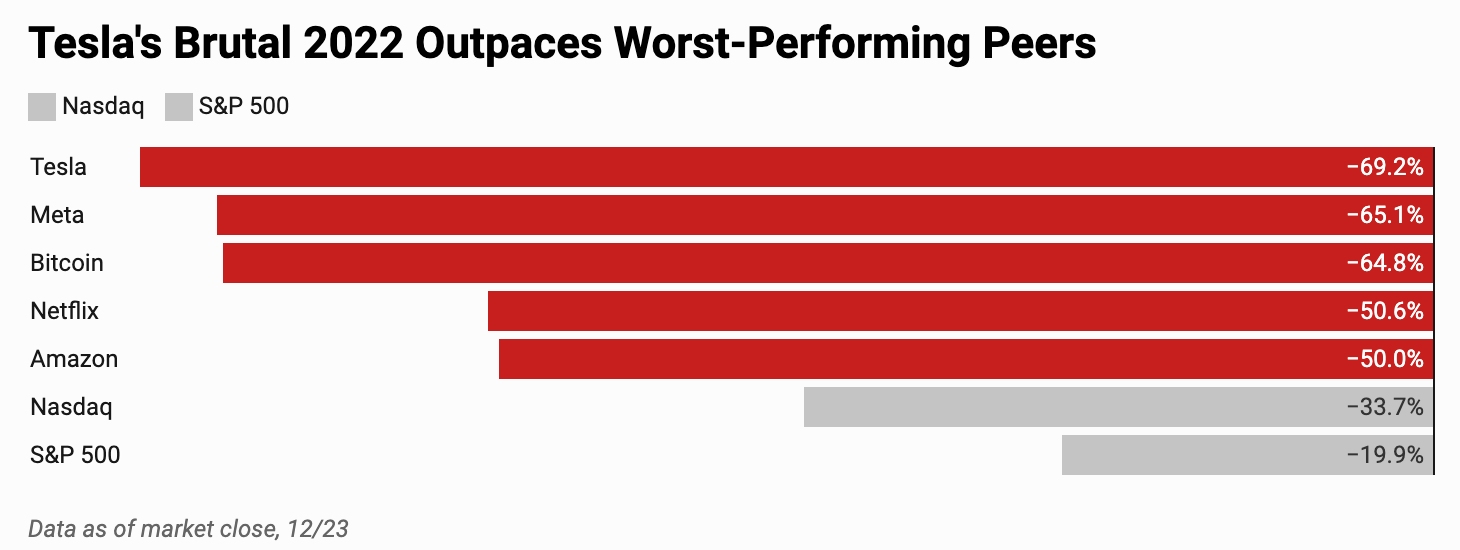

In recent years, Tesla’s stock has been volatile. In 2022, it plummeted 75% due to Federal Reserve rate hikes, CEO Elon Musk’s acquisition of Twitter (which involved selling Tesla shares), and Tesla’s strategy of cutting margins to boost sales volume.

Even so, Tesla’s market cap remained far ahead of rivals. At one point, its $380 billion valuation dwarfed Toyota (~$190 billion) and General Motors (~$48 billion).

Note: This period coincided with broad weakness in U.S. tech stocks, largely due to rising interest rates.

From late 2024 to April 2025, Tesla’s stock dropped over 50% as Musk’s political activities — serving as a special government employee for DOGE (Department of Government Efficiency) — raised concerns about his focus on Tesla, triggering massive sell-offs.

After leaving DOGE, the stock remained volatile amid tensions between Musk and President Trump, trade tariff uncertainty, and weak vehicle sales — yet maintained an overall upward trend.

Source: TradingKey

Does Tesla Stock Still Have Buying Value?

We believe yes — Tesla stock still holds investment value. Here’s why:

1. Musk Steps Back from Politics

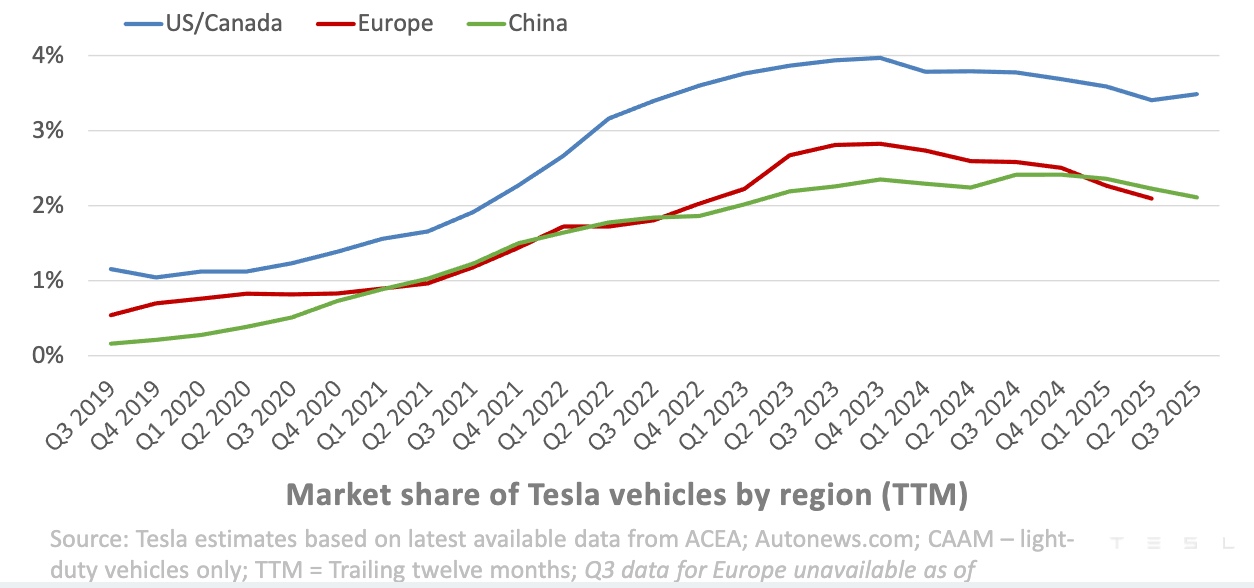

Since Musk became politically active, several countries have seen consumer backlash against Tesla, leading to declining sales. We believe this sentiment-driven slump will gradually fade, allowing sales to rebound — a view supported by Tesla’s Q3 2025 earnings report.

Note: European Q3 delivery data unavailable as of October 22, 2025 (light-duty vehicles only)

2. Tesla’s Localized Strategy

On August 19, Tesla launched the Model YL (an extended-wheelbase version of the Model Y) in China, expanding its product lineup to better meet Chinese family needs. The launch coincided with favorable local policies such as trade-in subsidies and government incentives.

The strong sales of the Model YL demonstrate robust demand for large six-seat SUVs. Even amid fierce competition from domestic brands like BYD and NIO, Tesla has carved out a new growth path.

Meanwhile, Tesla reported record deliveries in South Korea, Taiwan, Japan, and Singapore, and has begun delivering the Model Y in India.

Additionally, Tesla rolled out Full Self-Driving (FSD) in Australia and New Zealand, and is preparing for broader FSD deployment in China — pending regulatory approval.

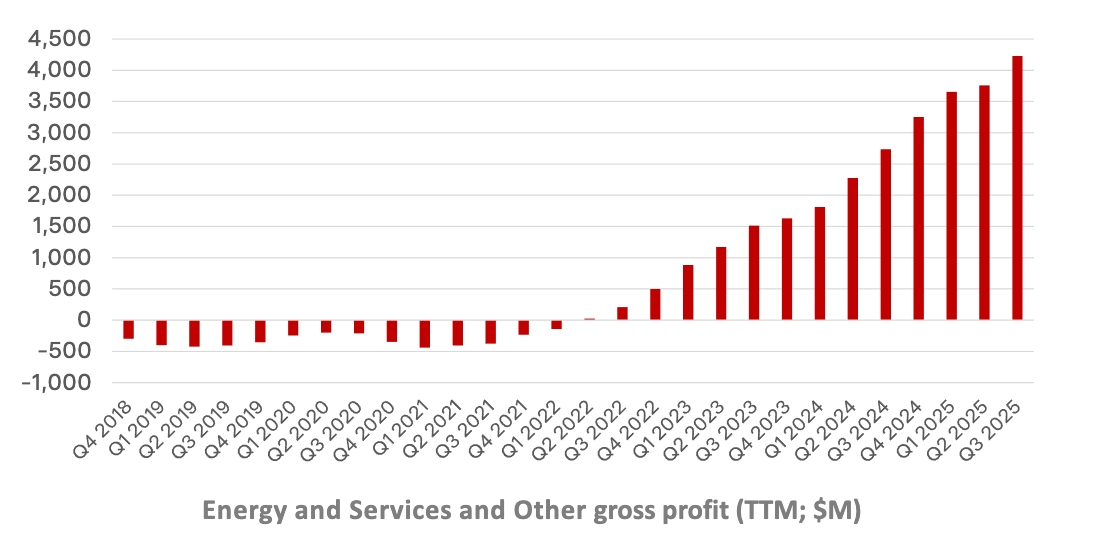

3. Energy Storage Business Booms

Tesla’s energy storage segment has alleviated investor concerns over slowing EV growth. Thanks to sustained output from the Shanghai Gigafactory and record Powerwall deployments, Tesla achieved its highest-ever quarterly energy storage deployment.

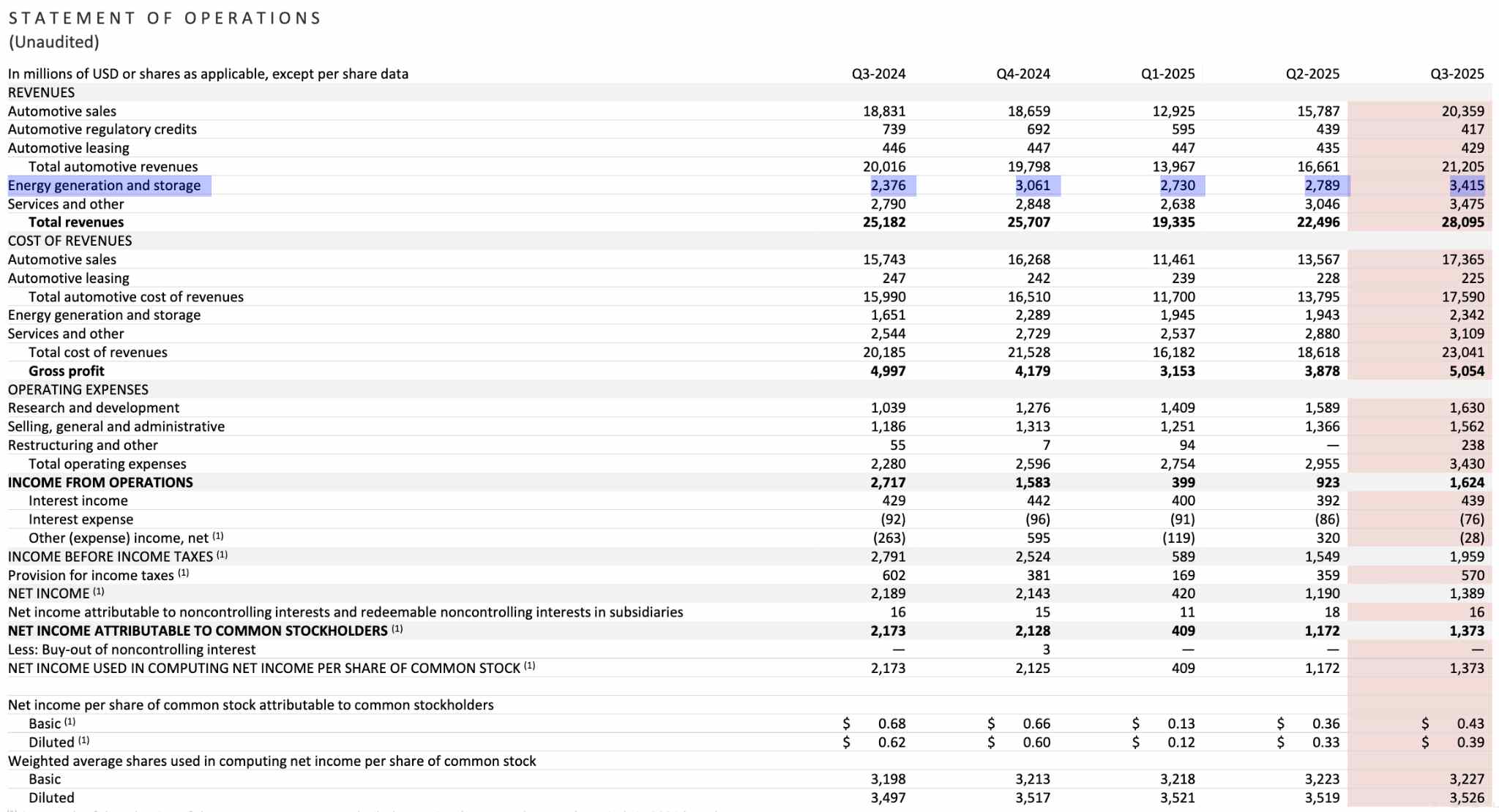

Gross profit from the energy segment rose both sequentially and year-over-year, reaching a record $1.1 billion.

[Source: Tesla Q3 Financial Report]

Q3 2025 results showed energy generation and storage revenue up ~24.6% quarter-on-quarter, with profits tied to energy storage and services also growing strongly.

With explosive demand for AI computing power and surging data centers, global grid stress is rising. Tesla’s energy storage systems are now central to backup and load-balancing in AI data centers. We expect this business to remain strong for years.

Jed Dorsheimer, analyst at William Blair, noted in 2024 that Tesla’s energy storage growth gives it the potential to become an “Apple-like ecosystem.”

4. Musk Makes Record-Breaking Share Purchase

According to an SEC filing disclosed Monday, Elon Musk bought approximately 2.57 million shares of Tesla (TSLA.US) between September 12–13, 2025, at prices ranging from $371 to $396 per share, totaling about $1 billion — the largest personal share purchase of his career.

Dan Ives, tech analyst at Wedbush Securities, stated: “The market sees Tesla’s greatest asset as Elon Musk himself.”In other words, Musk brings significant celebrity premium to Tesla. His influence — both in ownership and leadership — remains pivotal.

5. Technical Bullish Breakout

Source: TradingView

After Musk’s share buyback on September 12, 2025, Tesla’s stock broke through a key ascending triangle pattern without resistance, continuing its rally. Rising investor confidence and strong buying momentum are pushing the stock toward new highs.

Recent Events Affecting Tesla’s Stock

Recently, Tesla Chair Robyn Denholm said that if shareholders reject Musk’s proposed compensation package and he resigns, the company is prepared to appoint a new CEO from within.

Denholm confirmed she has spoken directly with Musk. If the pay plan fails, Musk may exit or significantly reduce his involvement in Tesla operations.

As Dan Ives noted, Musk is Tesla’s most valuable asset. We recommend investors wait for clearer signals before making decisions. If Musk steps down as CEO, widespread panic selling could trigger extreme volatility.

Conclusion

Driven by soaring AI compute demand, Tesla’s energy storage business is poised for sustained expansion. Combined with recovering sales in the Americas and continued growth in Asia, Tesla is likely to maintain its leadership in the EV market. Therefore, we believe now remains a good time to buy Tesla stock.