Prediction: XRP (Ripple) Will Be Worth This Much by 2030

Key Points

XRP has swiftly become one of the most popular opportunities in the cryptocurrency sector over the last year.

Although XRP's utility is clear, a number of factors could prevent the token from moving higher anytime soon.

XRP has already witnessed a stunning run-up, and a decline could be in store.

- 10 stocks we like better than XRP ›

The last 12 months have been a rollercoaster ride in the capital markets. While the S&P 500 (SNPINDEX: ^GSPC) and Nasdaq Composite (NASDAQINDEX: ^IXIC) both generated double-digit percentage gains in 2024, each index took a nosedive earlier this year.

Two of the driving factors that inspired the market sell-off were concerns around heightened competition in artificial intelligence (AI) from China, as well as President Donald Trump's new tariff policies -- which, admittedly, remains a fluid situation.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Nevertheless, the capital markets have demonstrated an impressive sign of resilience during the past several months -- with the S&P 500 now trading at all-time highs. Stocks are not the only investments that have held up well during the past year, though.

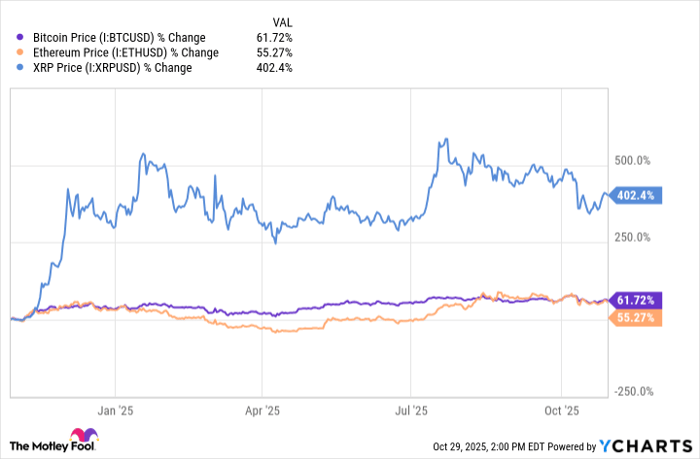

Major cryptocurrencies have also benefited from the bull market. During the past year, Bitcoin and Ethereum have surged by about 61% and 55%, respectively. Meanwhile, XRP (CRYPTO: XRP) has posted even larger returns of more than 400% during the same time frame.

Bitcoin Price data by YCharts

With XRP trading at about $2.65 (as of Oct. 29), investors may be curious about where the token could be headed and why. Below, I'll break down what Wall Street thinks about XRP, while also providing my own analysis of whether I think the cryptocurrency is headed even higher.

What does Wall Street think of XRP?

Standard Chartered's Geoff Kendrick is one of the most well-respected cryptocurrency analysts on Wall Street. Kendrick is bullish on XRP, going as far as to say the token could surpass Ethereum in value during the next few years.

Some of the macro tailwinds that could benefit XRP include lower interest rates and rising institutional adoption of the coin.

Generally speaking, when borrowing costs are lower, investors are more willing to take on some added risk as their purchasing power improves. Should the Federal Reserve loosen its monetary policy in the near term and cut rates, it's plausible that more investors will gravitate toward alternative asset classes, such as cryptocurrency.

Moreover, in the same way that spot Bitcoin exchange-traded funds (ETFs) paved the way for accelerated adoption of the cryptocurrency among major banks on Wall Street, the launch of XRP-themed funds could witness a similar trajectory.

Lastly, the Trump administration has so far echoed a pro-crypto stance with respect to leadership changes at the Securities and Exchange Commission (SEC), as well as new regulatory frameworks. Should this continue, XRP's perception in the investment world could swiftly evolve from skepticism to broader acceptance -- thereby propelling its value.

Image source: Getty Images.

Why I'm not as bullish as Kendrick

Although XRP has a number of catalysts that could drive its price higher, I am suspicious about whether this will actually happen during the next five years.

First and foremost, XRP is a cryptocurrency coin native to Ripple's financial infrastructure. At its core, Ripple is seeking to disrupt legacy payment systems that often feature slow processing times and hefty foreign exchange fees.

Within Ripple's system, users have the option to denominate their transactions in XRP -- essentially using the coin as a bridge currency to avoid locking up funds that go toward exchange settlements.

While the value proposition is clear, I think XRP's usage will remain limited for quite some time. In other words, I'm more optimistic about Ripple's ability to disrupt incumbents in the financial services arena than I am about broader adoption of XRP. That leads to a key distinction: banks and corporations can use Ripple's network and still denominate their transactions in fiat currencies as opposed to using XRP. In other words, broader usage of Ripple does not guarantee higher adoption rates of XRP.

This leads to a second concern of mine. Ripple has recently gotten into the stablecoin movement, as shown by its $200 million acquisition of Rail.

Major financial institutions such as JPMorgan Chase, Citigroup, Wells Fargo, and Bank of America, payment processors Visa, Mastercard, and PayPal, and retail powerhouses Walmart and Amazon are all either exploring stablecoins as a means of payment or already accepting them. This is important because the rise of stablecoins adds yet another layer to the evolving cryptocurrency landscape, and could potentially serve as a headwind for XRP's adoption.

When you layer these factors on top of the fact that XRP already competes with the likes of Stellar and some other cryptocurrencies, I'm hard-pressed to buy into the narrative that its upward trajectory is a sure thing.

The direction of XRP during the next five years is anyone's guess

The chart below illustrates XRP's price movement during the past 12 months. With the exception of a pronounced melt-up at the end of last year, the token has essentially been trading sideways throughout 2025.

XRP Price data by YCharts.

I see XRP as more of a narrative-driven investment than one supported by sound fundamentals. In other words, the token moves based on the latest headlines. Against that backdrop, I don't have a crystal ball to see what future news will look like with respect to XRP and the sentiment around it.

If I had to pick a 2030 price target, I would lean more in the direction that XRP could retrace back to its prior lows -- somewhere between $0.50 and $1. I think there are too many structural hurdles in its way to confidently say that the token is headed much higher during the next five years.

Should you invest $1,000 in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Citigroup is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Wells Fargo is an advertising partner of Motley Fool Money. Adam Spatacco has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Bitcoin, Ethereum, JPMorgan Chase, Mastercard, PayPal, Visa, Walmart, and XRP. The Motley Fool recommends Standard Chartered Plc and recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2025 $75 calls on PayPal. The Motley Fool has a disclosure policy.