This High-Yield Vanguard ETF Has 15% of Its Portfolio Invested in Just 3 Dividend Stocks. Here's Why That's a Good Thing.

Key Points

These three stocks are proven payout growers.

Two are beloved AI names.

All three are prolific buyers of their own shares.

- 10 stocks we like better than Vanguard Dividend Appreciation ETF ›

One of the big reasons so many investors are flocking to exchange-traded funds (ETFs) is that these products can provide diversification. It's true that there are scores of ETFs on the market holding thousands of bonds or stocks, providing investors with deep-bench portfolios.

Diversification can also be in the eye of the beholder. It's possible for capitalization-weighted index funds and ETFs to hold a lot of stocks, but also be heavily concentrated in just a handful of names, thanks to the ascent of the "Magnificent Seven" stocks. Just look at basic cap-weighted S&P 500 ETFs. Just five stocks command over 27% of those funds' rosters because their market caps are so big.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

That's a historically high level of concentration and one that's got investors buzzing about related risks, but it's hard to argue with the index's returns as a small number of stocks have become more prominent in the gauge.

So, perhaps it's fair to say it can be a good thing when a tiny group of stocks takes on big roles in certain ETFs. The Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) may be an example of that phenomenon.

Image source: Getty Images.

A trio of familiar names looms large in this ETF

Home to $98 billion in assets under management, the Vanguard Dividend Appreciation ETF is king of the dividend ETF category. It's also concentrated at the top with just three stocks -- Broadcom (NASDAQ: AVGO), Microsoft (NASDAQ: MSFT), and JPMorgan Chase (NYSE: JPM) -- combining for roughly 15% of the ETF's portfolio at the end of the third quarter.

Understanding how and why those three names loom large in the Vanguard Dividend Appreciation ETF is important. The ETF's benchmark, the S&P U.S. Dividend Growers Index, includes companies that have increased payouts for at least 10 consecutive years while excluding the 25% with the highest yields. Components are then weighted by market capitalization.

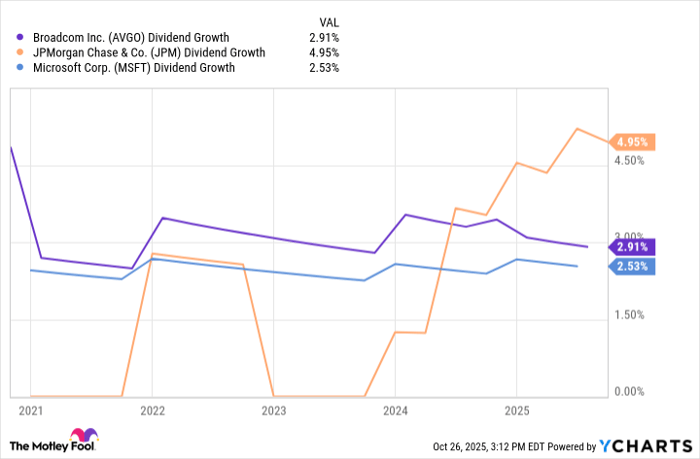

Put simply, the Vanguard Dividend Appreciation ETF is comprised of stocks with both the willingness and capability to grow payouts over time. All right, so we've pinned down its mechanics. Now, let's look at why it's just fine that Broadcom, Microsoft, and JPMorgan are so prominent in this ETF. First, those companies are reliable dividend growers. If they weren't, they wouldn't be this ETF's holdings -- but they grow payouts at gradual paces, keeping payout ratios tame while maintaining plenty of dry powder for long-term growth.

AVGO Dividend Growth data by YCharts

Second, those holdings reward investors in other ways, including through large-scale buyback programs. In April, Broadcom launched a new $10 billion repurchase plan. Upon announcing its latest dividend hike in July, JPMorgan added a $50 billion buyback effort to the mix. In September 2024, Microsoft unveiled a $60 billion share buyback program.

Combine those companies' dividend growth trajectories with their dedication to buying their own shares and maintaining fortress-like balance sheets, and the ETF's shareholder yield proposition is enhanced, indicating it's just fine that those three stalwarts are the co-captains of its ship.

Don't sweat the ETF's technique

Something else to note about the Vanguard Dividend Appreciation ETF is that it's concentrated at the sector level, with tech and financial services stocks combining for almost half the portfolio. That's partially the result of the 10-year dividend increase streak requirement. The objective of the S&P U.S. Dividend Growers Index is to find stocks that meet that criteria, not necessarily build an equal-weight roster from a sector perspective.

This ETF's sector concentration isn't something for investors to fret about. In fact, it could be a long-term positive. Significant exposure to Broadcom, Microsoft, and tech at large is advantageous at a time when that sector is roaring higher and increasing its dividend profile. And investors should look to other securities to get broad diversification. This ETF should not be their only holding.

Likewise, the prominence of JPMorgan Chase and the broader financial sector in the ETF is noteworthy because the Federal Reserve is displaying more flexibility when it comes to banks' shareholder rewards plans, including dividends.

Add it all up, and the concentration risk some investors may be fretting about with this ETF might not be a risk at all. It could be a source of allure.

Should you invest $1,000 in Vanguard Dividend Appreciation ETF right now?

Before you buy stock in Vanguard Dividend Appreciation ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Dividend Appreciation ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,442!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,269,127!*

Now, it’s worth noting Stock Advisor’s total average return is 1,071% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Todd Shriber has positions in Broadcom. The Motley Fool has positions in and recommends JPMorgan Chase, Microsoft, and Vanguard Dividend Appreciation ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.