AI Needs Data Centers and Bitcoin Miners Are Delivering Them

Key Points

AI businesses need enormous computing power and efficient data centers to operate.

So do Bitcoin miners.

Miners are happy to resell their data center and electric power capacity to AI customers when the market conditions are right.

- 10 stocks we like better than Mara Holdings ›

Artificial intelligence (AI) needs a lot of computing power. From training the back-end systems to running the daily operations, AI businesses rely on tons of high-end chips and rivers of electric energy.

It's not easy setting up an AI shop, since you need at least one data center with ample and affordable power. Luckily, another group of number-crunching tech companies are ready to sell, rent, or lease powered data center space to the incoming AI hopefuls.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

That's the Bitcoin (CRYPTO: BTC) mining crews taking a break from their costly main business. AI specialists are willing to pay a premium price for their data center services.

Who's making the switch?

MARA Holdings (NASDAQ: MARA) supports "high-performance computing applications, from AI to the edge" these days. Riot Platforms (NASDAQ: RIOT) is now "in the business of monetizing megawatts." Terawulf (NASDAQ: WULF) has signed a 25-year joint venture deal with Fluidstack, an AI capacity provider with close ties to Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

These are some of the largest players on the Bitcoin mining scene. Terawulf had 12.2 exahashes per second (EH/s) of mining capacity in Q2 2025. Riot had a 35.4 EH/s hashrate at the same time, and MARA overshadows them all with a 50 EH/s capacity. Together, they account for about 8% of global Bitcoin mining activity. I could keep going; smaller Bitcoin miners are also jumping aboard the AI opportunity.

Is the new idea working?

Bitcoin mining is a cyclical business. Mining rewards are halved on a predictable four-year schedule. Each halving disrupts the mining industry as service providers scramble to find a profitable operating plan with a thinner revenue stream and steady expenses.

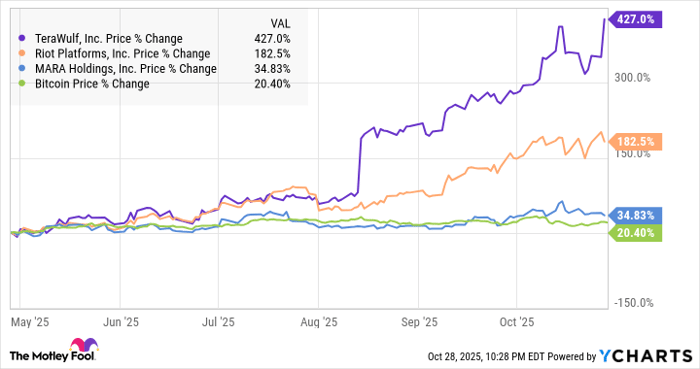

It's no surprise to see these companies cast a wandering eye at alternative plans, at least to keep the lights on while the Bitcoin business isn't terribly lucrative. And the new plan seems to work, at least for now. All of the Bitcoin mining stocks with an open mind for AI operations have outperformed Bitcoin in the last six months:

WULF data by YCharts

Should you invest $1,000 in Mara Holdings right now?

Before you buy stock in Mara Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Mara Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $594,569!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,232,286!*

Now, it’s worth noting Stock Advisor’s total average return is 1,065% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Anders Bylund has positions in Alphabet, Bitcoin, and Mara Holdings. The Motley Fool has positions in and recommends Alphabet and Bitcoin. The Motley Fool has a disclosure policy.