1 Undervalued Growth Stock Down 8% to Buy Before 2026

Key Points

Eli Lilly's performance over the past year hasn't been as strong as usual.

The company's growth prospects justify its higher-than-average valuation.

Lilly is also a terrific dividend stock.

- 10 stocks we like better than Eli Lilly ›

Eli Lilly (NYSE: LLY) has been on a tear for the better part of the last decade, but the company has experienced a bit of a slowdown of late. The stock is down 8% over the trailing-12-month period, partly because of a clinical setback, although general market volatility and the threat of tariffs probably didn't help.

However, this is little more than a temporary slump. Lilly's prospects remain incredibly bright, and at current levels, the company's shares even look undervalued.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Looking at (and beyond) valuation metrics

One might scoff at the idea that Eli Lilly is undervalued. The company is trading at 27 times forward earnings, which is well above the average of 17.5 for the healthcare industry.

Image source: Getty Images.

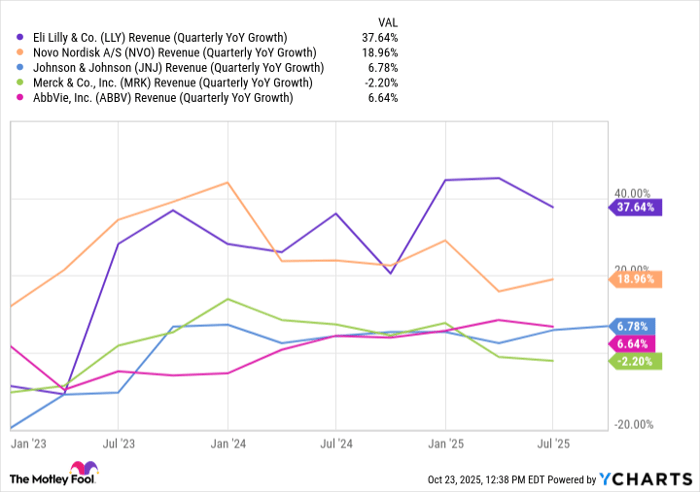

However, that doesn't tell us the whole story. If Eli Lilly can grow its revenue and earnings much faster than the average over the next five years or so, then that would more than justify its premium. Note that the company has been doing precisely that over the past two years. In fact, Lilly's recent top-line growth is, frankly, abnormal for a pharmaceutical company of its size, especially considering it's kept it up over several quarters.

LLY Revenue (Quarterly YoY Growth) data by YCharts.

The only other pharmaceutical giant that has come close to Eli Lilly in this category is its longtime rival, Novo Nordisk, which it's now leaving in the dust. So, Lilly has proven it can beat the average in this category -- what about the future?

There's more to look forward to

Eli Lilly should benefit from significant tailwinds that will help it maintain strong sales growth over the next five years. The most important is the growth of the market for weight management medicines. Breakthroughs in the field, the growing population of overweight individuals over the past few decades, and the higher prevalence of a range of health conditions associated with that are all helping to fuel soaring demand for anti-obesity drugs.

Lilly is at the forefront of this wave. Its drug tirzepatide, sold under the brand name Zepbound in weight management, is beating records. Wall Street analysts were licking their chops when they modeled peak annual sales of $25 billion for the medicine a few years ago. That would have put tirzepatide in an exceedingly rare, elite category of therapies ever to reach a peak that high. However, tirzepatide could generate more than that this year (it racked up $14.7 billion in the first half of the year), after being approved only three years ago.

Some new projections now predict sales of almost $62 billion for tirzepatide by 2030. That would put it in a category of...one.

But tirzepatide won't be Eli Lilly's only growth driver. The company is inching closer to launching orforglipron, an oral GLP-1 medicine. This therapy aced late-stage clinical trials, some of which put it head-to-head against other notable drugs -- and orforglipron emerged the winner.

Orforglipron could address some crucial shortcomings. First, some patients prefer oral pills over needles. Second, pills are cheaper to manufacture, store, and transport. They are arguably more commercially viable than subcutaneous injection at the same efficacy. And while orforglipron didn't match tirzepatide's potency, it will likely end up being cheaper and a better option for patients paying out of pocket -- tirzepatide's price tag has been a significant turnoff for many.

By 2030, orforglipron could generate up to $12.7 billion in sales. Together with tirzepatide and other products, it could help make Lilly the world's top-selling pharmaceutical company by then. So Eli Lilly's growth outlook still looks strong. The drugmaker is more than reasonably valued relative to its growth potential.

Don't forget the dividend

There are plenty of other aspects of Eli Lilly's business that make the stock a buy. Let's focus on just one of them: its dividend program. Lilly has been generating plenty of cash and has used some of it to reward shareholders with consistent and material payout increases. Over the past five years, the company's dividend has doubled. And there's more where that came from -- the payout ratio of 37% still looks reasonable.

The stock may not have a particularly impressive forward yield. It's just 0.7%, which is lower than the S&P 500's already low average of 1.2%. However, every other aspect of its dividend profile looks great. Altogether, Eli Lilly is an excellent choice for both income- and growth-seeking investors.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,287!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,173,807!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

Prosper Junior Bakiny has positions in Eli Lilly, Johnson & Johnson, and Novo Nordisk. The Motley Fool has positions in and recommends AbbVie and Merck. The Motley Fool recommends Johnson & Johnson and Novo Nordisk. The Motley Fool has a disclosure policy.