Should You Buy Pfizer Stock Before Nov. 4?

Key Points

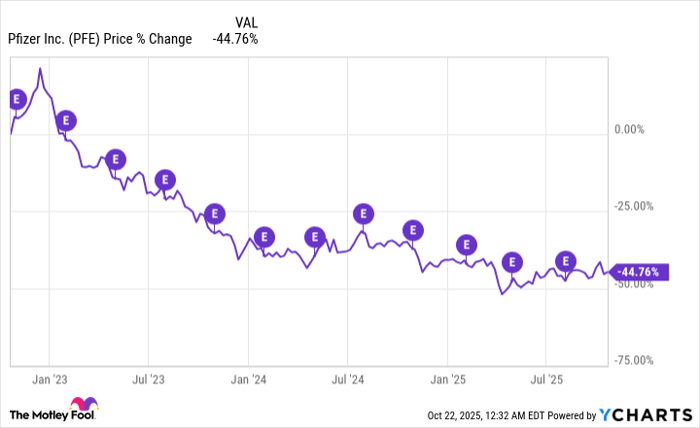

Pfizer's stock has been trading at low levels for a while.

Diminished growth and concerns about the future have investors thinking twice about the stock.

The company did show signs of progress in its previous quarterly report.

- 10 stocks we like better than Pfizer ›

One struggling pharma stock that could use a boost from a strong earnings report is Pfizer (NYSE: PFE). The company's valuation has plummeted in recent years as patent cliffs and question marks about its long-term growth have made investors hesitant to invest in the business, despite its offering an exceptionally high yield.

Pfizer's stock has fallen close to 30% in the past five years, but despite its low valuation, investors haven't been taking the bait. However, the company has been reporting solid results in its recent quarters. It even raised its guidance when it last reported its numbers in August.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

With its third-quarter earnings report scheduled to come out on Nov. 4, could yet another strong performance be what finally gets the stock going, and should you consider investing in Pfizer before those numbers come out?

Image source: Getty Images.

What has to happen for Pfizer's stock to get out of its current rut?

Pfizer is a cheap stock by most metrics. It trades at a price-to-earnings multiple of only 13, while the S&P 500 average is 25. But Pfizer has been trading at a discount for a while, and that hasn't been enough to get investors on board and believing that it's a good buy. Many might be worried that it's a value trap.

A strong outlook might be what's necessary to turn things around for the pharma stock. There's been a lot of talk from the Trump administration about lowering drug prices. The government has also imposed tariffs on some imported pharmaceuticals. Last month, Pfizer reached a "landmark agreement" with the government to work on lowering drug prices. And it also committed to spending $70 billion on research and development efforts in the U.S. to avoid tariffs.

Investors may be looking for some reassurance from Pfizer about its growth opportunities in both the short and long term. If the company is able to paint a more promising picture for the future, then there could finally be a rally forthcoming for this beaten-down stock. But I wouldn't hold my breath.

Why a rally isn't likely to happen after Pfizer reports earnings

Investors have been hesitant to invest in healthcare stocks this year, largely due to the uncertainty around tariffs and government policies. While the S&P 500 has risen nearly 15% thus far in 2025, the Health Care Select Sector SPDR Fund is up by just over 5%. There's clearly some caution from investors, and it may take more than increased guidance or strong earnings performance from Pfizer to convince the market that the stock is a safe buy.

There's no mistaking the continuous downward trend for the stock, with earnings reports doing little to stop the tailspin in recent years.

PFE data by YCharts.

Why Pfizer's stock might be worth buying anyway

I don't anticipate that Pfizer's Q3 earnings will prove to be a significant catalyst for the stock. While the company has been building out its pipeline and investing in companies to help further its growth, those are steps that will take time. And with healthcare stocks, it's usually strong clinical trial results that can send them soaring, rather than an impressive earnings report.

That being said, if you're a long-term investor, this can still be a stock worth taking a position in right now, simply because its valuation is so low. Pfizer hasn't been trading at its current levels in years, and the business is by no means in bad shape. Its top line grew by 10% last quarter, and its adjusted earnings rose by 30%.

The company is not in a dire situation, which is why I don't believe it's a value trap. Investors are discounting it due to market and industry conditions, but if you're willing to buy and hold and be patient with the stock, I think investing in Pfizer's stock today can pay off years from now.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.