Ripple Price Forecast: Could XRP restore uptrend on high spot ETF approval odds, XRPL EVM Sidechain launch?

- XRP's downtrend persists, reflecting lethargic sentiment in the broader cryptocurrency market.

- Analysts Eric Balchunas and James Sayffart raise the odds of XRP spot ETF approval to 95% by the end of the year.

- Ripple announces the launch of XRPL EVM Sidechain on the mainnet, raising the stakes for developers eyeing cross-chain functionality.

Ripple's (XRP) upside remains heavy, weighed down by a lethargic sentiment across the cryptocurrency market. Trading at $2.19, the XRP price is down nearly 2% on Tuesday, representing a decline of approximately 35% from its all-time high of $3.40.

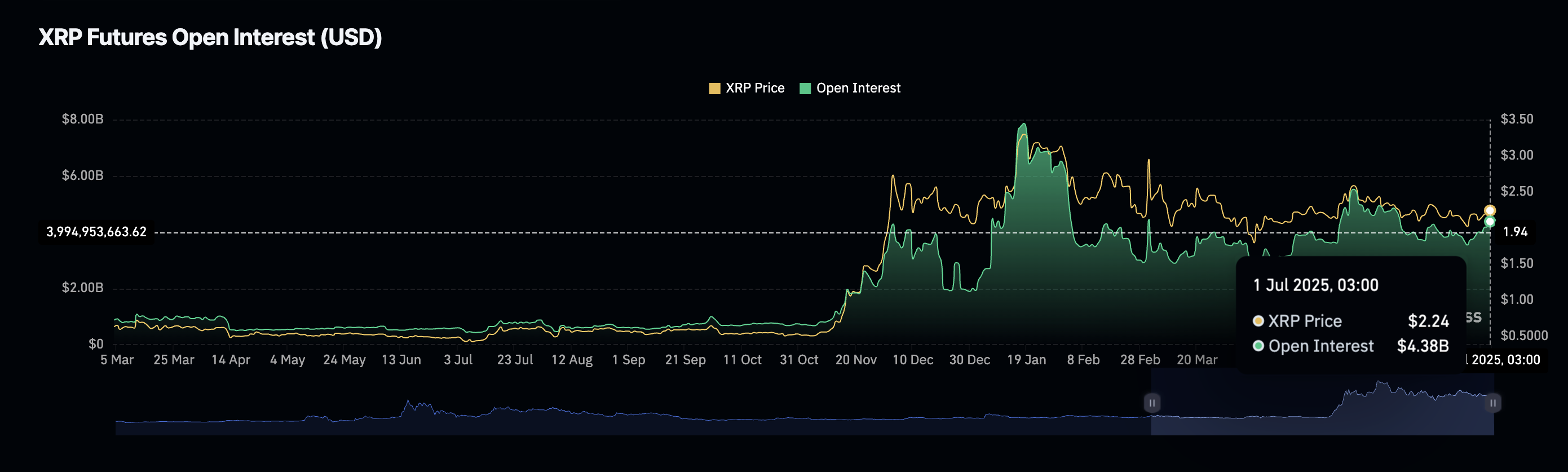

Interest in the cross-border money remittance token has significantly declined compared to November, December, and January, as evidenced by the downtrend in the futures Open Interest, which now stands at $4.38 billion, down from $7.76 billion posted on January 17.

XRP Futures Open Interest | Source: CoinGlass

Analysts raise XRP spot ETF approval odds to 95%

Bloomberg analysts Eric Balchunas and James Sayffart have released their projections for the ratification of various spot Exchange Trade Funds (ETFs), with XRP spot ETFs assigned a 95% approval chance by the United States (US) Securities and Exchange Commission (SEC).

Proposals by Grayscale, Bitwise, Canary Capital, 21Shares, WisdomTree, CoinShares, and Franklin Templeton have been acknowledged by the SEC, all of which have a 95% chance of approval.

Spot ETFs approval odds | Source: Bloomberg

The price of XRP failed to react to the development, which raises the stakes for the acceptance of XRP as an institutional-grade digital asset traded directly on stock exchanges without the need to own the actual cryptocurrency.

XRPL EVM Sidechain live on the mainnet

Ripple has announced the launch of the XRPL EVM Sidechain on the mainnet following years of development in collaboration with Persyst and its broader ecosystem.

The launch marks a major step toward integrating general-purpose smart contract capabilities to the XRP Ledger (XRPL), allowing developers to "build, port, and deploy cross-chain and EVM (Ethereum Virtual Machine) only decentralized applications (dApps)."

Web3 financial functionalities, including stablecoins, real-world asset (RWA) tokenization, and cross-border payments, are heavily dependent on robust blockchain infrastructure that ensures liquidity, speed, security and scalability.

"The XRPL EVM Sidechain introduces a flexible environment for developers to deploy EVM-based applications, while maintaining a connection to the XRPL's efficiency," Ripple CTO and co-founder David Schwartz said in the press release. "It extends the capabilities of the ecosystem without changing the fundamentals that make the XRPL reliable," Schwartz added.

Technical outlook: XRP recovery elusive despite key support

The price of XRP is on the verge of extending its downtrend toward support at $2.06, tested on Friday. A break below the immediate 50-week Exponential Moving Average (EMA) support at $2.18 could validate another sell-off round, considering the slump to $1.90 on June 21, triggered by geopolitical tensions in the Middle East.

XRP/USDT weekly chart

A further decline below the support at $1.90, which sits slightly below the 100-week EMA, could be unlikely, especially with the Money Flow Index (MFI) at 40, reversing the trend toward the midline. This upswing suggests risk-on sentiment is rising, with demand for XRP likely to steady the price and trigger the resumption of the uptrend.

Key areas of interest to traders are the 50-day EMA support at $2.18, the previous month's peak at $2.34 and the highest level reached in May at $2.65.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.