XRP upholds optimism despite the SEC and Ripple's abeyance request in the Second Circuit

- The US SEC and Ripple seek a delay in appeals, expected to last until August 15, amid the pending request for an indicative ruling.

- Despite the delay in the SEC against Ripple case conclusion, optimism remains strong in the XRP derivatives market.

- The technical outlook remains bullish as XRP bounces off the 200-day EMA.

Ripple and the US Securities and Exchange Commission (SEC) filed a request to hold the appeals in abeyance with the US Court of Appeals for the Second Circuit on Monday. Despite the abeyance testing investors’ patience, the optimism surges in XRP derivatives as the Open Interest crosses above $4 billion.

Reason behind the Ripple and SEC abeyance request

The sudden request to hold the appeals in the Second Circuit comes in light of a renewed indicative ruling request submission to Judge Analisa Torres. The pending request in the US Southern District Court of New York intends to dissolve the injunction over Ripple and release the confiscated escrow payment of $125,035,150.

The SEC requests $50 million from the confiscated funds as a penalty, while the rest will be transferred to Ripple. Due to the pending approval of this indicative request, the parties have requested abeyance, while the SEC has agreed to update the Second Circuit by August 15.

Optimism grows in XRP

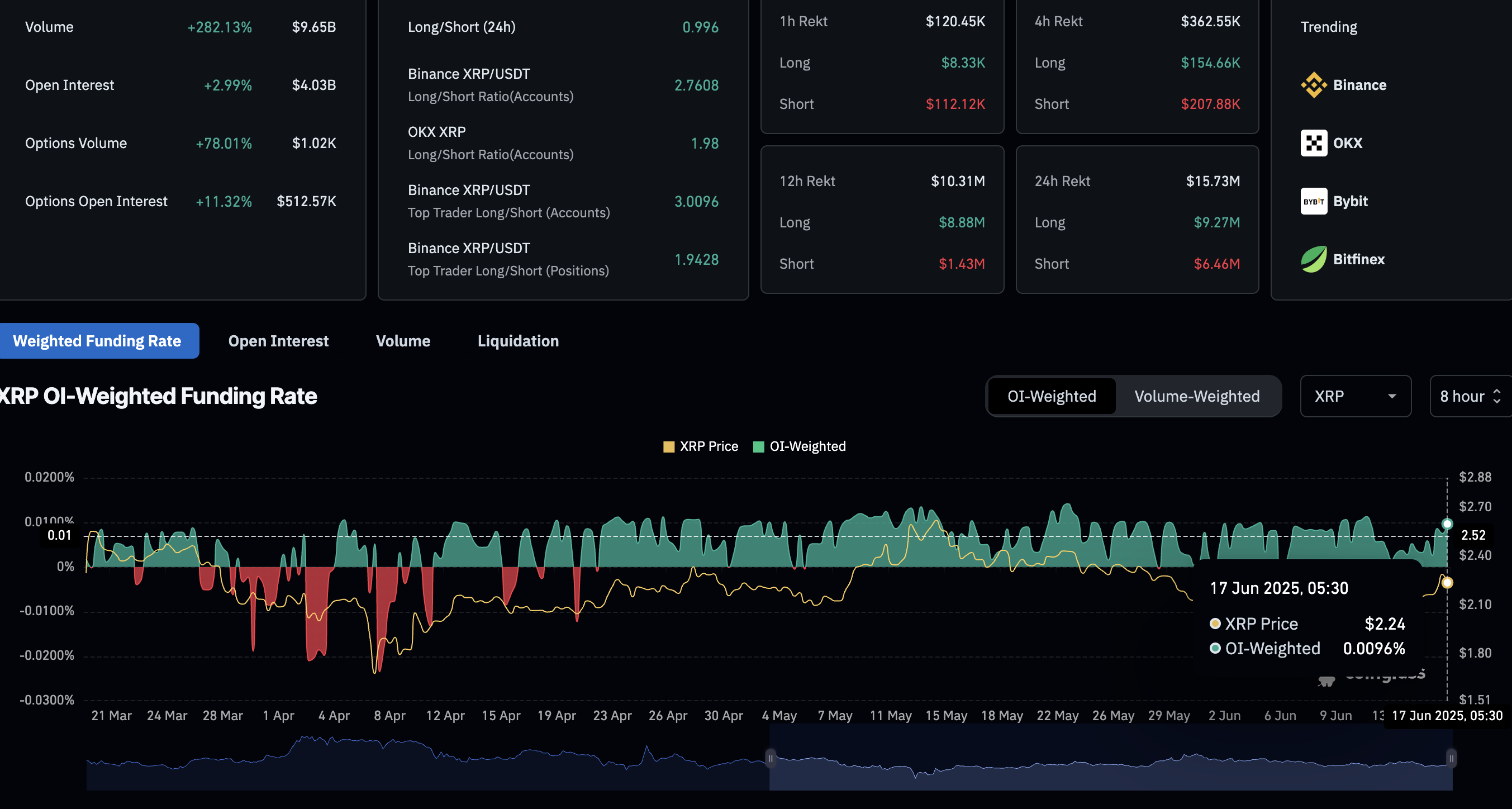

CoinGlass’ data shows a near 3% surge in XRP Open Interest (OI) reaching $4.03 billion, suggesting increased buying activity fueling capital inflows into the derivatives market.

The surge in OI-weighted funding rate to 0.0096% backs the thesis of increased bullish activity in XRP derivatives. A positive spike in funding rates is imposed on bulls to match swap and spot prices, due to increased leveraged-driven buying pressure.

However, the $9.27 million in long liquidations over 24 hours outpaces the $6.46 million in short liquidations, suggesting a larger wipeout of bullish traders. Nevertheless, the long/short ratio at 0.996 reflects just a minor drop in bullish positions compared to short positions.

XRP derivatives data. Source: Coinglass

Overall, the bullish bias in derivatives suggests traders' anticipation of a bullish comeback in XRP.

Dynamic resistance and a trendline hold down XRP

With a 3.35% recovery on Monday, XRP faces opposition from the 50-day and 100-day Exponential Moving Averages (EMAs). At the time of writing, XRP is down marginally, while the long wick visible on the previous day's candle warns of a bearish turnaround.

The price action also reveals a long-standing resistance trendline formed by peaks on January 16, May 12, and June 16. A potential closing above the 50-day and 100-day EMAs at $2.24 could prolong XRP’s recovery to the overhead trendline near the weekly high at $2.33.

The Moving Average Convergence/Divergence (MACD) indicator triggers a buy signal as it crosses above its signal line. A surge of bullish green histogram bars from the zero line backs the trend reversal thesis.

The Relative Strength Index (RSI) at 49 remains flat near the halfway line, indicating a lack of momentum and indecision among traders as it reaches a crossroads.

XRP/USDT daily price chart.

If XRP fails to uphold the recovery, it could test the 200-day EMA at $2.09. Sidelined traders looking to short-sell could target a close below the 200-day EMA, with the next support level at $1.79, marked by the lowest 3-month closing.