Ethereum Leverage At All-Time High as BlackRock Ramps Up Accumulation

Ethereum (ETH) is making headlines as leveraged bets and institutional inflows converge. This synergy has pushed the network’s futures market to new extremes.

Analysts are monitoring Ethereum amid talk of an altcoin summer, with ETH floated as a likely frontrunner.

Leverage and Institutions Drive Ethereum’s Market Momentum

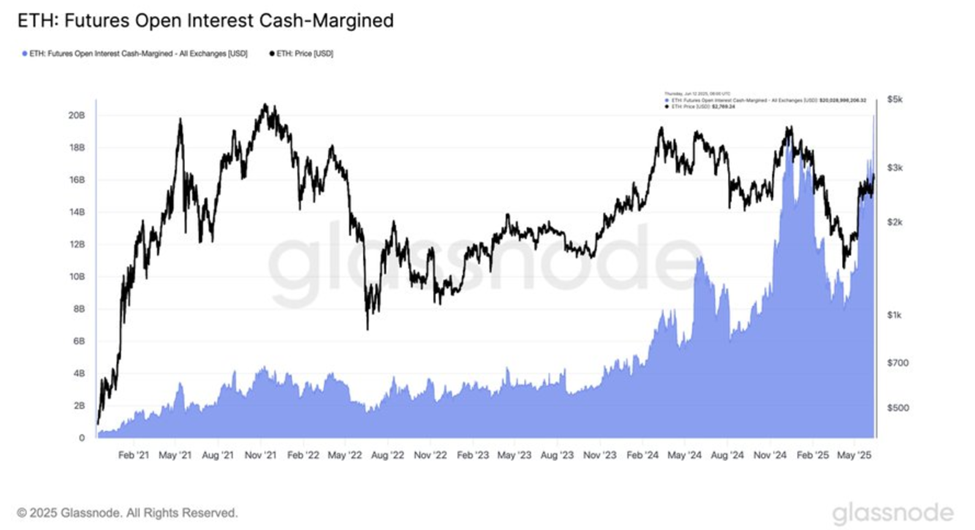

According to blockchain analytics firm Glassnode, Ethereum futures open interest has hit an all-time high (ATH), topping $20 billion, even as ETH’s spot price hovers below the key $2,800.

“Ethereum futures open interest (cash-margined) just hit a new all-time high — topping $20 billion… leverage continues to build as traders load up using stablecoins,” Glassnode wrote in a post.

Ethereum Futures Open Interest. Source: Glassnode on X

Ethereum Futures Open Interest. Source: Glassnode on X

Glassnode’s remarks come barely two days after CryptoQuant analysts highlighted Open interest in Ethereum futures recording a previous peak of 7.17 million ETH. Therefore, this extension signals a sustained appetite for speculative positioning.

Based on the report, cash-margined contracts are driving much of this activity, amplifying exposure and, by extension, market volatility.

On-chain data also reveals that retail investors are leaning into derivatives, even as Bitcoin’s on-chain activity stagnates.

“Futures trading frequency among small investors just spiked above its 1-year average…the Bitcoin network feels like a ghost town: low on-chain activity and retail volume…while ETH open interest hit an ATH, and retail trading frequency is spiking.,” CryptoQuant stated.

BlackRock’s ETH Buying Spree Signals Deepening Institutional Bet on Ethereum

This risk appetite coincides with a fresh wave of institutional buying from BlackRock. On Wednesday, the asset manager bought ETH for two consecutive weeks, with an additional $163.6 million in Ethereum purchases.

Blockchain analytics firm Lookonchain also reported that whales are accumulating ETH, withdrawing millions of dollars worth of Ethereum over the past few days.

Abraxas Capital, an institutional player, withdrew 44,612 ETH ($123 million) from Binance and Kraken on Wednesday.

While retail trading volumes on centralized exchanges (CEXs) remain near multi-year lows, long-term Bitcoin holders are increasing their stashes. Yet in Ethereum’s case, momentum appears to be shifting toward active speculation and accumulation, retail and institutional, with traders and analysts noticing.

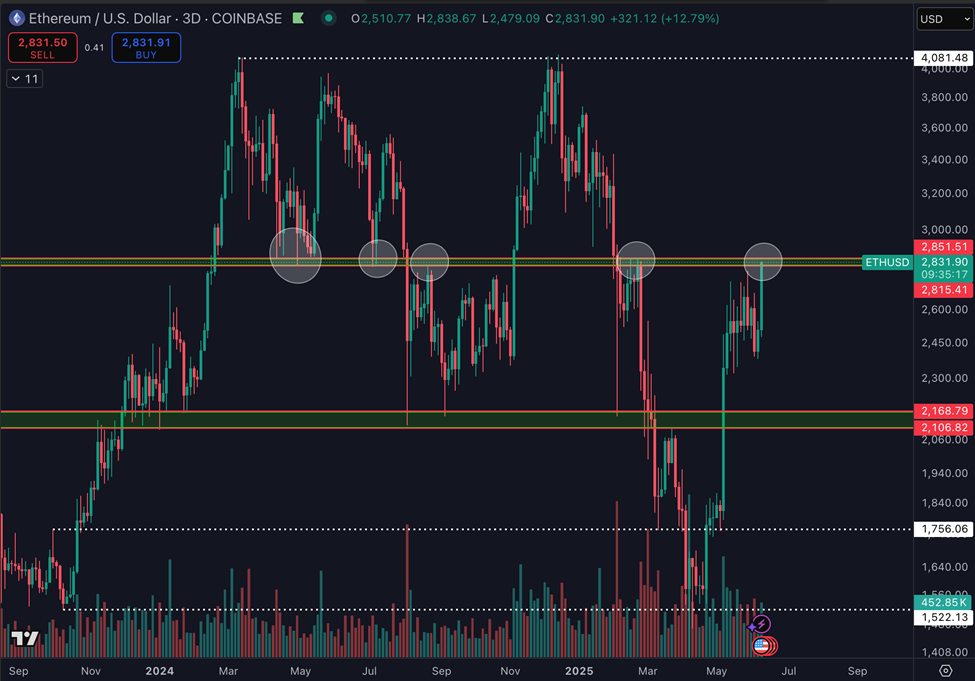

“The $2,800 level is important throughout this cycle. It has sparked the biggest moves after retesting or breaking above/below it,” analyst Daan Crypto Trades observed.

Ethereum Price Chart. Source: Daan Crypto Trades on X.

Ethereum Price Chart. Source: Daan Crypto Trades on X.

Analyst Duo Nine echoed this sentiment, which believes Ethereum is gearing up for a sharp rally, potentially beyond the $3,000 psychological level.

The general sentiment among analysts is that Ethereum may be an obvious play right now, with prevailing narratives likely to continue building around it as positive sentiment grows.

However, this surge in leverage comes with risks. Historically, high open interest levels and excessive retail positioning have preceded sharp liquidations. Based on this outlook, Lookonchain highlights that some traders are also opening short positions for ETH.

With many positions backed by stablecoins in cash-margined futures, any volatility could trigger a cascade.

Ethereum (ETH) Price Performance. Source: BeInCrypto

Ethereum (ETH) Price Performance. Source: BeInCrypto

As of this writing, Ethereum was trading for $2,755, down by 0.27% in the last 24 hours.