Bitcoin Price Forecast: BTC edges below $108,000 as geopolitical risks weigh on sentiment

- Bitcoin price continues its pullback, trading below $108,000 on Thursday, following the previous day's decline.

- Risk-off sentiment rises as the conflict in the Middle East escalates, with reports suggesting that Israel is readying an imminent attack on Iran.

- Public companies' demand for BTC continues to strengthen despite the capital preservation mode in the market.

Bitcoin (BTC) price extends its decline on Thursday, trading below $108,000 and extending the previous day's drop. The rising conflict in the Middle East fueled this correction, with reports suggesting that Israel is readying an imminent attack on Iran. Despite the overall gloomy market mood, public companies' demand for BTC continues to strengthen.

Risk aversion increases as Middle East conflicts escalate

Bitcoin price faced a mild pullback on Wednesday and closed below $109,000, continuing its correction during the European session on Thursday.

The rising conflict in the Middle East fueled this correction. According to the Kobeissi Letter report on Thursday, US officials have been informed that Israel is fully prepared to launch an operation against Iran. These ongoing geopolitical risks have triggered risk-off flows in the market, which do not bode well for assets like Bitcoin.

Safer assets like Gold saw a slight upward trend, with XAU/USD reaching a high of $3,386 during the early Asian trading session on Thursday, indicating investors were moving their funds toward safe-haven assets. Apart from this, Oil prices have reached $69 per barrel for the first time since March. If the Middle East conflicts further escalate, Bitcoin prices could continue to fall.

Moreover, the Russia-Ukraine war also escalated on Thursday as Russia intensified bombardments that it said were retaliatory measures for Ukraine's recent attacks. Specifically, a new concentrated wave of drone attacks occurred on Ukraine's second-largest city of Kharkiv. These rising geopolitical risks could be a headwind for cryptocurrency prices.

Bitcoin price declines as trade uncertainty rises

Haresh Menghani, an analyst at FXStreet, says: “The initial market reaction to a positive development surrounding the US-China trade war turned out to be short-lived in the wake of US President Donald Trump's fresh tariff threats on Wednesday.”

Trump said he would impose unilateral tariff rates and notify trading partners within two weeks ahead of the deadline set for July 9. This adds a layer of uncertainty and overshadows the optimism led by a positive tone following US-China trade talks in London.

Trade uncertainty gave rise to a cautious investor mood in the market, which led to a decline in the prices of riskier assets.

Some signs of optimism

Despite the increase in risk aversion, public companies' demand for BTC remained resilient. Mercurity Fintech Holding Inc. (MFH) announced on Wednesday its plans to raise $800 million to establish a long-term Bitcoin treasury reserve.

On the same day, GameStop announced its plans to raise $1.75 billion through a private offering of 0.00% Convertible Senior Notes due 2032. The firm had added 4,710 BTC between May 3 and June 10, which followed its $1.3 billion convertible note offering issued in March.

The companies’ interest in Bitcoin indicates a growing acceptance of BTC as a strategic asset, boosting its legitimacy and potentially driving long-term adoption.

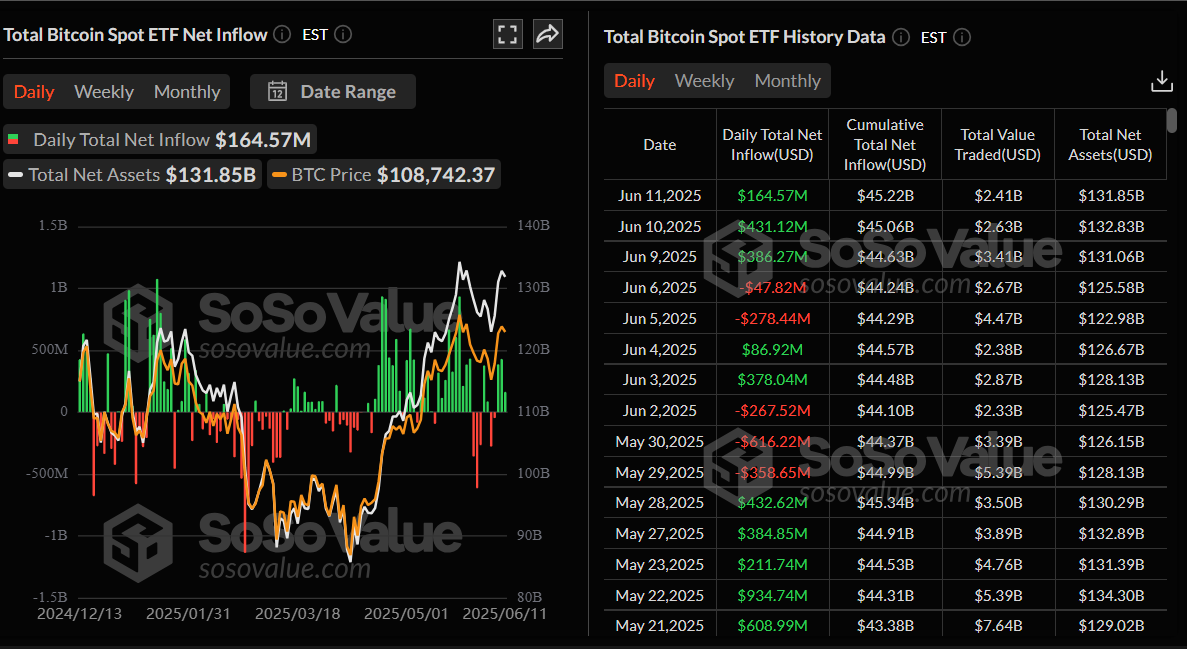

Institutional demand for Bitcoin has continued to strengthen so far this week. According to SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded an inflow of $164.57 million on Wednesday, marking the third consecutive day of inflows this week.

Total Bitcoin spot ETFs daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC shows signs of weakness

Bitcoin price failed to retest its all-time high of $111,980 following a sharp rally on Monday and declined slightly until Wednesday. At the time of writing on Thursday, it continues to trade below $108,000.

If BTC continues its pullback, it could extend the decline to retest its daily support at $106,406. A successful close below this level could extend the fall toward its 50-day Exponential Moving Average (EMA) at $102,471.

The Relative Strength Index (RSI) reads 54 and points downwards towards its neutral level of 50, indicating fading bullish momentum. For the bearish momentum to be sustained, the RSI must move below its neutral level of 50.

Moreover, the two lines of the Moving Average Convergence Divergence (MACD) indicator on the daily chart coil against each other, indicating indecisiveness among traders. If the MACD flips a bearish crossover, it will give a sell signal and further support the bearish thesis.

BTC/USDT daily chart

However, if BTC recovers, it could extend the recovery to retest its May 22 all-time high of $111,980.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.