Ripple Price Forecast: XRP at crossroads as Ripple ramps up Asia-Pacific investment

- XRP's uptrend shows signs of faltering, suggesting trader exhaustion and potential profit-taking.

- Ripple enhances investment in the Asia-Pacific region with $5 million in additional funding to support blockchain innovation.

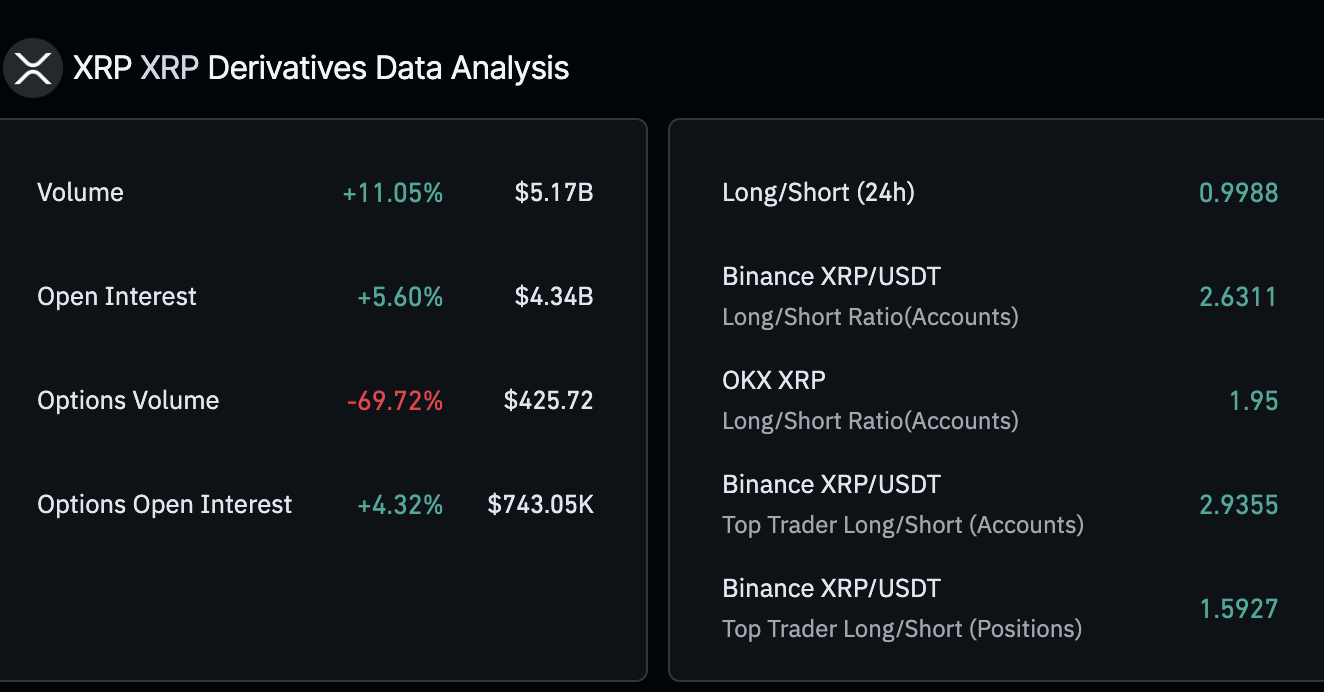

- A 5% increase in the derivatives market's Open Interest and a spike in trading volume to $5.2 billion suggest growing bullish sentiment.

Ripple (XRP) is slowly losing its grip on the uptrend printed on Monday, following last week's sell-off, triggered by the public spat between United States (US) President Donald Trump and Tesla's CEO Elon Musk. Meanwhile, the cross-border money remittance token hovers at around $2.27 at the time of writing on Tuesday, down over 2% on the day, as global markets await the aftermath of the ongoing trade talks, now on the second day, between top US and Chinese officials.

Ripple expands investment in the APAC region

Ripple has ramped up investment in the Asia-Pacific (APAC) region, with an additional $5 million in funding through its global University Blockchain Research Initiative (UBRI).

The investment spans six countries, featuring renewed partnerships in South Korea, Japan and Singapore, as well as new grants extended to Taiwan and Australia.

Ripple's increasing focus on the APAC region reflects the progress being made by respective governments to ensure clarity in crypto regulations and support for the development of digital finance.

Meanwhile, UBRI has been making inroads within communities thriving with builders, stakeholders and users by laying the foundation for blockchain innovation in higher education.

As part of the renewed partnerships, Ripple will invest $1.1 million in Korea University over six years. This collaboration builds on an earlier partnership with Yonsei University.

In Japan, Ripple has renewed a partnership with Kyoto University, aiming to advance blockchain research in the country. The partnership entails a $1.5 million grant.

A $3 million funding has been allocated to Nanyang Technological University (NTU), which will extend a partnership with the National University of Singapore (NUS).

"This support allows us to involve more students and researchers in the blockchain ecosystem by enabling them to build on the XRPL and contribute to its growth, thereby advancing our blockchain education initiatives," said Professor Yang Liu, College of Computing & Data Science at NTU.

In addition to the grants, UBRI supports research and development, ensuring that talents in blockchain, cybersecurity and information systems are nurtured. In total, UBRI has invested over $11 million to promote education, adoption, and innovation in blockchain and fintech spaces within the APAC region.

XRP's price upside remains heavy despite the groundbreaking funding announcement, with the technical outlook offering bearish signals. The token is currently trading between support at $2.25 and resistance at $2.32.

Technical outlook: XRP struggles to sustain uptrend amid declining risk appetite

XRP's price is sliding toward confluence support at $2.25, established by the 50-day Exponential Moving Average (EMA) and the 100-day EMA, after facing rejection at around $2.32.

The unsteady uptrend suggests that market sentiment remains strikingly cautious, especially with US-China trade talks in focus.

The Relative Strength Index (RSI) is sideways at the 50 midline, indicating a lack of conviction and confidence in the uptrend. Should the RSI slip below the midline, losses could extend 8% below the current level to test the support provided by the 200-day EMA, which is around $2.08.

A sell signal from the SuperTrend indicator validates XRP's downside vulnerability. This indicator signals traders to consider selling XRP when the price falls below the SuperTrend line, changing its color from red to green.

Traders often utilize this trend-following tool as a dynamic support and resistance. In other words, XRP could uphold the bearish bias as long as the SuperTrend stays above the price.

XRP/USDT daily chart

Meanwhile, the derivatives market has seen a significant increase in Open Interest (OI), rising to $4.34 billion over the last 24 hours, alongside an 11% surge in trading volume to $5.2 billion.

XRP derivatives market stats | Source: CoinGlass

OI refers to the total number of outstanding futures and options contracts that have not been settled or closed. Therefore, an increase in OI alongside the trading volume underlines growing interest in XRP, backed by rising market participation.

If the trend persists, the price of XRP could uphold the short-term support at $2.25, allowing bulls to resolve the technical outlook with a potential 30% breakout to $3.00 from the current price level.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.