Ripple Price Forecast: XRP could extend recovery after $300M XRP treasury filing with US SEC

- XRP consolidates in a narrow range between support offered by the 50-period EMA and resistance at the 100-period EMA.

- China-based Webus International files with the SEC to raise $300 million for XRP treasury strategy and Ripple-powered payments.

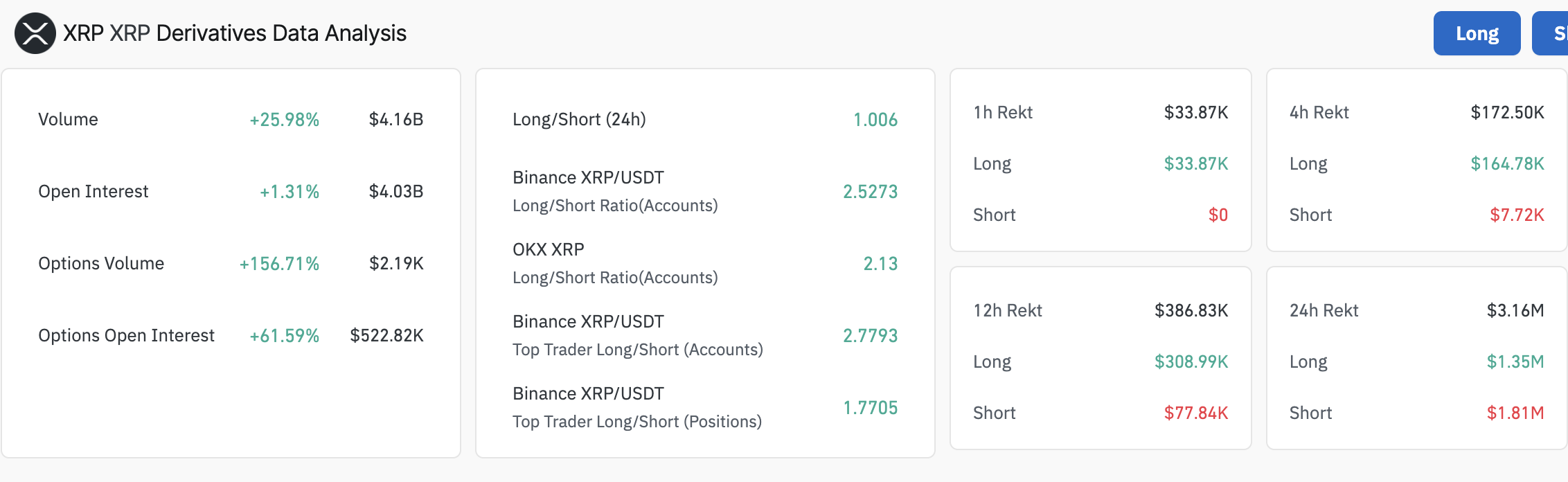

- Rising derivatives market Open Interest to $4 billion, accompanied by a surge in short liquidations, signals potential bullish momentum.

Ripple’s (XRP) price has stalled after testing resistance at $2.27. The token hovers at around $2.24 at the time of writing on Wednesday, amid lethargic sentiment in the broader cryptocurrency market.

The narrow, range-bound movement also comes after Webus International, a Chinese company, filed with the United States (US) Securities and Exchange Commission (SEC) to raise funds toward a strategic XRP treasury.

Webus International plans to raise $300 million for XRP treasury strategy

Webus International, a fast-paced Artificial Intelligence (AI)-driven provider of customizable mobility solutions in the hospitality industry, has filed with the SEC outlining plans to raise $300 million for an XRP-focused corporate treasury strategy.

The filing, which used the Form 6-K to update the Commission and US investors, was published on Tuesday following an announcement made on May 29. Webus intends to raise funds through a non-equity credit facility to support the treasury initiative as well as Ripple-powered payments.

To spearhead the development, Webus signed a partnership agreement with Samara Alpha, an asset management firm. The company will help establish the strategic reserve and integrate Ripple-based blockchain payments into the Webus network to streamline cross-border transactions across its travel and hospitality business.

Webus is the latest company to announce the adoption of the XRP token and Ripple’s payment system. However, institutional interest in XRP and related products has been gaining traction in recent weeks. For instance, renewable energy company VivoPower announced a $121 million XRP-focused treasury on Tuesday. This follows the launch of XRP futures contracts by Coinbase Derivatives and the CME Group.

XRP consolidating amid rising institutional adoption

XRP’s price hovers sideways between the support offered by the 4-hour 50-period Exponential Moving Average (EMA) at around $2.22 and the resistance highlighted by the 100-period EMA at $2.26.

A recent recovery from last week’s drop to $2.07 failed to break above resistance at $2.27, resulting in the ongoing pullback.

The reversal of the Relative Strength Index (RSI) after briefly peaking at 66 signals a bearish shift. If the RSI slides below the 50 midline, reflecting changing market dynamics, the path of least resistance could remain downward in upcoming sessions.

XRP/USD 4-hour chart

Beyond the 50-period EMA support at $2.22, other key areas of interest include a recently tested level around $2.07 and the buyer congestion zones at $1.92, $1.85, and $1.61, all of which were tested in April.

The XRP derivatives market data indicates bullish potential, with Open Interest (OI) rising by 1.31% to $4.00 billion.

XRP derivatives market Open Interest | Source: CoinGlass

Rising trading volume, along with higher short position liquidations of $1.81 million compared to $1.35 million over the last 24 hours, could create an environment suitable for a sustainable recovery.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.