Ethereum Price Forecast: ETH eyes $2,850 following unveiling of Trillion Dollar Security initiative

Ethereum price today: $2,600

- The Ethereum Foundation launched the Trillion Dollar Security effort to scale Ethereum's security for global adoption.

- Ethereum Foundation executives and key ecosystem participants will spearhead the initiative.

- ETH eyes a recovery above the $2,850 key level but faces resistance at the 50-week SMA.

Ethereum (ETH) is down 2% on Wednesday despite the Ethereum Foundation's (EF) latest security initiative to onboard billions of users and institutions who can store trillions of dollars on its network.

Ethereum Foundation lays out plan for global adoption

The Ethereum Foundation announced the "Trillion Dollar Security Initiative," an effort to boost Ethereum's security above that of traditional systems and make it the go-to platform to "bring the world on-chain."

Despite being the largest smart contract blockchain network with nearly $62 billion in total value locked (TVL), the EF is looking to expand beyond the corridors of the crypto ecosystem.

In a blog post on Wednesday, the Foundation said it aims to scale Ethereum's security to help onboard billions of users and institutions that can hold above $1 trillion on its network.

"Being the most secure platform in the crypto ecosystem isn't enough," the EF wrote. "Ethereum's ambition is far greater: to be civilization-scale infrastructure that securely underpins the internet and global economy, surpassing the safety and trustworthiness of the world's legacy systems."

The 1TS initiative will follow a three-stage structure that involves producing a report that explores Ethereum's current security status across several areas, fixing discovered issues and providing clear communication to allow users to understand the network's security state.

While participation is open to the public, Fredrik Svantes, EF Protocol Security Lead, and Josh Stark from the EF management team will lead the project. Samczsun, founder of Security Alliance, Mehdi Zerouali, co-founder of Sigma Prime, and Zach Obront, co-founder of Etherealize, will serve as advisors.

The announcement comes after Ethereum's successful Pectra upgrade last Wednesday and an organizational restructuring at the EF.

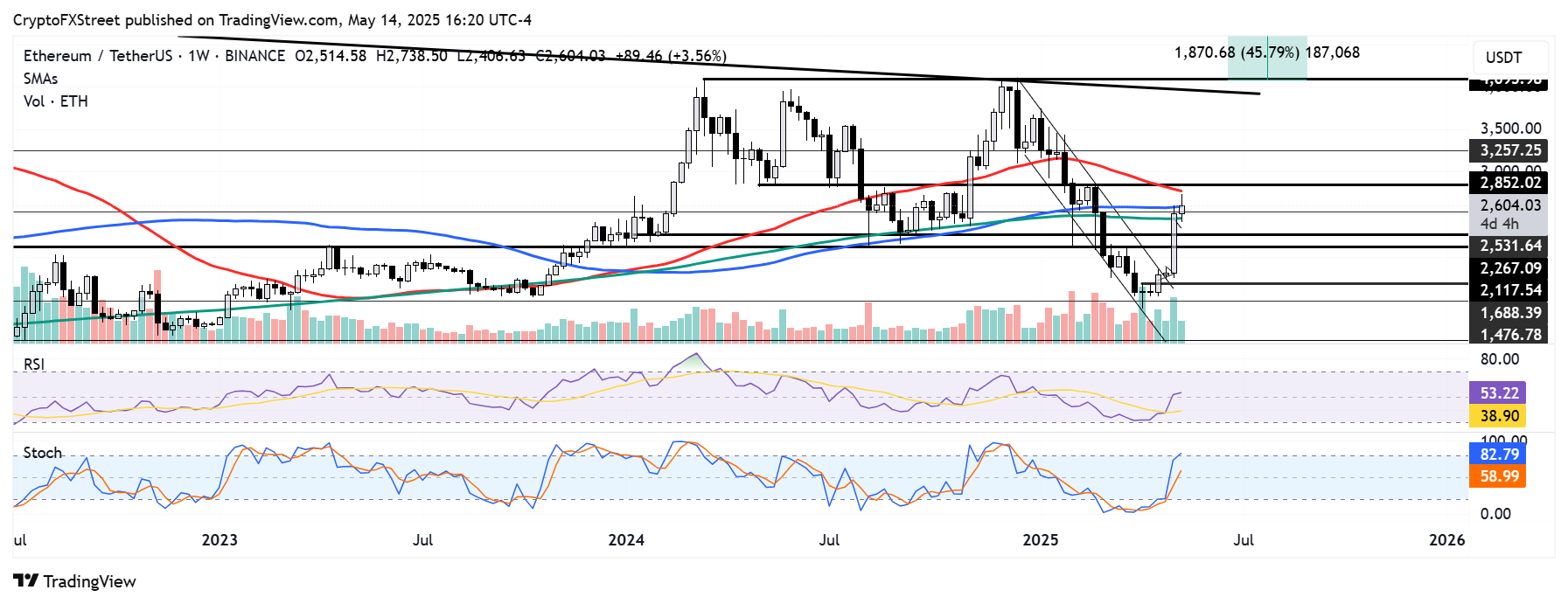

Ethereum Price Forecast: ETH eyes $2,850 key level but faces resistance at 50-week SMA

Ethereum saw $105.07 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $74.09 million and $30.98 million, respectively.

After rising to $2,750, ETH saw a rejection at the 50-week Simple Moving Average (SMA) just below the $2,850 resistance level. Following the rejection, ETH could find support near the $2,530 key level, which is strengthened by the convergence of the 100 and 200-week SMAs.

ETH/USDT daily chart

On the upside, ETH could reclaim the $3,000 psychological level and test the $3,250 resistance if it sustains a firm move above the 50-week SMA and the $2,850 resistance level.

The Relative Strength Index (RSI) is slightly above its neutral level while the Stochastic Oscillator (Stoch) is testing the overbought region. A weekly candlestick close above their neutral levels could strengthen the bullish momentum and push ETH above $2,850.

A weekly candlestick close below $2,110 will invalidate the thesis and potentially send ETH to $1,688.