Binance addresses ACT traders after sudden $1.8M in liquidations

- Binance adjusted leverage limits for the ACT token, triggering a 50% price drop and forced liquidations.

- Three VIP users and one retail trader dumped over $1 million in ACT, intensifying the sell-off.

- Binance reduced ACTUSDT futures leverage to limit further risk, but cannot freeze trading due to the token's full circulation.

ACT The Prophecy (ACT) token price plunged by more than 50% during intraday trading on Tuesday as Binance adjusted the leverage position limit for the token. The adjustment affected both the futures and spot markets, causing cascading liquidations on Wednesday.

ACT token traders book $5 million losses as Binance tweaks leverage limit

Reports indicate three VIP users offloaded approximately $514,000 of ACT tokens, while an additional retail trader sold $540,000. This collective sell-off created an immediate price gap between the futures and spot markets.

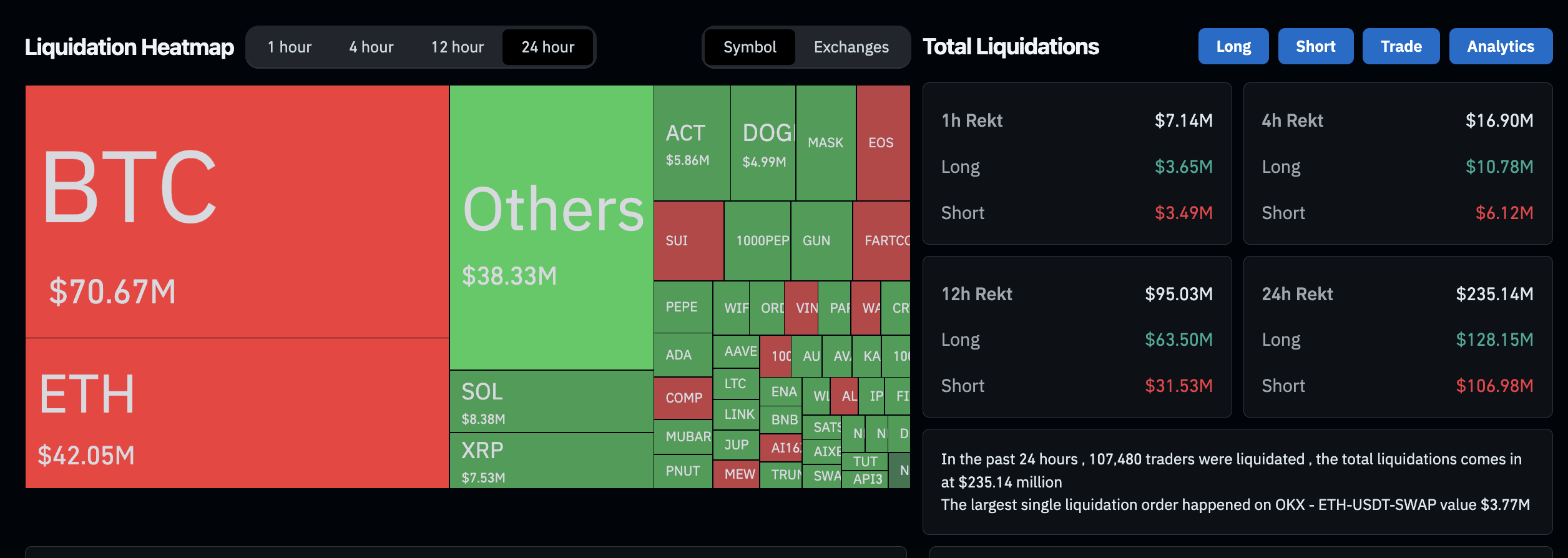

ACT token traders booked 4th largest losses on Wednsday, April 2, 2025 | Source: Coinglass

ACT token traders booked 4th largest losses on Wednsday, April 2, 2025 | Source: Coinglass

The mass liquidation that followed disrupted market stability, forcing Binance to take action.

At press time, Coinglass data shows that ACT token traders have booked losses worth $5.9 million in the last 24 hours, with an accompanying 37% price decline on the daily chart.

Despite this sharp decline, Binance confirmed that no single entity profited significantly from the event, but concerns about market manipulation remain.

The impact of ACT price volatility and expert commentary

This unexpected liquidation wave has reignited discussions around leverage adjustments and their effects on market stability. The incident has also highlighted the role of exchange policies in shaping investor sentiment.

Market participants have raised concerns about the transparency of Binance’s risk management approach, calling for more structured communication to prevent similar occurrences in the future.

Benson Sun, a well-known cryptocurrency analyst, emphasized the importance of communication between exchanges and traders. He argued that Binance should have notified stakeholders about such impactful changes beforehand to mitigate risks.

"Binance should inform stakeholders of such impactful changes to minimize market disruption."

- Benson Sun

Regulatory bodies could further scrutinize Binance’s actions, potentially influencing future oversight of leverage trading within the crypto space.

Binance investigates ACT token dump: What they found

Following the dramatic price crash, Binance launched an internal investigation into the incident.

The platform identified four users, including three VIP traders, who sold more than 1.05 million USDT of ACT tokens on the spot market.

The mass sell-off resulted in futures liquidations and affected several low-market-cap tokens.

As a precautionary measure, Binance has reduced the leverage on ACTUSDT futures to prevent similar volatility events.

However, since ACT tokens are already fully circulated, Binance stated that it cannot impose trading restrictions on the asset.

The exchange continues to monitor trading activity and has urged traders to exercise caution when using leverage.

Market reactions and ACT's current status

This event emphasizes the risks of highly leveraged trading on low-cap meme tokens.

As Binance continues its investigation, traders remain on high alert, monitoring potential regulatory implications and future adjustments in leverage policies.

The ACT token is trading at $0.56 at the time of publication, down 35.9% within the past 24 hours.

Act The AI Prophecy token price action, April 2, 2025 | Source: CoinMarketCap

Act The AI Prophecy token price action, April 2, 2025 | Source: CoinMarketCap

According to CoinMarketCap, the ACT’s market capitalization stands at $53 million which reflect nearly 95% losses from its all time high valuation of $811 million recoded in November 2025