BNB price prediction: Binance Coin crosses $650 as Changpeng Zhao urges traders to buy Bitcoin before Trump

- BNB price rebounded 4% in the last 24 hours as bulls look to keep price steady above the $650 psychological support level.

- BNB has witnessed increased social media traction amid Changpeng Zhao recent comments on the crypto industry and BNB-hosted projects.

- Weeks after denouncing memecoins, CZ urged investors to purchase Bitcoin as US government and institutions race to launch BTC strategic reserve.

BNB price rebounded 4% in the last 24 hours as bulls look to hold the Binance native token steady above the $650 psychological support level. On-chain data shows BNB continues to dominate social media discourse amid recent viral market commentary from founder and ex-CEO Changpeng Zhao.

BNB price retakes $650 as court okays Binance return to US markets

Binance Coin (BNB) has recorded considerable gains this week as market interest returned to the crypto sector.

While the resumption of crypto trade discussions between the United States (US) and Russia lifted global financial market sentiment, the Binance ecosystem experienced another internal bullish catalyst.

On Wednesday, Binance US announced the resumption of deposits and withdrawals in US Dollars (USD), ending an 18-month hiatus amid a long-drawn-out legal battle with the US Securities and Exchange Commission (SEC).

Binance.US confirmed the full reactivation of its USD services, allowing American customers to deposit and withdraw funds via bank transfers (ACH), trade pairs in USD and link their bank accounts to the platform. This deployment will be gradual, enabling all eligible customers to access these services "in the coming days."

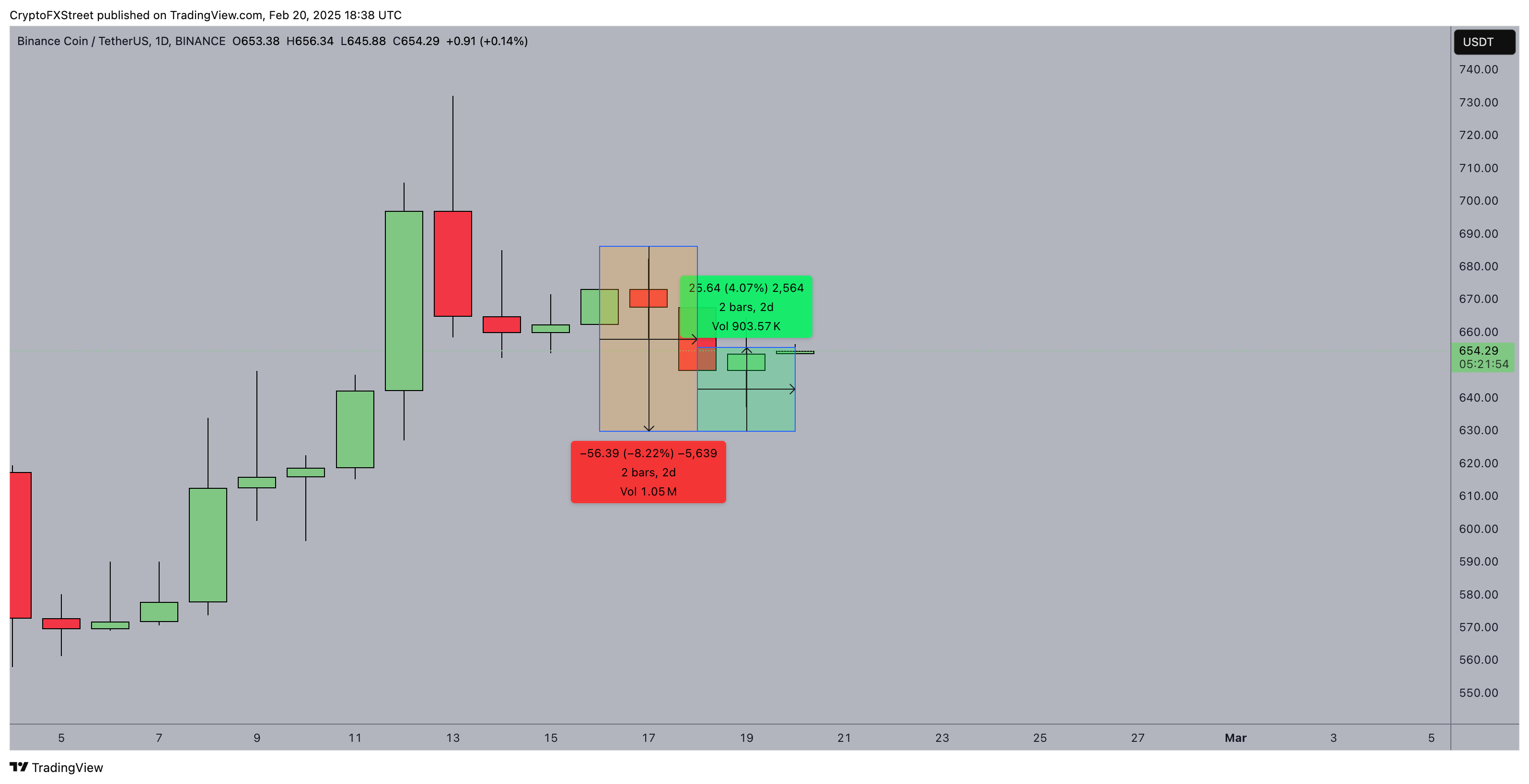

Binance Coin (BNB) Price Action | BNBUSDT

BNB price reacted positively to this major milestone, rising as high as $654 on Thursday—up 4% from the local bottom of $629 recorded on Tuesday.

Previously, Binance US was forced to restrict its operations due to what the company described as "extremely aggressive and intimidating tactics" from regulators.

The initial suspension led the exchange to temporarily reposition itself as a "crypto-only exchange," significantly limiting services for American users.

BNB media traction grows as Changpeng Zhao urges traders to avoid memes and buy Bitcoin before US Government

Binance Coin has recently gained positive momentum, largely due to renewed market interest in response to Binance US resuming USD services and diplomatic developments between the US and Russia.

However, on-chain data emphasizes other active bullish catalysts.

Santiment's Social Volume score, which tracks the level of media mentions a crypto project attracts relative to the top 50 trending assets, indicates heightened engagement surrounding BNB.

The increase in social media traction coincided with Changpeng Zhao’s recent commentary on the crypto industry and BNB-hosted projects.

Binance Coin Price vs. Trading Volume | BNBUSDT

When CZ first denounced the TST memecoin rumors on February 13, BNB's media mentions surged, reaching a four-month peak Social Volume score of 499.

Since then, BNB’s social volume has remained relatively high, hitting 209 on Wednesday, as CZ made another viral comment urging investors to purchase Bitcoin ahead of the US government and institutions launching a BTC strategic reserve.

Responding to an X post hinting at Montana becoming the fourth US regional government after Utah and Oklahoma to adopt a Strategic Bitcoin Reserve (SBR), CZ stated:

"You can buy bitcoins after the US government is done buying, or before. There is no other choice.."

- Chang Peng Zhao

Binance’s US market re-entry could expand demand for BNB

The reactivation of Binance’s USD services could significantly increase BNB demand among US-based investors at a time when regulatory stances appear to be softening.

With government and institutional demand for crypto trading rising, Binance's return to US markets could create a favorable environment for increased liquidity and utility of the Binance Coin.

Additionally, Changpeng Zhao’s comments on the US strategic Bitcoin reserves could amplify demand for exchange-native tokens like BNB.

As institutions look to accumulate BTC, traders may increasingly turn to BNB as a strategic asset, bolstered by its role within the Binance ecosystem.

In the weeks ahead, continued regulatory clarity and heightened institutional participation in crypto markets could further strengthen BNB’s price outlook.

BNB price forecast: $700 breakout ahead if key support levels hold

BNB price forecast suggests a potential breakout toward $700 if key support levels hold, as the market structure remains cautiously bullish.

The daily chart highlights BNB’s recent rebound from $629 to $655, marking a 4% recovery in the past 48 hours.

BNB price remains above the psychological $650 level, indicating bulls' determination to establish a higher floor.

The upper Donchian Channel (DC) band at $732 serves as a key resistance level, while the lower boundary at $500 represents a significant downside risk.

Binance Coin (BNB) price forecast

Despite the short-term rally, BNB faces mixed signals. The Bull-Bear Power (BBP) indicator remains negative at -0.71, showing that bearish pressure has not fully dissipated.

However, the weakening red histogram bars suggest that sellers are losing momentum, potentially paving the way for further upside.

The recent volume surge of 905.97K in two days signals renewed market participation, which could support a breakout if buying pressure continues.

If bulls push BNB past $670, a move toward $700 becomes likely. Conversely, failure to hold $650 could expose the coin to a retest of $616.

A break below this level may accelerate losses toward the $500 support zone.