Ripple Price Forecast: XRP $2.00 breakout in focus, supported by unwavering institutional interest

- XRP holds $1.90 immediate support, signaling stability ahead of a potential breakout above $2.00.

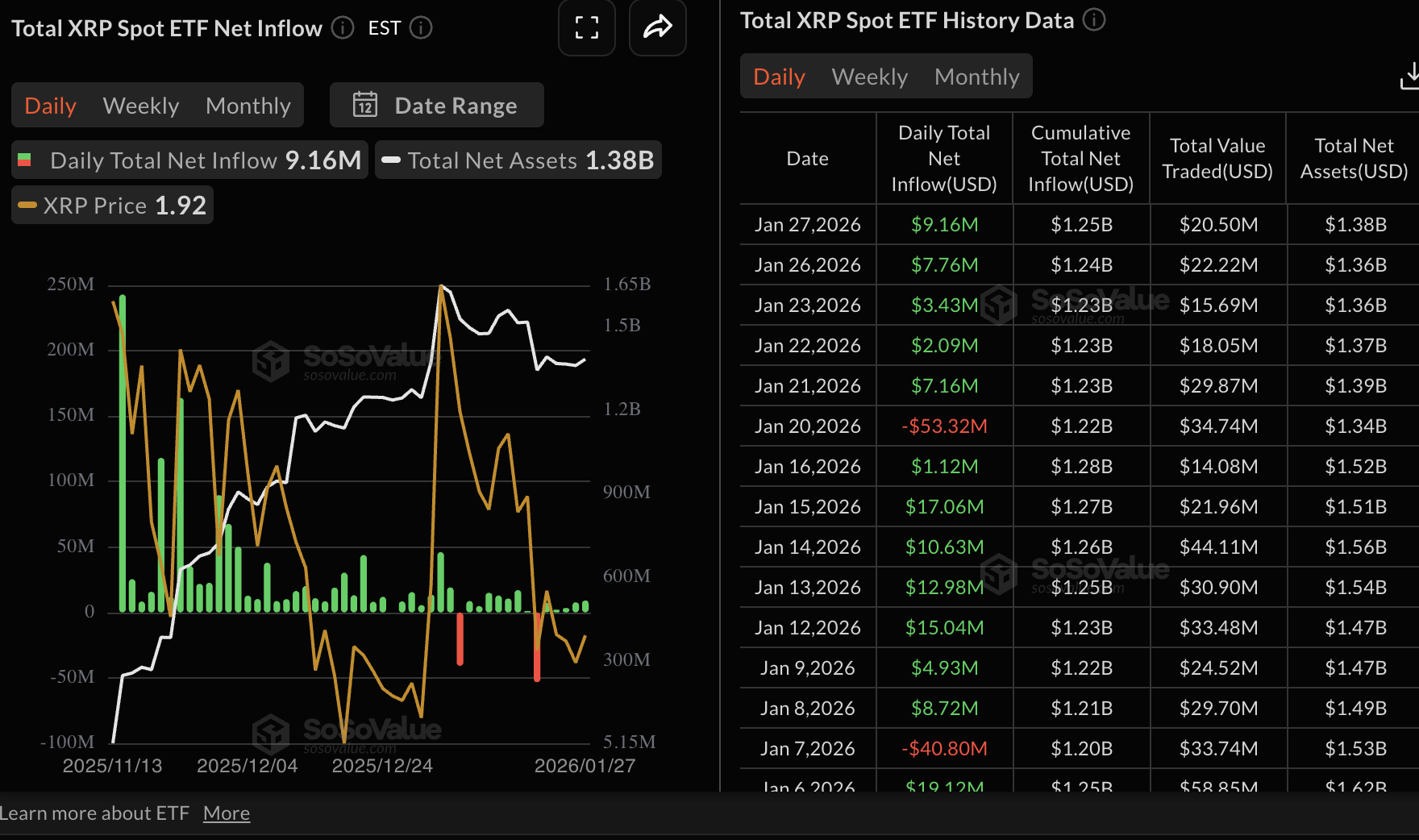

- XRP attracts institutional investors as inflows into ETFs exceed $9 million on Tuesday.

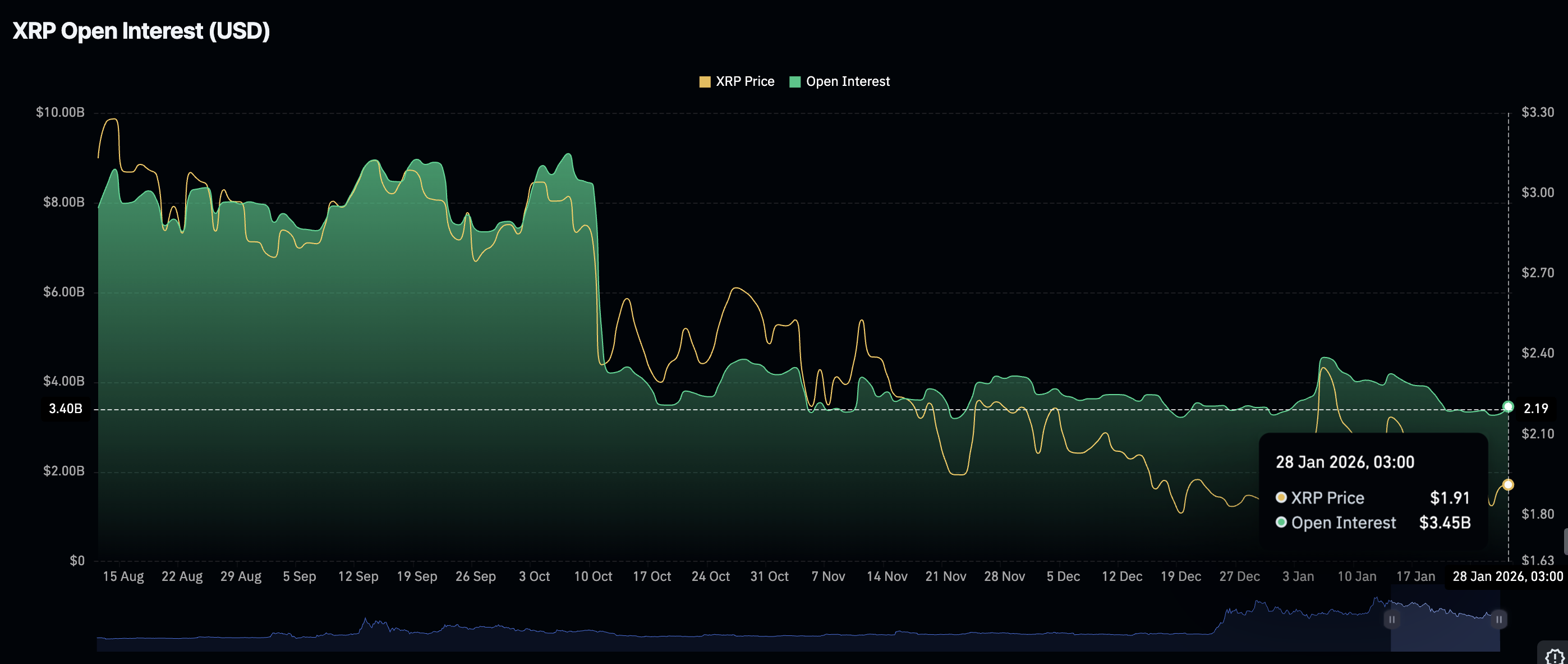

- The XRP derivatives market shows relative strength, with futures Open Interest rising to $3.45 billion.

Ripple (XRP) is trading at $1.92 at the time of writing on Wednesday, and consolidating above support at $1.90. Bulls have exhibited relative strength since Monday, driving XRP upward from the weekly open at $1.84.

Investors are navigating a delicate balance between institutional optimism and macro headwinds, especially with a market consensus that the Federal Reserve (Fed) will keep interest rates unchanged in Wednesday’s monetary policy decision.

XRP steadies as institutional and retail interest revives optimism

Interest in spot XRP Exchange Traded Funds (ETFs) has remained largely stable since their launch, despite price volatility. The ETFs, licensed to operate in the United States (US), recorded approximately $9 million in inflows on Tuesday, bringing cumulative net inflows to $1.25 billion, with the total assets under management (AUM) hovering at $1.38 billion.

The unwavering institutional demand for XRP spot ETFs stands in stark contrast to broader crypto market weakness, as Bitcoin (BTC) and Ethereum (ETH) ETFs faced significant outflows of approximately $147 million and $64 million, respectively, during the same period.

The derivatives market supports investor optimism for a breakout, as XRP futures Open Interest (OI) increases to $3.45 billion on Wednesday from $3.29 billion the previous day. The uptick in OI reflects renewed retail confidence in XRP’s near-term prospects. However, for XRP to steady its uptrend, traders should continue opening new positions. OI tracks the notional value of outstanding futures contracts.

Technical outlook: XRP bulls seek control

XRP showcases stability above support at $1.90, underpinned by strengthening technical indicators. For instance, the Relative Strength Index (RSI) has ascended to 45 on the daily chart, signalling fading bearish momentum. An increase in the RSI above the midline would steady bullish momentum and boost the chances of XRP rising above the $2.00 hurdle.

A decisive break above the 50-day Exponential Moving Average (EMA) at $2.02 could open the door for a move toward higher resistance levels. The 100-day EMA highlights the supply at $2.15 and the 200-day EMA at $2.28.

Still, the token faces mounting overhead pressure, as the Moving Average Convergence Divergence (MACD) remains in the negative region and below its signal line. Failure to hold current support risks extending losses toward the January lows of $1.81.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.