Monero Price Eyes $1,150 Target, but Long-Heavy Leverage Adds Risk

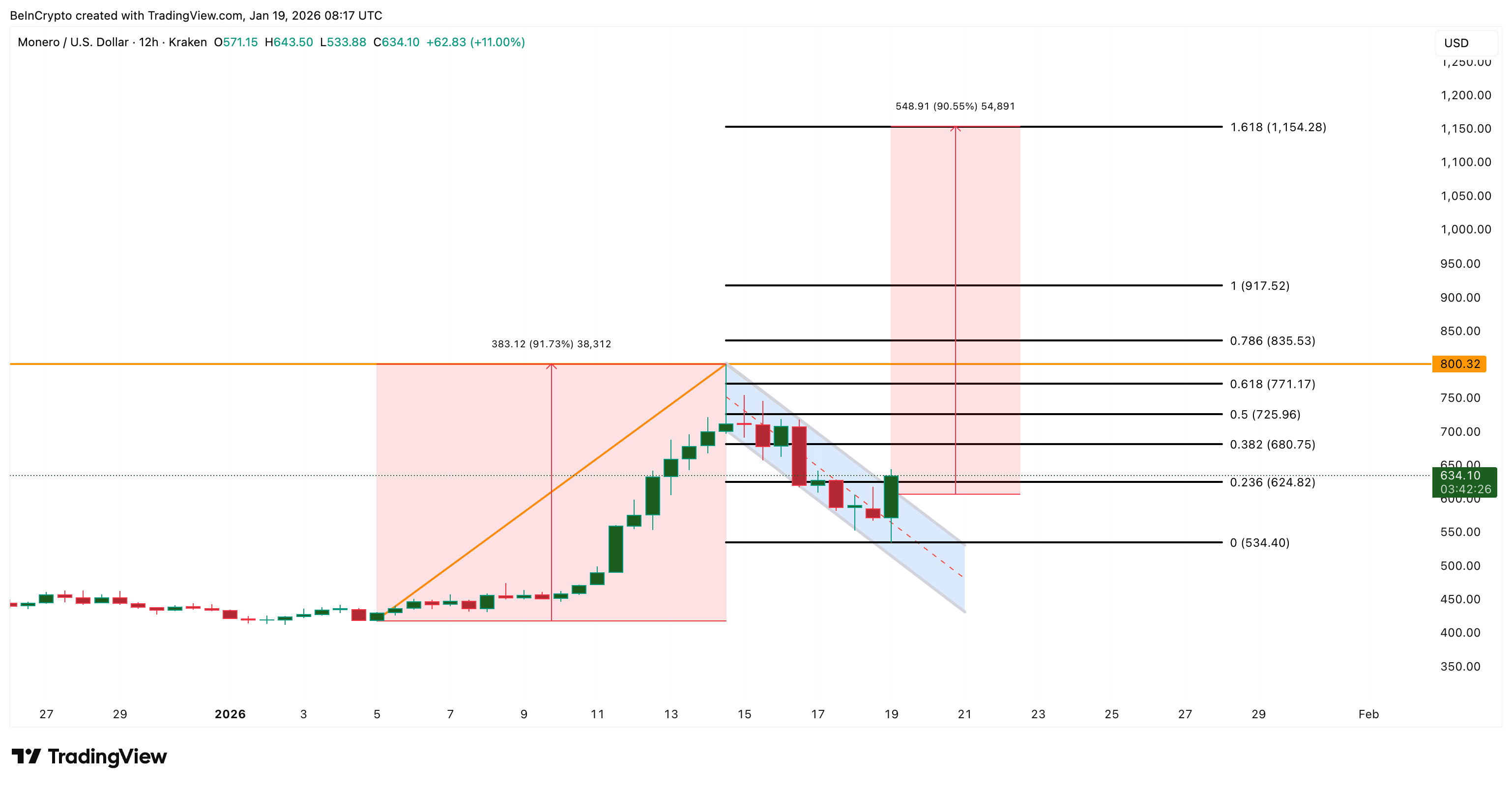

Monero price has stabilized after a sharp pullback, but the recovery is not straightforward. After peaking near $800 on January 14, XMR corrected by roughly 33%, shaking out late buyers. Since then, price action has compressed into a tight consolidation, setting up what looks like a potential continuation pattern.

At first glance, the structure appears bullish. But when momentum, capital flow, and spot behavior are viewed together, the setup carries mixed signals. A breakout is possible, yet the conditions supporting it are uneven.

Big Money Turns Up, but Dip Buying Looks Uneven

On the 12-hour chart, Monero has formed a flag-like consolidation after its sharp decline. The XMR price has now pushed above the upper trendline of that structure, hinting at a possible continuation of the broader uptrend.

What makes this move notable is the capital flow behavior. Chaikin Money Flow, which tracks whether big capital is entering or leaving an asset, avoided a breakdown during consolidation and has turned higher. CMF is currently near 0.05. A push above 0.06 would strengthen the breakout case. A more decisive confirmation would come if CMF can eventually move toward the 0.30–0.32 zone, where sustained upside moves previously gained traction.

Breakout Happens But Weak: TradingView

Breakout Happens But Weak: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, dip buying strength tells a different story. The Money Flow Index (MFI), which blends price and volume to measure buying pressure, has continued to drift lower. While the price trended higher between January 10 and January 19, MFI slipped below the 61.7 level rather than rebounding.

That bearish divergence suggests buyers are not stepping in aggressively, even as the price attempts to break higher.

Dip Buying Weakens: TradingView

Dip Buying Weakens: TradingView

In short, capital flow is improving, but participation remains selective rather than broad.

Spot Flow Flips as Breakout Triggers Caution

Spot market behavior adds another layer of tension.

On January 18, Monero saw strong exchange outflows of roughly $23.95 million. That signaled accumulation, with coins moving off exchanges and into private wallets. But as the breakout candle formed, that trend reversed.

On January 19, exchange flows flipped to inflows of about $2.31 million. This shift suggests that some participants used the breakout attempt to possibly move coins back onto exchanges, a common sign of short-term profit-taking.

Selling Pressure Returns: Coinglass

Selling Pressure Returns: Coinglass

This timing matters. Ideally, a healthy breakout is supported by continued outflows as buyers commit to higher prices. When inflows appear during the breakout itself, it raises the risk of rejection rather than continuation.

So while the XMR price chart shows expansion, spot behavior hints at hesitation.

Long Squeeze Risks Surface as Key Monero Price Levels Come Into Focus

Monero’s breakout attempt cannot be judged on just spot and money flows. Derivatives positioning adds a layer of fragility that makes nearby levels critical.

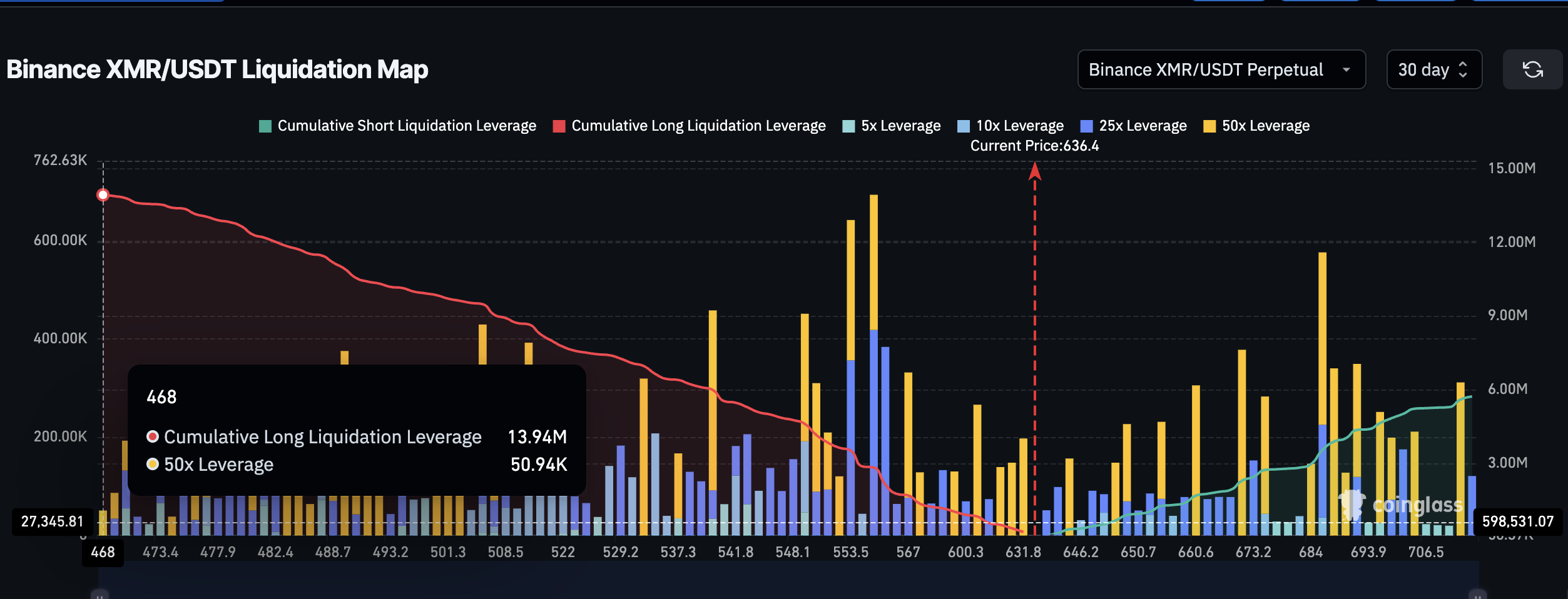

On Binance’s XMR/USDT perpetual market, positioning over the next 30 days is clearly long-heavy. Cumulative long liquidation leverage stands near $13.94 million, while short leverage is closer to $5.72 million. This leaves the market roughly 70% skewed toward long positions.

Long Squeeze Risk For XMR: Coinglass

Long Squeeze Risk For XMR: Coinglass

That imbalance matters because leverage is stacked beneath price, not above it. In a long-crowded market, downside moves tend to accelerate faster than upside moves, creating a long squeeze.

This puts extra pressure on Monero’s current structure.

From a chart perspective, Monero has broken above the upper boundary of its flag pattern on the 12-hour timeframe. As long as price holds above that breakout zone, the bullish setup technically remains valid. The measured move from the prior pole still projects toward the $910–$1,150 region.

However, for that upside path to strengthen, Monero needs a clean 12-hour close above $800, the prior peak. Without reclaiming that level, upside momentum risks fading under leverage pressure.

Monero Price Analysis: TradingView

Monero Price Analysis: TradingView

On the downside, $620 is the key danger zone. A sustained move below this level would expose a large portion of the $13.94 million in long leverage to liquidation. If that trigger is hit, forced selling could quickly turn the breakout into a failed move rather than a continuation. Losing $530 would liquidate most long positions and even invalidate the bullish pole-and-flag pattern.

In short, Monero sits at a conflicted zone. The chart allows for a push toward $1,150, but the long-heavy derivatives setup leaves little room for error. Until price cleanly clears $800, the breakout remains difficult.