Solana Price Faces Crash Risk Despite 8 Million New Investors

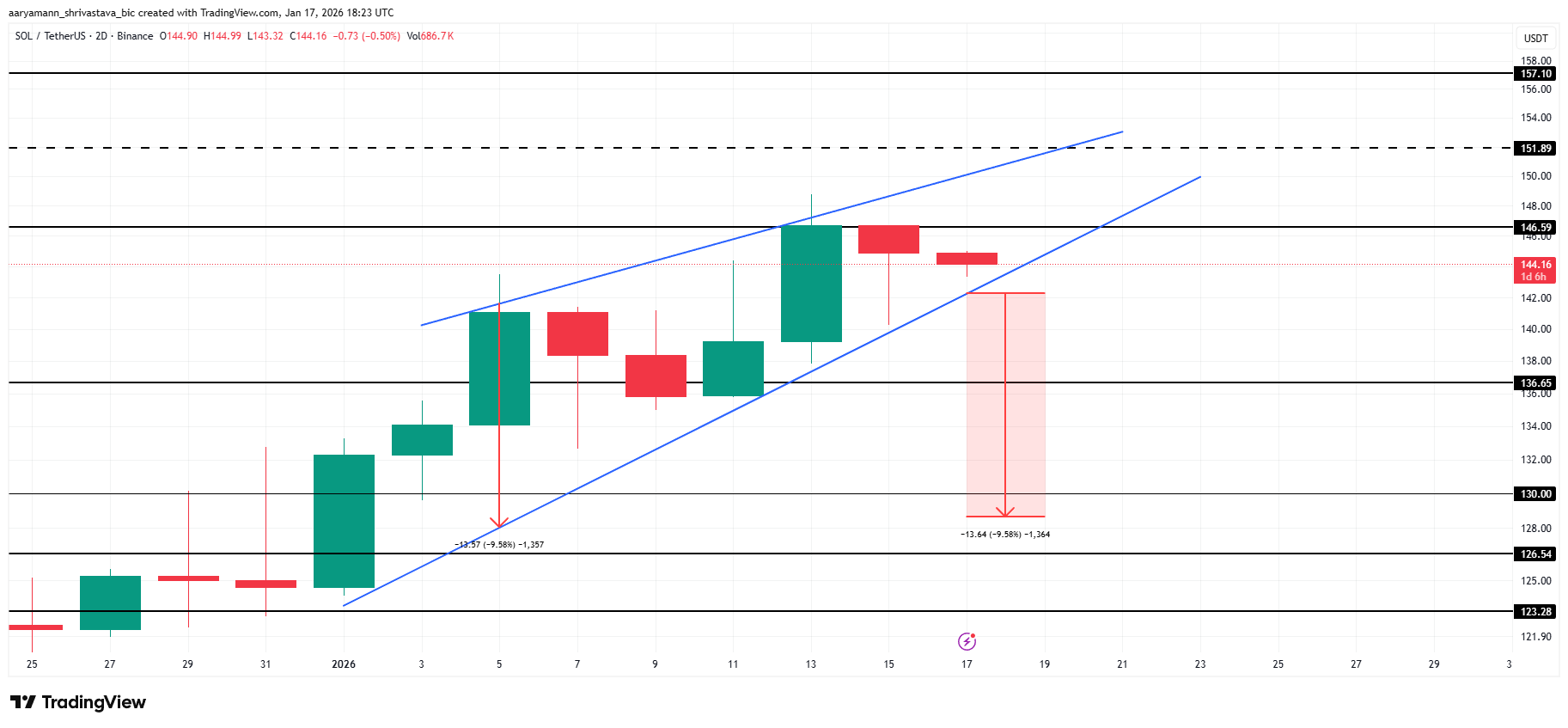

Solana price continues to trend higher overall, but near-term risks are building. SOL has formed an ascending wedge since the start of the month, a pattern that often precedes a pullback.

Despite strong investor participation, the setup suggests a potential dip that could undermine recent bullish efforts.

Solana Holders Counter Each Other

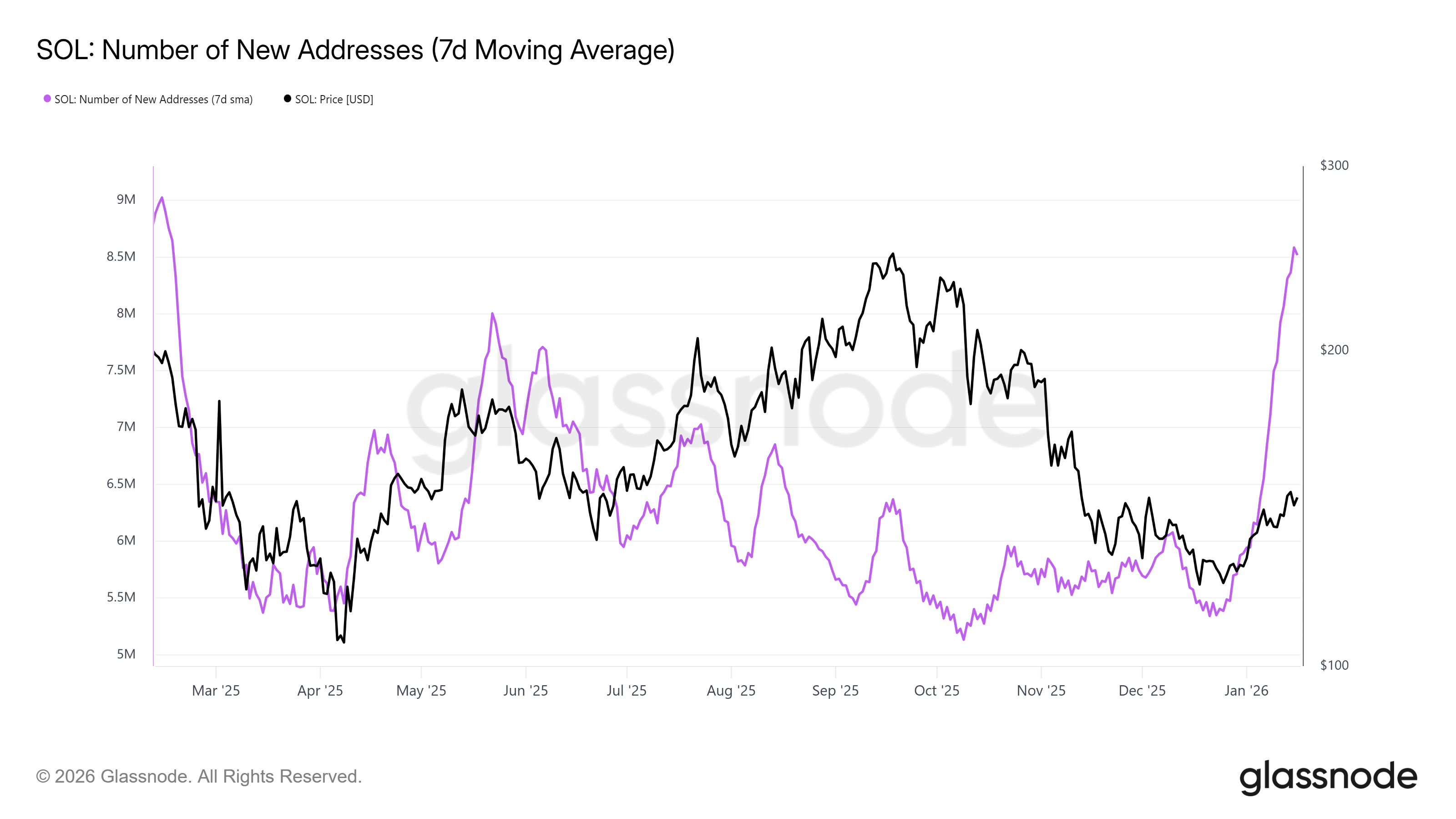

On-chain activity shows strong network growth. Since the beginning of the month, the number of addresses conducting transactions on Solana has surged sharply. At its peak, more than 8 million new addresses joined the network within a single 24-hour period.

This increase signals substantial demand for SOL. New addresses typically bring fresh capital, boosting liquidity and network usage. Such growth reflects Solana’s expanding ecosystem appeal, driven by DeFi activity, memecoins, and high-throughput applications attracting new participants.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana New Addresses. Source: Glassnode

Solana New Addresses. Source: Glassnode

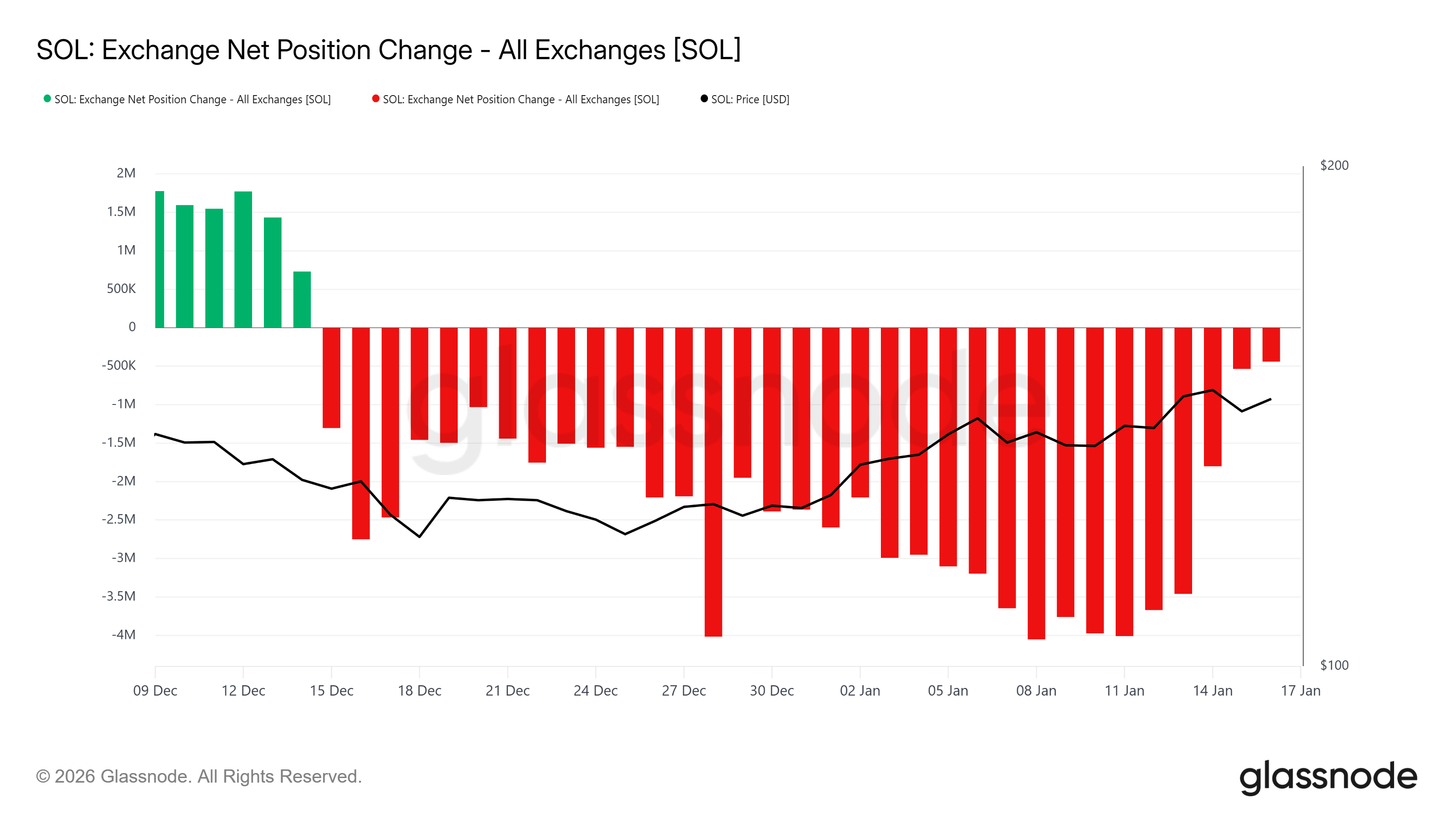

Despite rising network adoption, macro momentum tells a different story. Exchange position change data indicates existing holders are exerting a stronger influence on price action. Buying pressure from long-term participants has weakened, offsetting the impact of new capital inflows.

As buying momentum fades, selling pressure is beginning to dominate. This shift suggests that established SOL holders are reducing exposure or preparing to sell. When legacy supply outweighs new demand, price weakness often follows, increasing the probability of a breakdown from the current structure.

Solana Exchange Position Change. Source: Glassnode

Solana Exchange Position Change. Source: Glassnode

SOL Price Is Looking at a Correction

Solana price trades near $144 at the time of writing, moving within an ascending wedge formed over recent days. This bearish continuation pattern projects a potential 9.5% decline, placing the downside target near $129 if the structure resolves lower.

The projected drop aligns with weakening momentum indicators. A confirmed breakdown would likely push SOL toward $136 initially. Losing that support would expose the $130 level, where buyers may attempt to stabilize the price amid broader market caution.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingView

Still, the bearish scenario is not guaranteed. If investor sentiment improves and selling pressure eases, SOL could rebound from the wedge’s lower trend line. A move above $146 would signal renewed strength. Further upside could carry Solana toward $151, invalidating the bearish outlook.