Ethereum Bulls Might Fail Because of This Critical Reversal

Ethereum price recently broke out of a bullish triangle pattern, suggesting renewed upside momentum.

However, that breakout now appears vulnerable. ETH has printed a bearish divergence for nearly three weeks, raising concerns that the move lacks conviction.

Crucial Ethereum Holders Are Pulling Back

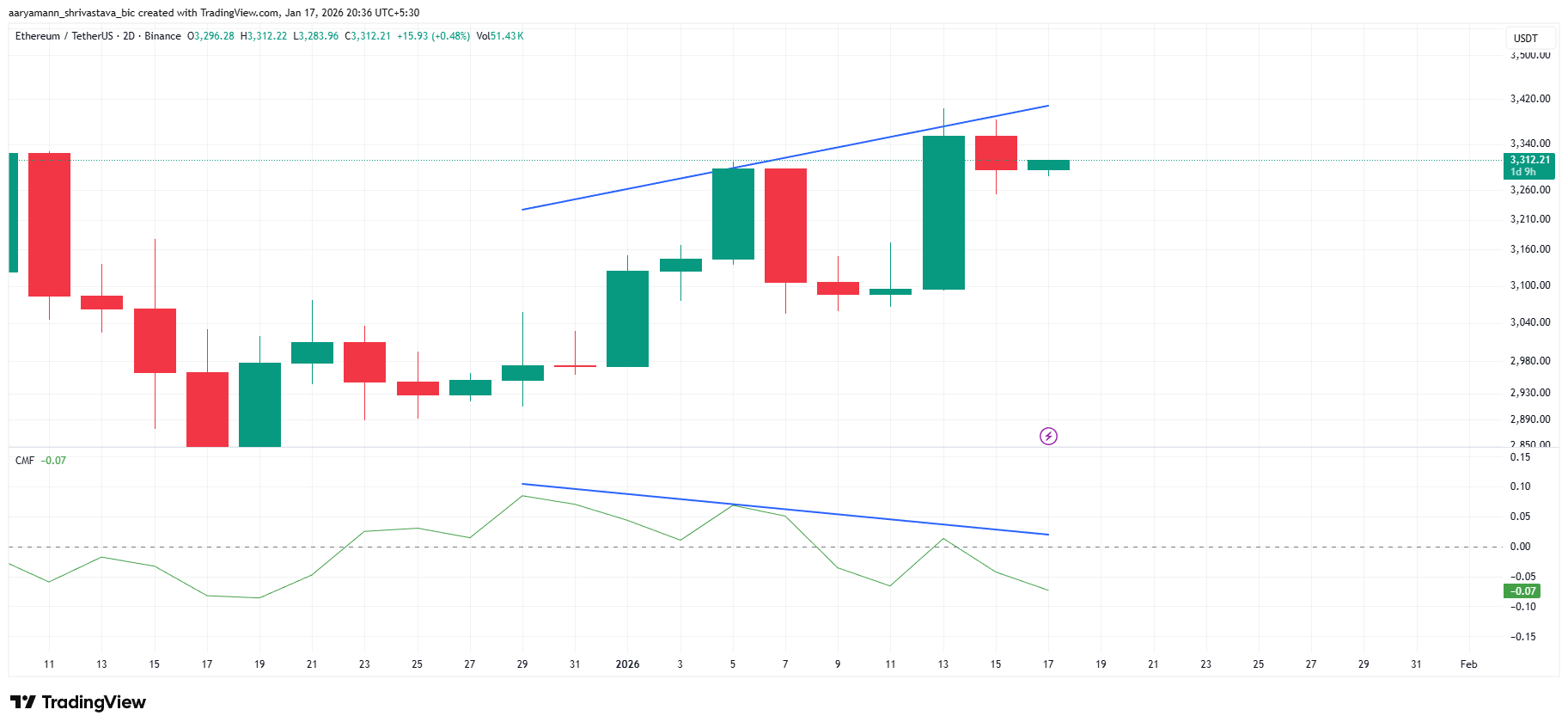

Ethereum has shown a clear bearish divergence over the past three weeks, signaling weakening internal strength. While the ETH price continued forming higher highs, the Chaikin Money Flow indicator posted higher lows. This pattern suggests price appreciation occurred alongside rising capital outflows rather than sustained inflows.

Such divergence often precedes a trend reversal. Investors appear to be distributing ETH into strength instead of accumulating. As capital exits the market during price expansion, upside momentum erodes. This dynamic increases the probability of a failed breakout, especially in a cautious broader crypto environment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ETH Bearish Divergence. Source: TradingView

ETH Bearish Divergence. Source: TradingView

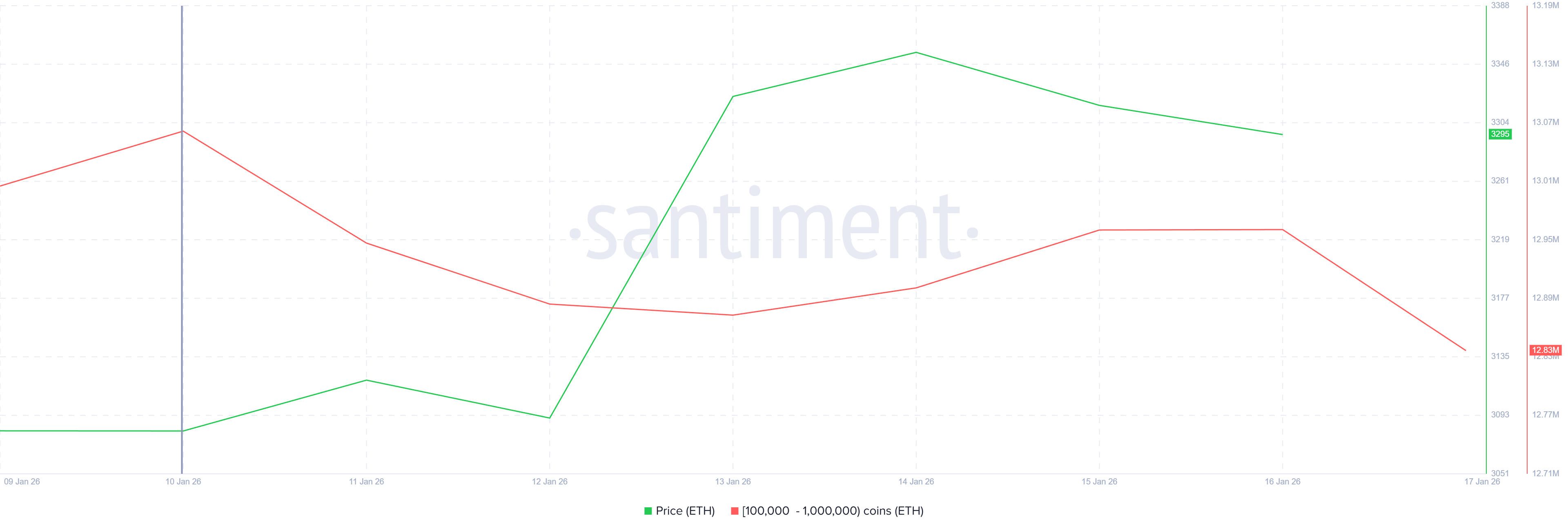

Macro data reinforces the bearish signal seen in momentum indicators. Ethereum whales have increased selling activity during the past week. Wallets holding between 100,000 and 1 million ETH sold more than 230,000 ETH, according to on-chain data.

This selling pressure equals roughly $760 million at current prices. Large wallet outflows align with the declining CMF, confirming reduced confidence among major holders. When whales sell into breakouts, price sustainability weakens, increasing the likelihood of further downside in the near term.

ETH Whale Holding. Source: TradingView

ETH Whale Holding. Source: TradingView

ETH Price Could Be Facing A Drop

Ethereum price trades near $3,309 at the time of writing, holding just above the $3,287 support level. The recent triangle breakout projected a 29.5% upside move, targeting $4,240. However, fading momentum and bearish divergence threaten to invalidate that bullish structure.

Given current conditions, ETH is likely to lose the $3,287 support. A breakdown would send the price toward the $3,131 level, confirming the move as a fakeout. Such a rejection would increase selling pressure and suggest a deeper correction below $3,000 could follow.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

Still, the downside is not guaranteed. If ETH successfully bounces from $3,287 and whale selling subsides, bullish momentum could return.

Holding that support may allow Ethereum to push toward $3,441. Further strength could extend gains toward $3,802, invalidating the bearish outlook.