Crypto market dips as Senate postpones market-structure bill discussion after Coinbase withdrawal

- Senate Banking Committee has pushed back on discussing crypto market-structure bill after Coinbase withdrew support for the latest draft.

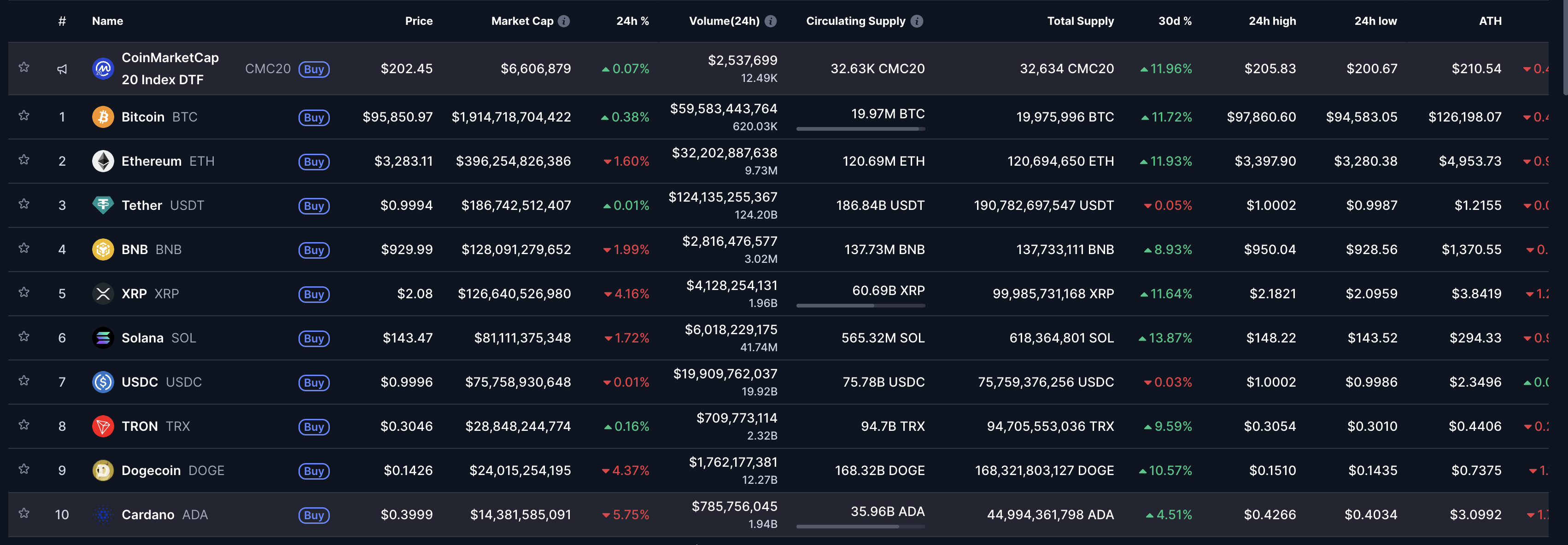

- Bitcoin drops 1% while major altcoins such as Ethereum, XRP, and Solana roughly lose over 2% on Thursday.

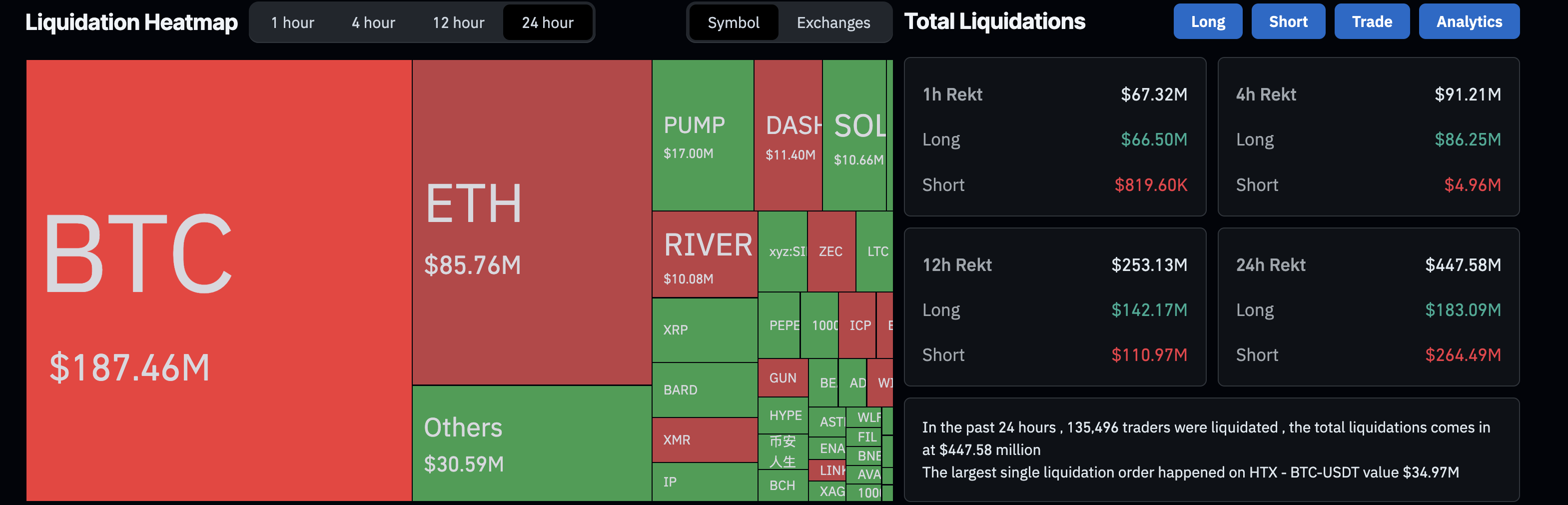

- Total liquidations over the last hour suggest roughly $66 million in bullish position wipeouts, while short liquidations remain below $1 million.

The cryptocurrency market trades in the red on Thursday after the US Senate Banking Committee (SBC) postponed discussions on crypto market structure following Coinbase's withdrawal of support due to multiple issues. Bitcoin (BTC) drops 1% by press time on Thursday, while Ethereum (ETH), Ripple (XRP), Solana (SOL), and other major altcoins decline further, leading to a spike in long liquidations.

Senate postpones the digital asset market structure discussion amid industry warnings

The US Senate Banking Committee canceled the markup of the digital asset market structure on Thursday, postponing it as bipartisan negotiations continue. SBC Chairman Tim Scott announced in an official statement that bipartisan leaders, alongside the crypto and financial sectors, are continuing to work on the draft.

Scott further added that, “This bill reflects months of serious bipartisan negotiations and real input from innovators, investors, and law enforcement.”

This announcement followed Coinbase’s CEO, Brian Armstrong, suddenly opposing the bill, saying, “We’d rather have no bill than a bad bill.” According to Armstrong, the bill kills stablecoin rewards, erodes the Commodity Futures Trading Commission's (CFTC) authority, imposes DeFi prohibitions that violate privacy rights, and imposes a de facto ban on tokenized equities.

The new official dates for discussing the markup have yet to be determined, and the delay suggests the possibility of restructuring it. A few key contentious points in the bill are the ban on stablecoin rewards and the lack of clarity on government officials profiting from crypto.

Crypto market dips as Senate delays the markup

Bitcoin dips below $96,000 at press time on Thursday, down 1%, pricing in the Senate announcement. This intraday pullback risks breaking the streak of four consecutive days of recovery.

If BTC ends the day in red, it could extend the decline to the 50-day Exponential Moving Average (EMA) at $92,089.

However, the technical indicators on the daily chart suggest that the bullish momentum sustains. The Relative Strength Index (RSI) is at 65, reversing from the overbought zone, while the Moving Average Convergence Divergence (MACD) keeps rising.

If Bitcoin recovers later in the day, a positive close could extend the recovery to the 200-day EMA at $99,562, close to the $100,000 psychological milestone.

In line with the dip in BTC, altcoins such as Ethereum, XRP, Solana, and Dogecoin (DOGE) are down roughly 2% to 4%.

CoinGlass data shows a bearish bias in the crypto market, as long liquidations of $66.50 million outpaced short liquidations of $819,600, suggesting that more bullish positions were liquidated.