Cardano Whales Buy 100 Million ADA, but Price Still Struggles Below $0.40

The Cardano price is stuck in an uncomfortable place. It is down roughly 6% over the past seven days and has barely moved over the last 24 hours. That flat action reflects hesitation.

Price has been hugging one key trend line for days without breaking lower or pushing higher. This same line has already decided Cardano’s fate once before. The market now faces a familiar question: Is this support holding because buyers are stepping in, or because sellers are simply waiting?

Trend Support Builds as Volume Weakens Under the Surface

The most important level right now is Cardano’s 20-day exponential moving average (EMA). An EMA gives more weight to recent prices and helps show whether short-term trend support is intact.

This line matters because it already failed once. On December 11, Cardano lost the 20-day EMA and followed with a sharp drop of nearly 25%. That move turned a slow pullback into a fast sell-off.

This time, the EMA is still holding. But volume tells a less comfortable story.

That warning comes from On-Balance Volume (OBV). OBV tracks whether trading volume is flowing into up candles or out through down candles. When OBV falls while price moves sideways or higher, it often signals quiet selling rather than healthy demand.

Cardano Price And EMA Line: TradingView

Cardano Price And EMA Line: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Between December 28 and January 5, Cardano price trended higher, but OBV trended lower. Sellers were distributing into strength. Since then, OBV has slipped below its recent trendline, suggesting volume support is still weakening, not improving.

So why hasn’t the ADA price broken down already? That question leads directly to what is happening on-chain.

Dip Buying Is Real as Whales Add Around 100 Million Coins

Despite weakening OBV, Cardano has not collapsed because large holders have been buying dips. On-chain data shows clear accumulation near the trend line.

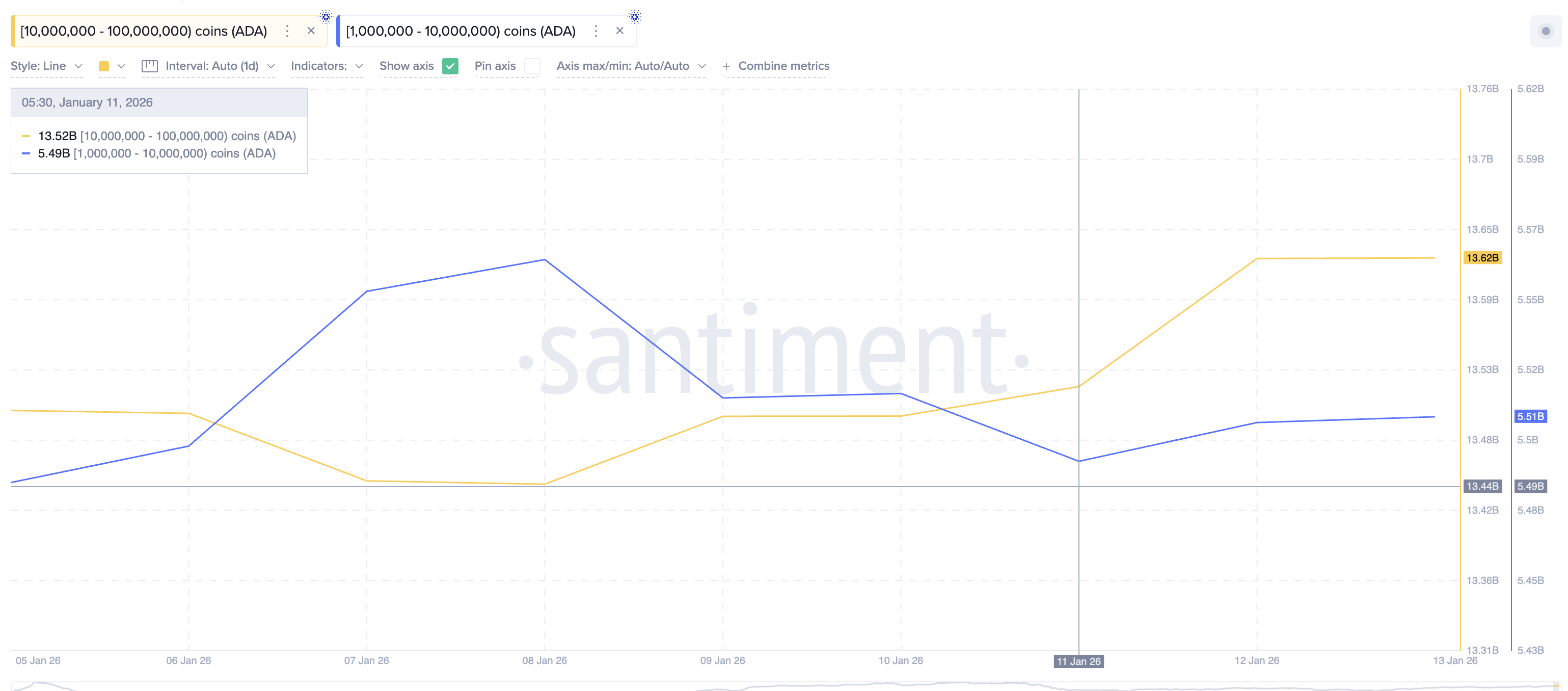

Here is what the numbers show: Wallets holding 1 to 10 million ADA increased their balances from roughly 5.49 billion to 5.51 billion ADA, adding about 20 million ADA starting January 11.

Over the same period, wallets holding 10 to 100 million ADA increased holdings from roughly 13.44 billion to 13.52 billion ADA, adding about 80 million ADA. Combined, whales added close to 100 million ADA over this period. At current prices, that equals roughly 40 million in dip buying.

ADA Whales In Action: Santiment

ADA Whales In Action: Santiment

Momentum data supports this behavior.

The Money Flow Index (MFI), which combines price and volume to track buying pressure, has been trending higher. This shows money flowing into Cardano even as broader conviction remains mixed. This explains the standoff.

Dip Buying Intensifies: TradingView

Dip Buying Intensifies: TradingView

Sellers lack follow-through, while buyers, including whales, continue to absorb dips. But accumulation alone does not guarantee a rally. For direction, the market still looks to derivatives and price structure.

Derivatives Positioning Shows Why $0.40 Decides the Next Cardano Price Move

Derivatives data adds an important layer of caution. Over the past 24 hours:

- Smart money positioning has stayed mostly unchanged, despite being net long. (minimal bounce hopes)

- No strong buildup of new long positions

- Top 100 addresses and regular whale traders remain net short, with no meaningful long buildup.

Most Positions Are Net Short: Nansen

Most Positions Are Net Short: Nansen

This behavior means that traders expect a move, but they are not committing to upside yet.

That brings the focus back to price levels. Since January 7, Cardano has traded in a tight range between $0.37 and $0.40. The reason $0.40 matters is simple. ADA lost this level on January 8 and has failed to reclaim it since.

A clean move above $0.40, followed by acceptance toward $0.43, would signal trend recovery. That would also require OBV to stabilize and turn higher, confirming real demand.

Cardano Price Analysis: TradingView

Cardano Price Analysis: TradingView

The downside is clearer. A daily close below $0.37 would weaken the structure and open a move toward $0.35, with $0.31 back in play if selling accelerates.