3 Meme Coins To Watch In The Second Week Of January 2026

The meme coin market is sending mixed signals. While the category is still down over 5% in the past week, prices are up roughly 5% in the last 24 hours, hinting at renewed interest. Against this backdrop, three meme coins to watch stand out for very different reasons.

One is rising despite whale selling, another is seeing heavy accumulation during a pullback, and a third is drawing growing volume around a key technical reclaim.

Pump.fun (PUMP)

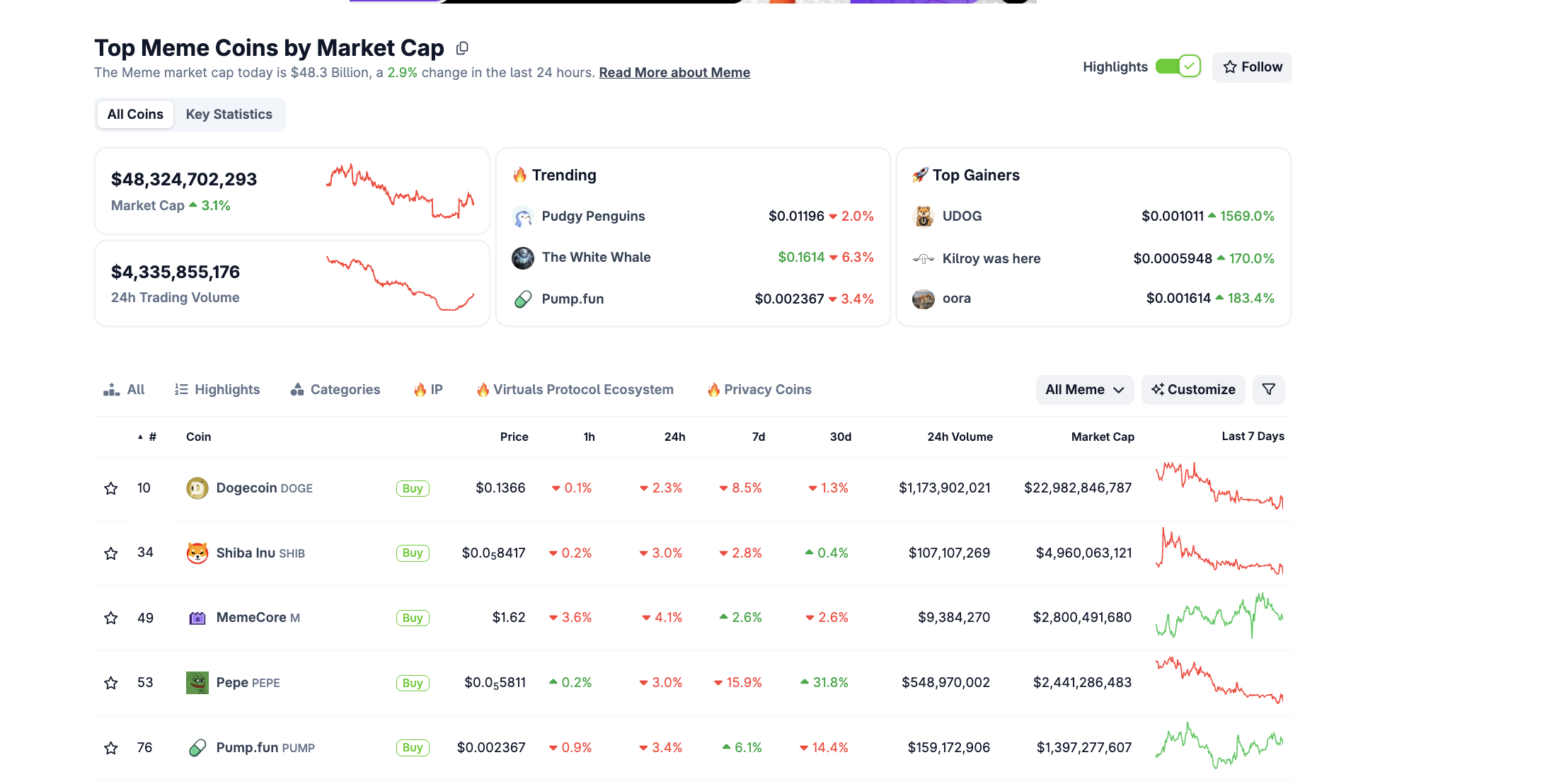

Among the meme coins to watch this week, Pump.fun (PUMP) stands out for a different reason. While many meme tokens are losing momentum, PUMP continues to show relative strength. The token is up around 6% over the past 24 hours and nearly 9% over the past seven days, keeping it on short-term trader watchlists.

Note: Pump.fun is not a meme coin by design. It is a launch platform where meme coins are created and traded. It is included here because CoinGecko classifies it under the meme coin category, and its recent move has materially influenced the performance of that category this week.

PUMP Features In The Meme Category: CoinGecko

PUMP Features In The Meme Category: CoinGecko

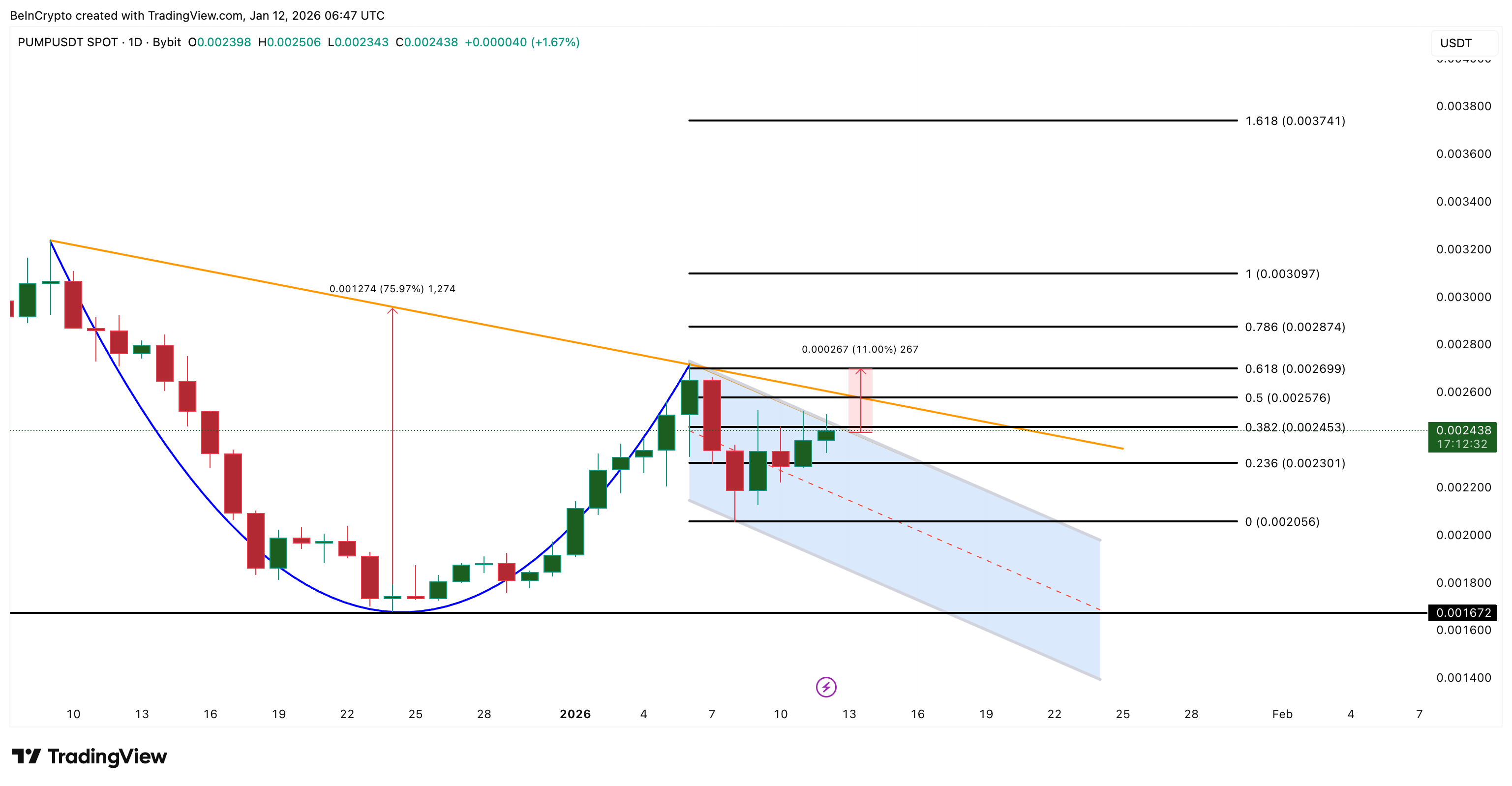

Price action shows Pump.fun forming a cup and handle pattern, but with an important caveat. The cup is downward sloping, not flat. This matters because a downward-sloping cup often reflects weaker conviction beneath the surface. Breakouts from this structure are possible, but they require stronger follow-through buying than normal.

PUMP Price Analysis: TradingView

PUMP Price Analysis: TradingView

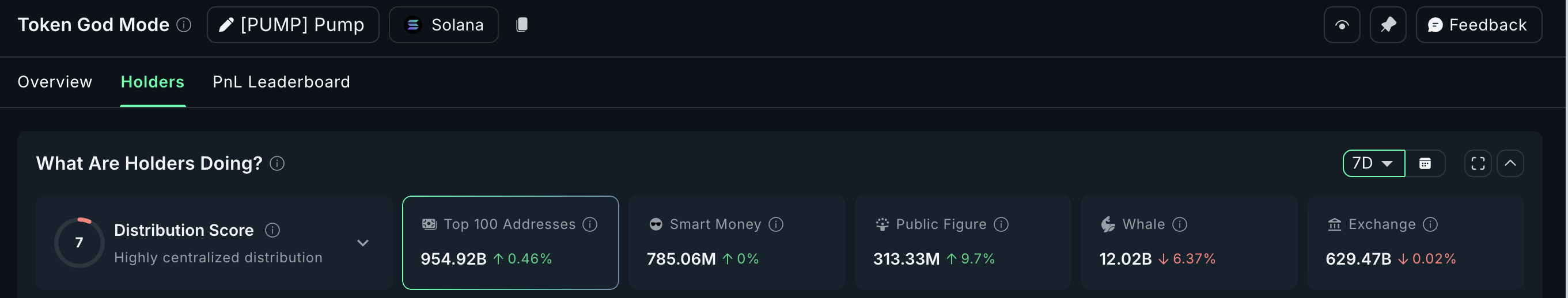

That hesitation is visible in whale behavior. Over the past seven days, whale wallets have reduced holdings by 6.37%. Whale balances now sit at 12.02 billion PUMP, meaning roughly 820 million tokens were sold during a week when the price was still rising. At the current price, that equals about $2 million in distribution.

PUMP Whales: Nansen

PUMP Whales: Nansen

This divergence is important. Price is moving higher, but large holders are selling into strength. That does not kill the bullish setup, but it does raise the confirmation bar.

On the chart, $0.0026 is the key level to watch. A daily close above it would confirm the neckline break and open a move toward $0.0037, moving PUMP towards the projected 75% upside based on the cup depth. On the downside, losing $0.0023, followed by $0.0020, would invalidate the pattern and confirm that whale caution was justified.

Pepe (PEPE)

Pepe remains one of the strongest meme coins to watch this week, but its structure is sending mixed signals. The token is up nearly 35% over the past 30 days, making it one of the top gainers in the meme coin category. At the same time, Pepe is down about 14.5% over the past seven days, showing clear short-term weakness inside a still-strong broader trend.

What stands out is whale behavior during this pullback. Since January 7, whale wallets increased their holdings from 133.15 trillion PEPE to 134.32 trillion, an addition of roughly 1.17 trillion tokens. At the current price near $0.0000059, that equals roughly $6.9 million in net accumulation. This buying happened while the broader meme coin market fell more than 5%, showing selective conviction rather than broad risk-on behavior.

PEPE Whales: Santiment

PEPE Whales: Santiment

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The price chart explains why whales may be positioning early. On the 12-hour chart, Pepe is trading tightly between the 20-period and 200-period EMA. An EMA, or exponential moving average, gives more weight to recent prices and helps define trend direction. These two EMAs are converging, increasing the odds of a bullish crossover if price holds.

Historically, reclaiming the 20-period EMA has mattered for Pepe. The last sustained reclaim, on January 1, triggered a 74% rally. A clean 12-hour close above both EMAs could open upside toward $0.0000075, then $0.0000085.

PEPE Price Analysis: TradingView

PEPE Price Analysis: TradingView

Failure, however, carries risk. A 12-hour close below $0.0000056 could expose Pepe to a deeper pullback toward $0.0000039.

Whales appear to be betting on structure before confirmation. The next EMA decision will likely decide whether that conviction pays off.

Floki (FLOKI)

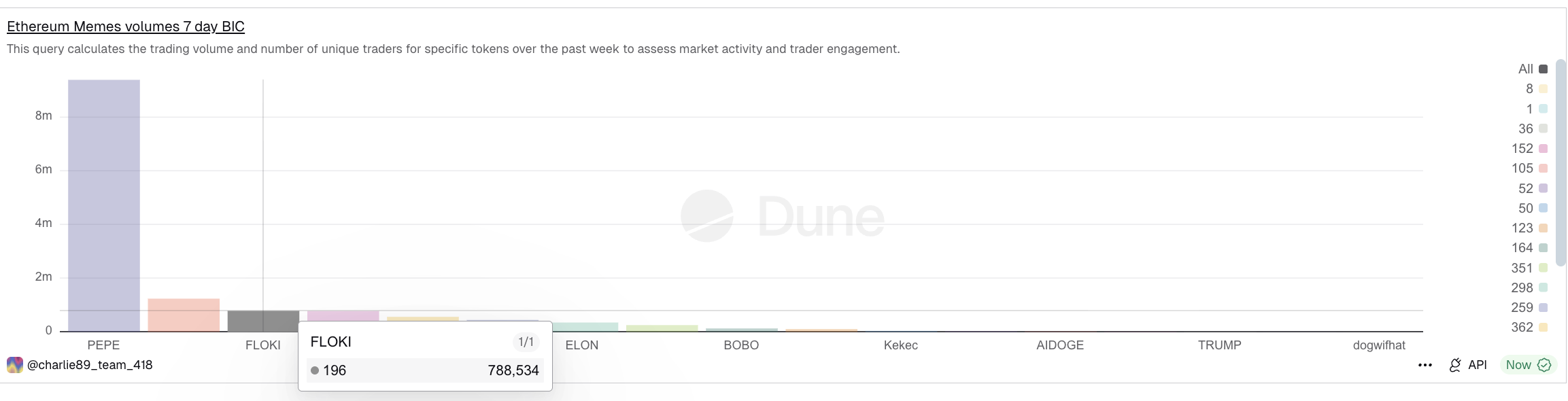

Another meme coin to watch this week is Floki, which is seeing rising attention despite short-term weakness. Over the past seven days, FLOKI is down about 8%, but it remains up nearly 12% over the past 30 days. That puts it in a similar position to Pepe, where recent cooling contrasts with broader strength.

Interest data supports this. Floki ranked as the third-most traded meme coin in early January by volume and unique traders, trailing only Pepe and BabyDoge. That rise in activity suggests traders are rotating attention rather than exiting the meme coin space.

FLOKI Metrics: Dune

FLOKI Metrics: Dune

The price chart helps explain why. On the 12-hour chart, FLOKI has reclaimed its 20-period exponential moving average (EMA). For Floki, this level has been important. Each reclaim over the past month has led to quick upside moves. On January 1, a similar reclaim triggered a 52% rally. A smaller reclaim on December 8 still produced an 11% bounce.

FLOKI Price Analysis: TradingView

FLOKI Price Analysis: TradingView

This makes the current reclaim notable. As long as price holds above the 20-period EMA, Floki could attempt a move toward $0.000053, followed by $0.0000619 if momentum builds. That aligns with the recent jump in trading interest.

The risk is clear. A failure to hold above the EMA would put $0.000050 back in focus. Losing that level could expose a sharper drop toward $0.000038, especially if volume fades.