Gold Nears $5,000, Silver Breaks $80 — and the Dollar Is Losing Its Grip on Markets

As geopolitical tensions rise, the US dollar (USD), long considered the market’s default safe haven, is failing to respond in the way it has historically.

Meanwhile, gold (XAU) and silver (XAG) are flashing signals that extend far beyond a typical commodities rally.

Gold Hits Records As Silver Explodes, But Markets Are Hedging Something Bigger Than Inflation

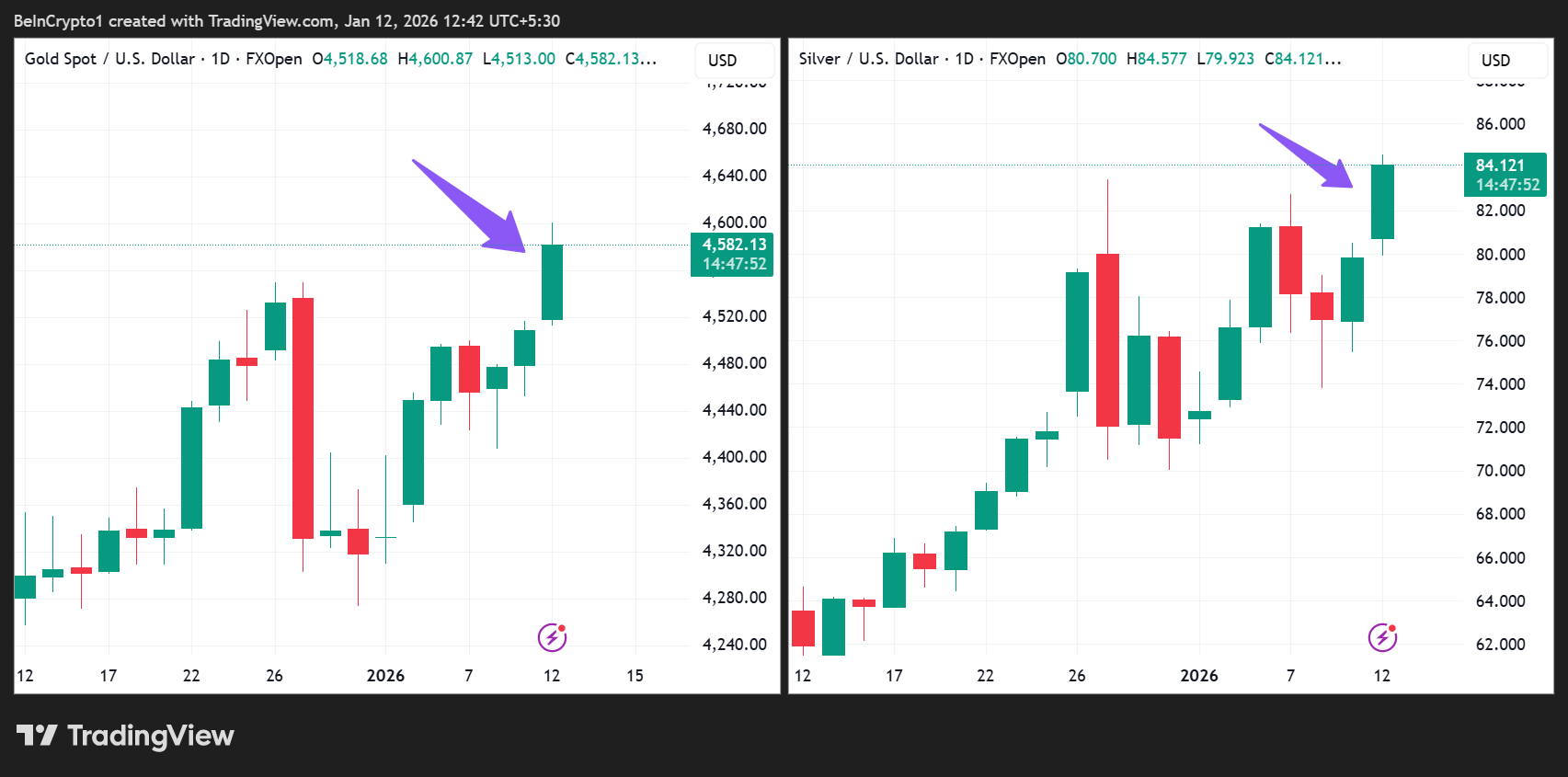

Instead, capital is flowing decisively into hard assets, pushing gold toward the $5,000 mark and silver above $80, levels that are forcing investors to reassess old macro assumptions.

Gold (XAU) and Silver (XAG) Price Performances. Source: TradingView

Gold (XAU) and Silver (XAG) Price Performances. Source: TradingView

Gold stock analyst Garrett Goggin highlighted the anomaly, noting that during previous US military escalations, the dollar almost always strengthened as investors rushed toward perceived safety. This time, the opposite occurred.

“The USD used to spike higher when the bombs dropped. Not anymore,” Goggin said, pointing to a sharp dollar pullback even as gold and silver surged.

Indeed, while gold and silver prices recorded God Candles on Monday, the US dollar index nosedived, dipping to 98.53 as of this writing. The divergence suggests growing skepticism toward the dollar’s role as a geopolitical hedge.

US Dollar Index (DXY) Performance. Source: TradingView

US Dollar Index (DXY) Performance. Source: TradingView

The price action itself is historic. Economist and long-time precious metals advocate Peter Schiff noted that gold has cleared $4,560 for the first time ever, placing it closer to $5,000 than $4,000.

Silver, meanwhile, has jumped above $84, posting one of its strongest relative performances in decades. The simultaneous breakout across both metals is unusual and typically associated with periods of deep monetary or systemic stress.

Analysts argue that silver’s move is not being driven solely by speculative frenzy. Synnax co-founder and COO Dario pointed to silver entering contango—a condition where futures prices trade above spot prices—as a potential signal that large corporate and industrial buyers are entering the market.

According to Dario, this behavior suggests companies are hedging against future supply shortages and rising costs. It indicates real-economy demand rather than short-term trading excess.

Why Gold and Silver’s Breakout Looks Like a Delayed Repricing

The rally has also revived long-standing debates around price suppression in precious metals markets. Kip Herriage argues that gold and silver were artificially restrained for years, citing JPMorgan’s 2020 manipulation fine as a key inflection point.

After that case, Herriage says, prices bottomed, and genuine price discovery began. From that perspective, today’s levels do not represent a bubble but a delayed repricing.

“The truth is, gold & silver should have been their current prices 10 years ago,” he said.

Beyond market structure, Herriage points to a convergence of political and monetary catalysts. He has floated expectations that a basket of gold, silver, and Bitcoin could partially back future US long-term Treasuries. Such a move would fundamentally alter sovereign debt dynamics and structurally boost demand for scarce assets.

While speculative, the idea reflects a broader search for credibility as debt levels rise and confidence in fiat frameworks erodes.

Veteran investors echo the view that the move is far from over. Robert Kiyosaki projected silver above $80 by late 2026 and said he would continue buying up to $100, while cautioning against reckless leverage.

According to the famous author, this is not a short-term trade, but rather what Kiyosaki views as a generational shift in how markets value trust, scarcity, and monetary risk.

Taken together, gold and silver’s breakout—and the dollar’s muted response—suggest markets may be quietly moving into a new regime, one where traditional safe-haven rules no longer apply.