Bitcoin Price Forecast: BTC extends gains as ETF inflows return and traders stay calm amid Venezuela tensions

- Bitcoin price extends its gains on Monday after rallying over 4% in the previous week.

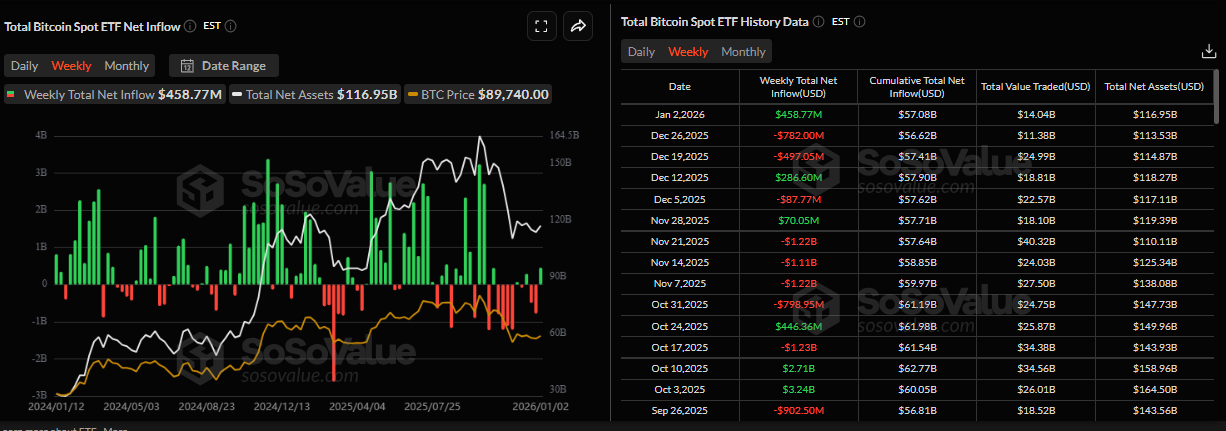

- US-listed spot ETFs recorded $458.77 million in net inflows last week, after two straight weeks of outflows.

- On-chain data suggests that Bitcoin traders remain calm despite rising geopolitical risks related to Venezuela.

Bitcoin (BTC) continues its gains, trading above $92,500 at the time of writing on Monday after surging over 4% in the previous week. Institutional demand for BTC returns as spot Exchange-traded Funds (ETFs) recorded positive flows last week, ending two consecutive weekly withdrawals. Meanwhile, on-chain data shows Bitcoin traders remain composed, with no signs of panic selling despite rising geopolitical risks linked to Venezuela.

Bitcoin institutional demand returns

Institutional demand for Bitcoin shows signs of strength. SoSoValue data show that spot Bitcoin ETFs recorded a net inflow of $458.77 million last week, marking the first net inflow since mid-December and ending two consecutive weeks of withdrawals. However, these inflows are small relative to those seen in early October, when BTC reached a new all-time high of $126,199. If inflows continue and intensify, BTC could see a price rally.

Bitcoin traders remain calm amid the Venezuela crisis

On Saturday, the US carried out a large-scale military strike against Venezuela, capturing the Venezuelan leader, President Nicolás Maduro, and his wife, Cilia Flores.

Later on the same day, at a press conference, US President Donald Trump said, “Maduro and his wife both will face US justice, adding that the US will be running Venezuela until they can do a safe, proper, and judicious transition.”

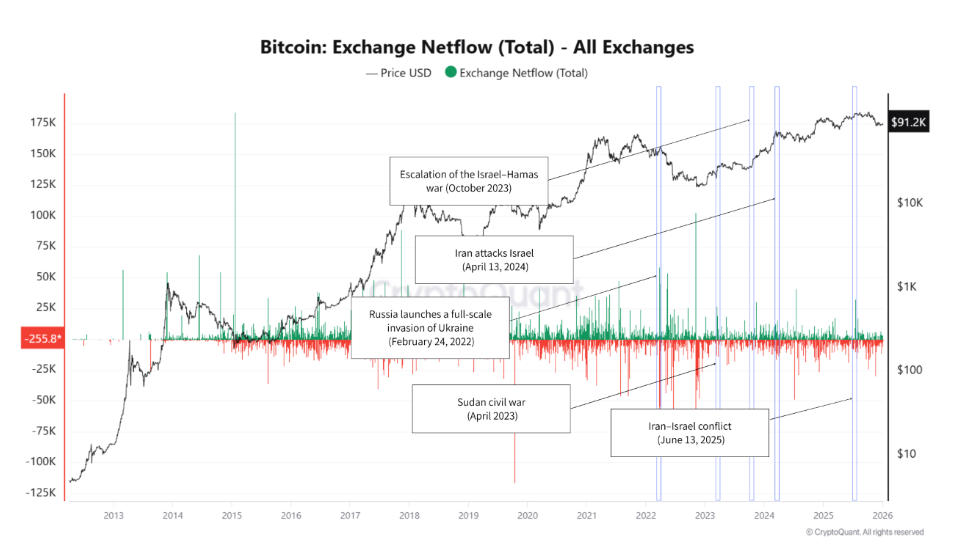

This development has brought geopolitical risk back into focus. While such headlines often trigger concern across global markets, CryptoQuant Exchange Netflow, which tracks whether Bitcoin is moving into or out of exchanges, suggests a calm scenario among traders.

The chart below shows that Netflow at the exchange showed no major movement in response to Saturday's news.

- All Exchanges (8)-1767605290743-1767605290745.png)

Historical conflicts — including Russia’s invasion of Ukraine and recent escalations in the Middle East — have often led to short-term volatility in Bitcoin prices. However, Exchange Netflow has rarely worsened in a sustained way. Since 2023, the market has become more resilient to localized military conflicts, with initial reactions fading quickly. In the current case of the Venezuela conflict, a similar pattern emerges. Despite some price sensitivity, there are no signs of large-scale Bitcoin inflows into exchanges. Panic selling is absent, suggesting the market is cautious but not fearful.

In addition, QCP’s Capital reported on Monday that Washington’s shock over Venezuela could serve as a near-term catalyst for BTC. The analyst explained that beyond the disinflationary impulse from lower Oil prices, market chatter has revived claims that Venezuela may control a substantial “shadow” BTC reserve, potentially comparable in scale to Strategy’s holdings. These claims are unverified.

“If accurate, this would put Venezuela as the largest sovereign holder of BTC. Such an outcome would be consistent with the country’s growing reliance on crypto across various businesses, including the use of USDT in oil transactions since 2024. Moreover, the prospect of the U.S. adding any seized BTC to its own strategic reserve reduces the likelihood of forced selling and underscores BTC’s rising strategic importance as nations compete to accumulate,” read the report.

Meanwhile, Asian Stocks climbed on Monday, with AI-linked themes in focus at the start of the year's first full trading week. At the same time, Oil prices dip amid views that US military action in Venezuela would be unlikely to disrupt a well-supplied energy market. MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) opened a new tab and rose 1.4% to a record high. At the time of writing, S&P 500 e-mini futures trade 0.2% higher as investors look past geopolitical developments ahead of a packed week of economic data releases.

Bitcoin Price Forecast: BTC closes above a consolidation zone

Bitcoin's price closed above the upper consolidation range of $90,000 on Saturday and rose slightly the next day. At the time of writing on Monday, BTC continues its gains, trading above $92,400.

If BTC continues its upward trend, it could extend the rally toward the next resistance at $94,253, which aligns with the 61.8% Fibonacci retracement level drawn from the April low of $74,508 to October's all-time high of $126,199.

The Relative Strength Index (RSI) on the daily chart reads 61, above the neutral level of 50, indicating bullish momentum is gaining traction. In addition, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover and rising green histogram bars above the neutral level, further supporting the bullish outlook.

However, if BTC faces a correction, it could extend the decline toward the key support level at $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.