Pudgy Penguins Price Forecast: PENGU holds $0.012 as 300 billion mindshare signals growing demand

- Pudgy Penguins' price steadies around $0.012 on Monday after surging more than 35% in the previous week.

- PENGU's mindshare exceeds 300 billion collective views, highlighting growing investor interest and meme-token adoption.

- On-chain and derivatives data support a bullish narrative, with rising whale orders, buy-side dominance, and increasing open interest.

Pudgy Penguins (PENGU) price holds around $0.012 at the time of writing on Monday after rallying more than 35% in the previous week. The meme token continues to attract strong market attention, with its collective mindshare surpassing 300 billion views. In addition, supportive on-chain and derivatives metrics indicate a bullish outlook, hinting at further gains for PENGU.

PENGU’s market engagement continues to rise

Pudgy Penguins posted on X on Sunday, stating that its mindshare surpassed 300 billion cumulative views across social media and trackers. This rise indicates growing investor interest and meme-token adoption, suggesting a bullish outlook for PENGU.

Pudgy Penguins bullish on-chain and derivatives data

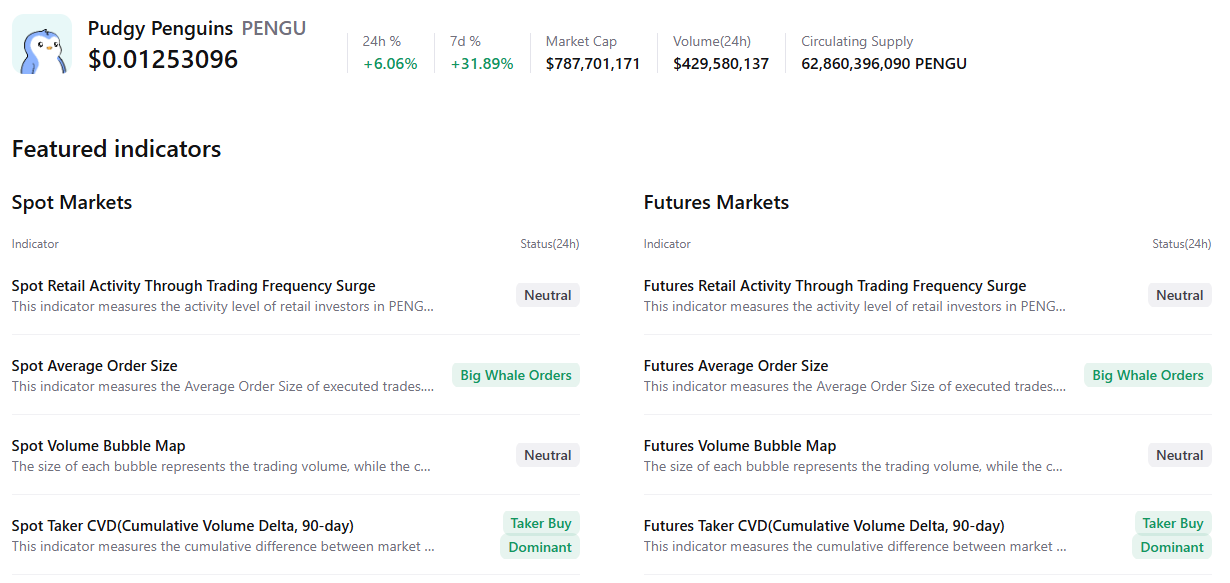

CryptoQuant’s summary data points to a bullish outlook, as Pudgy Penguins’ spot and futures markets show large whale orders and buy-side dominance. All these factors signal improving sentiment among traders, hinting at a potential continuation of the bullish move in the upcoming days.

On the derivatives side, CoinGlass’ data show that PENGU futures Open Interest (OI) at exchanges rises to $123.55 million on Monday from $67.07 million on Thursday, reaching the highest level since October 16. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current PENGU price rally.

Pudgy Penguins Price Forecast: PENGU bulls aiming for the $0.013 mark

Pudgy Penguins' price found support around the weekly level at $0.008 on Thursday and rose 45% through Sunday. As of Monday, PENGU is trading around $0.012.

If PENGU continues its upward trend, it could extend the rally toward the next daily resistance at $0.013. A close above this level could extend gains toward the next resistance level at $0.016.

The Relative Strength Index (RSI) on the daily chart reads 65, above the neutral level of 50, indicating bullish momentum is gaining traction. In addition, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover and rising green histogram bars above the neutral level, further supporting the bullish outlook.

On the other hand, if PENGU faces a correction, it could extend the decline toward the daily support at $0.011.