PEPE Surges 20% as James Wynn Gives Bold Prediction For 2026

The year 2026 has begun strongly for PEPE, the popular meme coin inspired by Pepe the Frog. On the second day of the new year, PEPE’s price increased by more than 20%.

What is driving this rally, and is the momentum strong enough to kick off a meme season in early 2026?

James Wynn Predicts PEPE Market Cap Reaching $69 Billion in 2026

James Wynn, a well-known trader on Hyperliquid, recently predicted that PEPE could reach a market capitalization of up to $69 billion by the end of 2026. The forecast has energized the investment community and triggered heavy buying.

When PEPE’s market cap stood at just $600,000, Wynn believed it could grow into a multi-billion-dollar asset. He reportedly earned tens of millions of dollars from the trade, with all activity recorded on-chain.

In his latest outlook, Wynn compared PEPE to SHIB, a token that surged from $3.5 billion to $41 billion in under one month during the previous cycle. According to Wynn, PEPE’s social metrics are significantly stronger, suggesting it could achieve a similar performance.

“Now, I’m calling PEPE to go from $1.7 billion to $69 billion+ in 2026 or I delete my account.” – James Wynn predicted.

PEPE Price Performance in Early 2026. Source: TradingView

PEPE Price Performance in Early 2026. Source: TradingView

Price charts show that shortly after Wynn posted his prediction, PEPE’s price climbed nearly 20%. Currently, PEPE’s market capitalization is approximately $2 billion. Wynn’s forecast implies that PEPE’s price could rise almost 35 times its current levels.

Wynn’s journey with PEPE has not always been smooth. During PEPE’s price decline from July onward, he opened highly leveraged long positions and suffered multiple liquidations.

Meanwhile, analyst SΞA explained that PEPE’s rally was driven by the impact of US tax rules, specifically tax-loss harvesting.

SΞA noted that at the end of 2025, many U.S. investors were sitting on losses and chose to sell at the last minute. This converted “paper losses” into “realized losses” to reduce their tax burden.

As the new 2026 tax year began, investors who remained bullish on PEPE rushed to buy back their positions immediately. PEPE’s 24-hour trading volume surpassed $600 million, marking the highest level in the past month, according to CoinGecko.

Multiple Meme Coins Rally in Early 2026, Reviving Hopes of a Meme Season

Alongside PEPE, several other meme coins posted strong gains at the start of 2026. Milady Cult Coin (CULT), for example, doubled in price after Vitalik stated “Milady is back” and changed his avatar to a Milady image. Floki (FLOKI) also rebounded by 10%.

“God candles PEPE. Full blow meme season loading. Pepe always leads for bullis meme indicators.” – Investor POΞ predicted.

Despite these isolated surges, most meme coins remain down 70%–90% from their peaks last year.

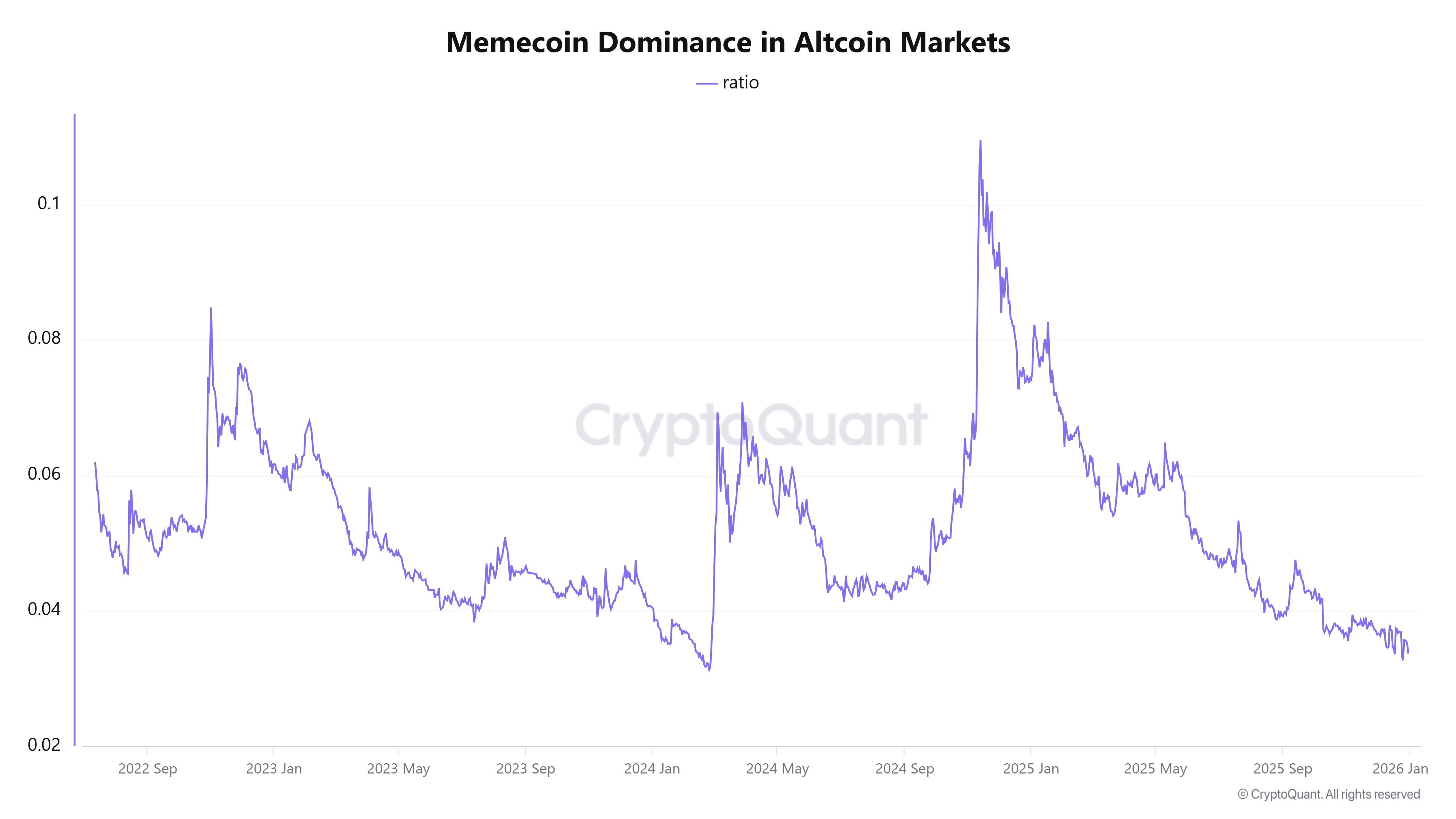

CryptoQuant data indicate that memecoin dominance remains at low levels, with no clear signs of recovery yet.

“‘Memecoins died’ → everything died. Literally all altcoins died, not just memes. Whether this bounce sticks remains to be seen. BTC has not shown any strength yet, so the market could easily bart straight back down. Still, memes are usually the fastest horse when even altcoins show the slightest risk-on signal.” – Investor CRG said.

Memecoin Dominance in the Altcoin Market. Source: CryptoQuant.

Memecoin Dominance in the Altcoin Market. Source: CryptoQuant.

The meme coin narrative continues to spark debate. While cautious investors focus on altcoins with strong fundamentals, others argue that meme coins occupy a central position in the attention economy. Supporters believe they attract retail investors and help drive overall market capitalization growth.