Ethereum Price Forecast: ETH holds above $2,900 despite rising selling activity

Ethereum price today: $2,980

- ETH deposited to exchanges outweighed withdrawals by about 400K ETH last week, indicating rising selling pressure.

- Retailers, alongside US investors, led the selling activity following a 370K ETH distribution and a decline in the US Coinbase Premium Index.

- ETH is retesting the $3,000 psychological level after seeing a rejection at the descending triangle resistance.

Ethereum (ETH) held the $2,900 level despite seeing increased selling pressure over the past week.

The Exchange Netflow metric, which tracks the difference between coins flowing into and out of exchanges, showed deposits outweighed withdrawals by about 400K ETH. The high value suggests rising selling activity amid the holiday season.

- All Exchanges (13)-1767112695234-1767112695240.png)

US investors are leading the selling pressure, as evidenced by the Coinbase Premium Index declining to -0.12, a level last seen during peak selling activity in the third week of November. The index measures the difference between ETH's price in Coinbase Pro and Binance.

-1767112725024-1767112725025.png)

A similar pattern is visible across US spot ETH exchange-traded funds (ETFs), which recorded net outflows of $102.3 million last week, according to SoSoValue data. Notably, the products have seen only one positive day since December 11.

Retail investors distribute while whales hold steady

Zooming in on the balance of wallet cohorts, investors holding between 100-1K ETH and 1K-10K ETH — majorly retailers — were the main source of selling, distributing a combined 370K ETH in the past week. However, whales held steady as the combined holdings of wallets with a balance of 10K-100K ETH and 100K ETH> stayed around the same levels as the previous week.

In a statement on Monday, Thomas Lee, chairman of Ethereum treasury BitMine, highlighted that the move is mainly due to year-end tax-loss-related selling.

Despite selling pressure, prices have remained fairly stable, and loss realization has been modest, according to Santiment data.

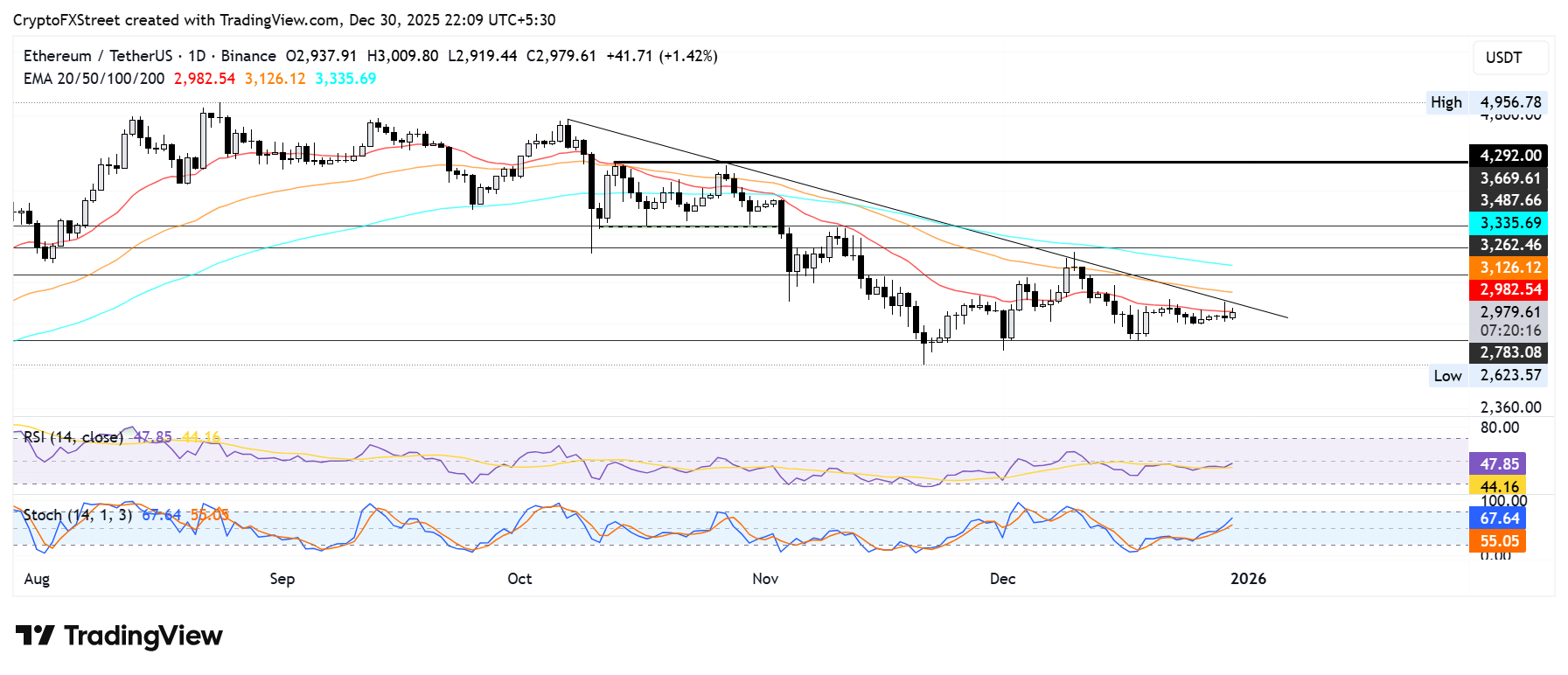

Ethereum Price Forecast: ETH retests $3,000 after descending triangle rejection

Ethereum saw $36.9 million in futures liquidations over the past 24 hours, driven by $25 million in long liquidations, according to Coinglass data.

ETH is attempting to rise above the $3,000 psychological level, near the 20-day Exponential Moving Average (EMA) and the descending triangle resistance, on Tuesday. The move comes after seeing a rejection around the same level on Monday.

A firm breakout could see ETH flip the 50-day EMA and test the $3,260 resistance. A rejection could push the top altcoin toward the $2,780 level.

The Relative Strength Index (RSI) is testing its neutral level, while the Stochastic Oscillator (Stoch) has crossed above its midline, indicating modest bullish momentum dominance.