EUR/USD continues slow-motion grind lower, extends decline from 1.18

- EUR/USD fell around 0.2% on a quiet, holiday-constrained Tuesday.

- Markets are churning quietly through the year-end low-volume period.

- Latest Fed Meeting Minutes confirms the Fed’s cautiously-dovish tilt.

EUR/USD slipped into the 1.1750 region on Tuesday, falling back a scant one-fifth of one percent following several days of muted declines. Markets are slumping their way through the year-end holiday period, with low volumes and a global lack of market participants keeping meaningful momentum restrained.

Global markets are set to close on Thursday for the rollover into the new calendar year, leaving already restrained markets even deeper in a holiday lurch through the second half of the last trading week of 2025. Meaningful economic data releases are functionally non-existent for this week.

Fed wants to cut, but timing remains complicated

The latest Meeting Minutes from the Federal Reserve (Fed) show Federal Open Market Committee (FOMC) members are cautiously tilted toward the dovish side, with the majority of policymakers expecting further rate cuts in the future; however, the pace of future rate cuts remains contingent on several factors, specifically that US inflation metrics continue to ease lower.

Read more: FOMC Minutes showed most officials judged further rate cuts would be appropriate

Quality of American inflation data remains a concern for both investors and central bankers: despite a steep cooling in headline Consumer Price Index (CPI) inflation data at the last print, investors noted that the underlying data was missing several key components, and a large swath of the data that was present involved a high degree of assumptions and carry-forward estimates due to large chunks of missing price information. Even if headline inflation ticket figures continue to ease lower, a lack of accurate measurement will keep both FOMC votes and trader expectations on the back foot.

EUR/USD technical outlook

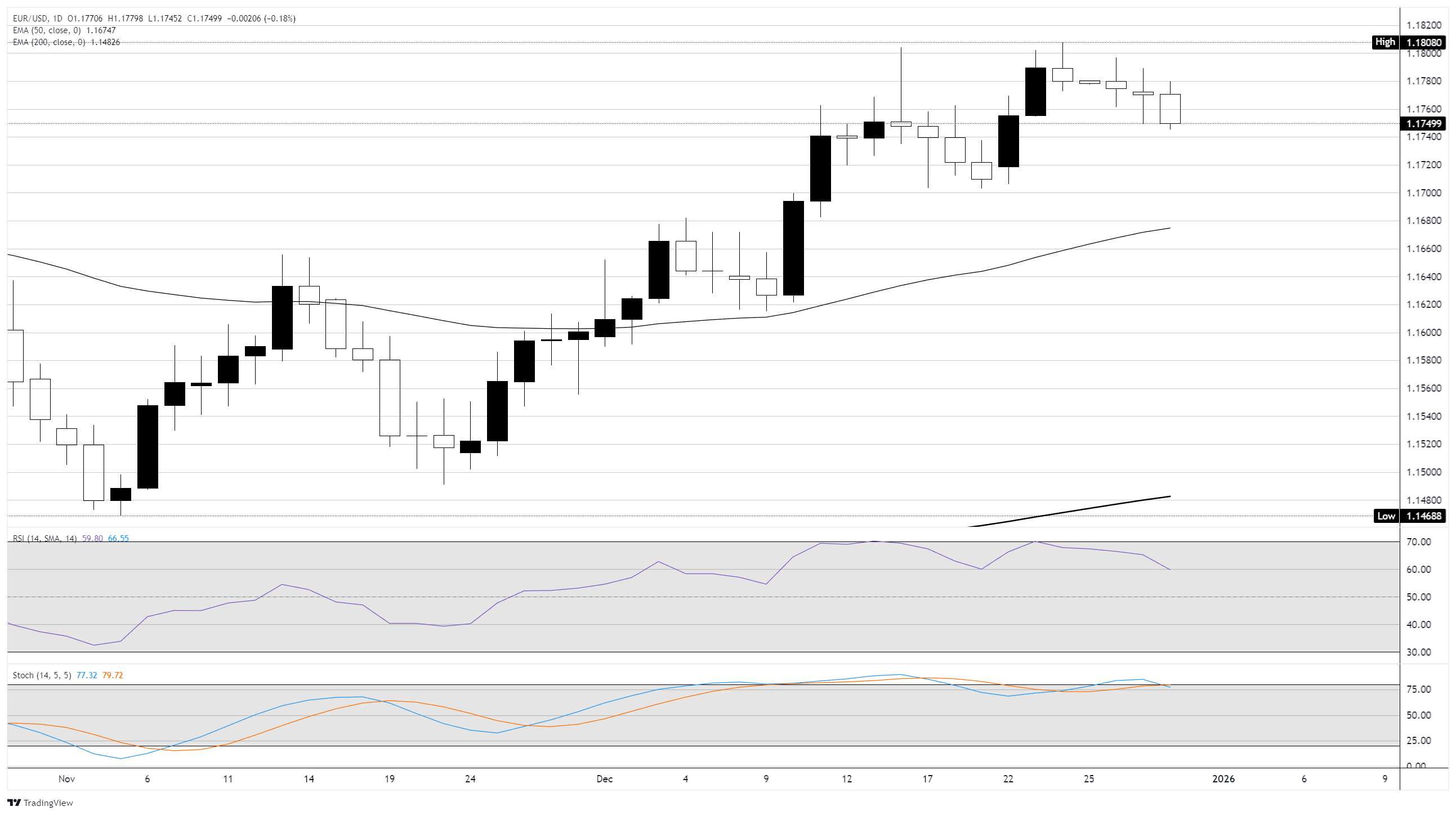

In the daily chart, EUR/USD trades at 1.1752. Price holds above the 50-EMA at 1.1675 and the 200-EMA at 1.1393, keeping a bullish bias intact. The 50-EMA rises and remains above the 200-EMA, reinforcing trend support. RSI at 60.22 stays bullish and below overbought. Initial support sits at the 50-EMA, while the 200-EMA underpins the broader advance.

Momentum cools at the margin as the Stochastic eases to 77.61 after exiting overbought, hinting at a pause or shallow consolidation. A close below the 50-EMA at 1.1675 would open room for a deeper pullback toward the 200-EMA at 1.1393, while sustained trade above the rising average would keep the upside scenario in play.

(The technical analysis of this story was written with the help of an AI tool)

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.