Crypto Investment Funds Turn Profits in December Despite Broad Market Weakness

Crypto markets struggled throughout December, but a small group of institutional investors managed to close the year in the black.

New on-chain data from analytics platform Nansen shows that while prices remained under pressure, several major crypto funds generated millions in realized gains, only to pivot toward aggressive selling as the month progressed.

Elite Funds Secure Top Gains Amid Market Downturn

According to Nansen, market maker Wintermute emerged as the most profitable fund in December, recording approximately $3.17 million in realized profit.

Dragonfly Capital followed closely, with profits spread across multiple wallets totaling $1.9 million, $1.0 million, and $990,000.

IOSG and Longling Capital also ranked among the top performers. Together, these trends suggest that profits were concentrated among a repeat group of highly active institutional traders rather than isolated, one-off wallets.

“Profits are concentrated among a small group of repeat funds, not one-off wallets,” Nansen noted, highlighting how consistent execution and active trade management separated institutional winners from the broader market downturn.

Arrington, Pantera, and Polychain also featured in Nansen’s 30-day dataset from five blockchain networks, each with varied profitability.

December 2025 profit rankings show Wintermute leading with $3.17M, followed by multiple Dragonfly Capital wallets. Nansen

December 2025 profit rankings show Wintermute leading with $3.17M, followed by multiple Dragonfly Capital wallets. Nansen

December proved challenging for most crypto participants as volatility increased and sentiment weakened into year-end.

Despite this backdrop, Wintermute and Dragonfly Capital capitalized on short-term dislocations and liquidity-driven opportunities.

Their performance highlights the advantage of scale, sophisticated trading infrastructure, and multi-chain monitoring during periods of market stress.

Dragonfly’s strategy stood out for its diversification across wallets, allowing the fund to spread risk while capturing upside across different positions.

Meanwhile, Wintermute’s dominance reflected its role as a leading liquidity provider capable of profiting from volatility rather than being harmed by it.

IOSG and Longling Capital also posted notable gains, placing them among the month’s most profitable funds. Together, the data paints a picture of institutional resilience at a time when retail traders largely struggled to stay afloat.

Active Profit-Taking Shapes On-Chain Behavior

However, Nansen’s on-chain tracking shows that these same profitable funds are now leaning toward selling rather than accumulation.

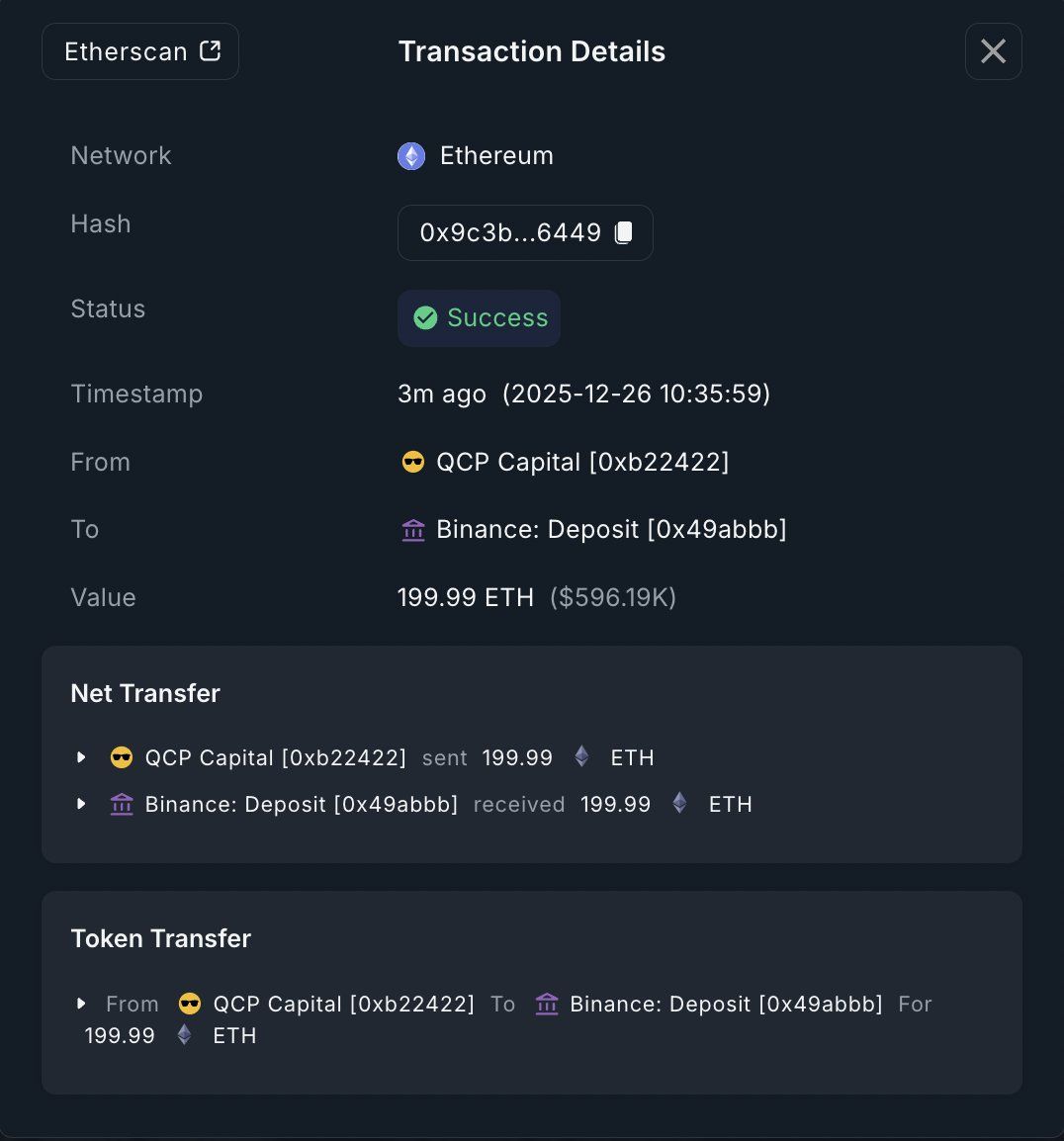

On December 26, QCP Capital deposited 199.99 ETH, worth roughly $595,929, into the Binance exchange, a move typically associated with preparing assets for sale.

QCP Capital transferred 199.99 ETH worth $595,929 to Binance on December 26, 2025. Nansen

QCP Capital transferred 199.99 ETH worth $595,929 to Binance on December 26, 2025. Nansen

Wintermute has also been active on the sell side. While social media commentary has accused the firm of aggressively dumping Bitcoin and Ethereum during December volatility, on-chain data confirms that Wintermute reduced exposure after building positions earlier in the month.

The activity aligns with profit-taking and risk management rather than passive holding.

Dragonfly Capital similarly reduced its positions in Mantle (MNT). Over seven days in December, the fund deposited 6 million MNT tokens, worth approximately $6.95 million, to Bybit.

Despite these sales, Dragonfly still holds 9.15 million MNT tokens, valued at around $10.76 million, suggesting a partial rather than complete exit.

The contrast between strong December profits and rising sell pressure illustrates a dual institutional strategy:

- Exploit volatility when opportunities arise,

- De-risk quickly as conditions shift.

For professional funds, year-end selling may also reflect portfolio rebalancing, capital preservation, or preparation for new allocations in the early part of 2026.

While continued selling from top-performing funds could weigh on short-term prices, it may also signal discipline rather than bearish conviction.