Bitcoin Buying Pressure Jumps 59% — Can It Finally Break the $89,000 Wall?

Bitcoin price has spent most of December moving sideways, frustrating both bulls and bears. Despite short-term volatility, the broader structure remains range-bound as the market approaches year-end.

Bitcoin is up around 5% over the past 30 days, but the past week has been mostly flat. That lack of direction shows hesitation. Still, recent on-chain data suggest that something is changing, particularly in the spot market. Buying pressure has increased sharply, raising a key question. Can this shift in demand finally help Bitcoin clear its strongest near-term resistance (wall)?

Whales and Exchange Outflows Show Buying Pressure Is Rising

Two on-chain signals stand out over the past few days: whale behavior and exchange outflows.

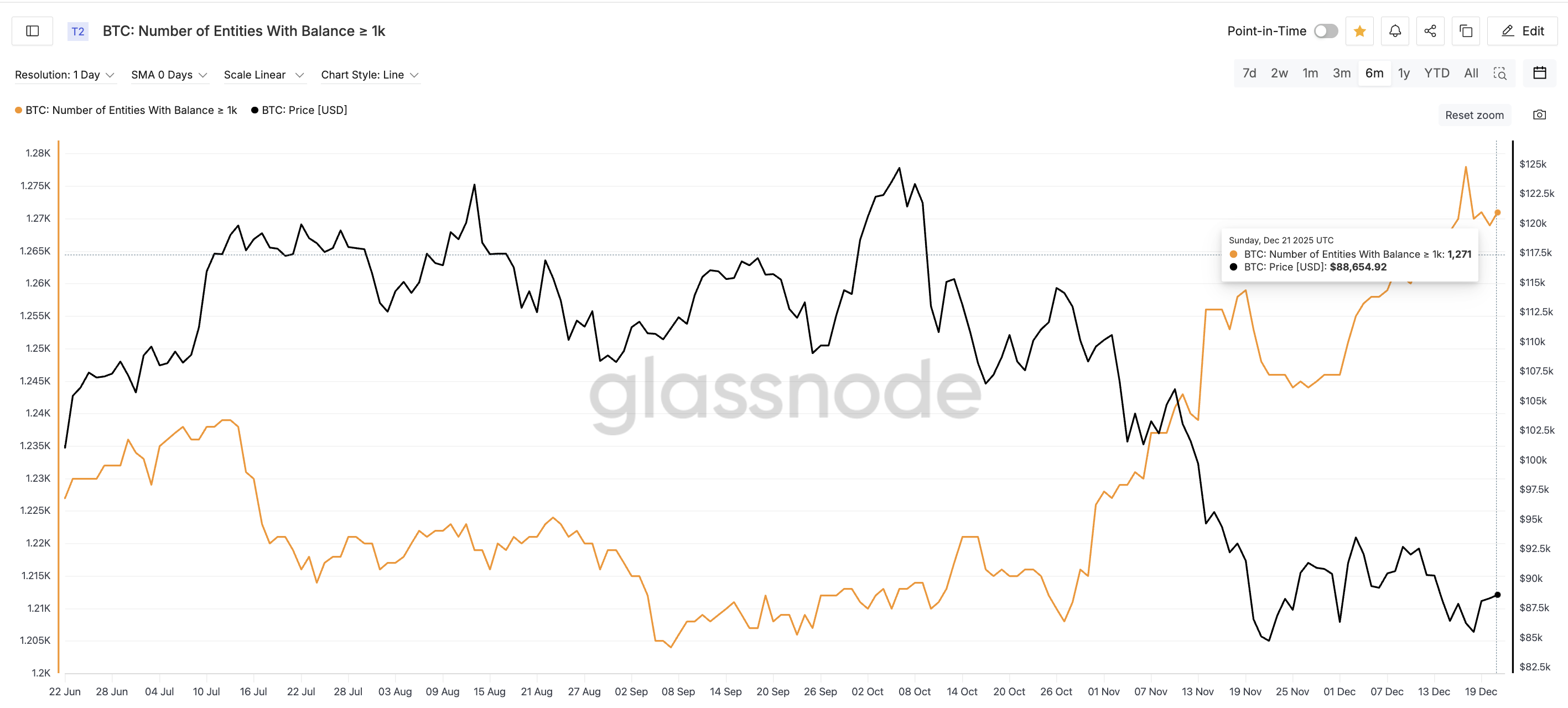

First, the number of entities holding at least 1,000 BTC has started to rise again after a sharp drop on December 17. This metric tracks large holders, often referred to as whales. When this number increases, it suggests that bigger players are accumulating rather than distributing.

Since December 20, the count of these large entities has been climbing gradually. While it is still slightly below recent six-month highs, the direction matters. Whales are cautiously adding exposure as BTC prices stabilize.

Bitcoin Whales Adding: Glassnode

Bitcoin Whales Adding: Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

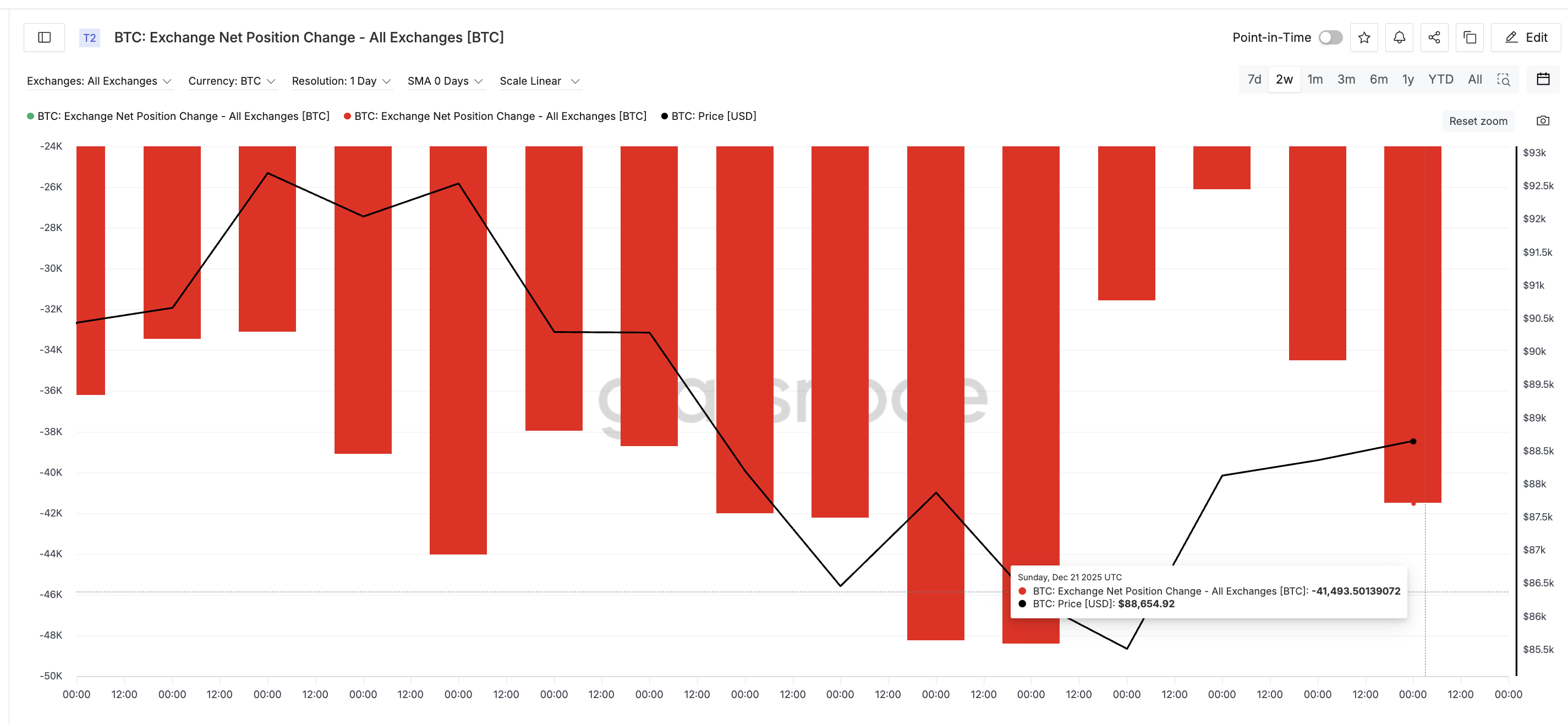

Second, the exchange net position change shows a strong jump in buying activity. This metric measures how many coins move in or out of centralized exchanges. When more coins leave exchanges, it usually means buyers are possibly moving BTC into self-custody, reducing immediate selling pressure.

On December 19, Bitcoin exchange outflows were roughly 26,098 BTC. By December 21, outflows had surged to 41,493 BTC. That is a 59% increase in net outflows in just two days.

Likely Retail Buying: Glassnode

Likely Retail Buying: Glassnode

This gap is important. Whale accumulation has been steady but modest. Exchange outflows, however, have accelerated much faster. That suggests retail and mid-sized buyers are also likely stepping in alongside whales, increasing spot demand across the market.

Together, these signals show spot buying pressure is rising, even though the price has not broken out yet.

Bitcoin Price Levels That Decide the Next Path?

Whether this buying pressure matters now comes down to the key Bitcoin price levels.

The most important resistance (wall) sits near $89,250. This level has capped upside moves since mid-December and aligns with multiple failed attempts to push higher. Until Bitcoin closes convincingly above it, the market remains range-bound.

If buyers manage to reclaim $89,250, Bitcoin could attempt a move toward $96,700, one of the strongest overhead resistance zones on the chart. That level has rejected price repeatedly and would be the next major test.

On the downside, $87,590 remains the key short-term support. A clean break below it would expose $83,550, followed by a bigger risk toward $80,530 if selling accelerates.

Bitcoin Price Analysis: TradingView

Bitcoin Price Analysis: TradingView

In short, Bitcoin is tightening between rising buying pressure and a stubborn resistance wall. Whales are adding cautiously, exchange outflows are accelerating, and the price is approaching a decision point. Whether Bitcoin breaks higher now depends on one thing. Can this surge in demand finally overpower $89,250, or will the range hold into the new year?