Humanity (H), Plasma (XPL) head $268M token unlock wave

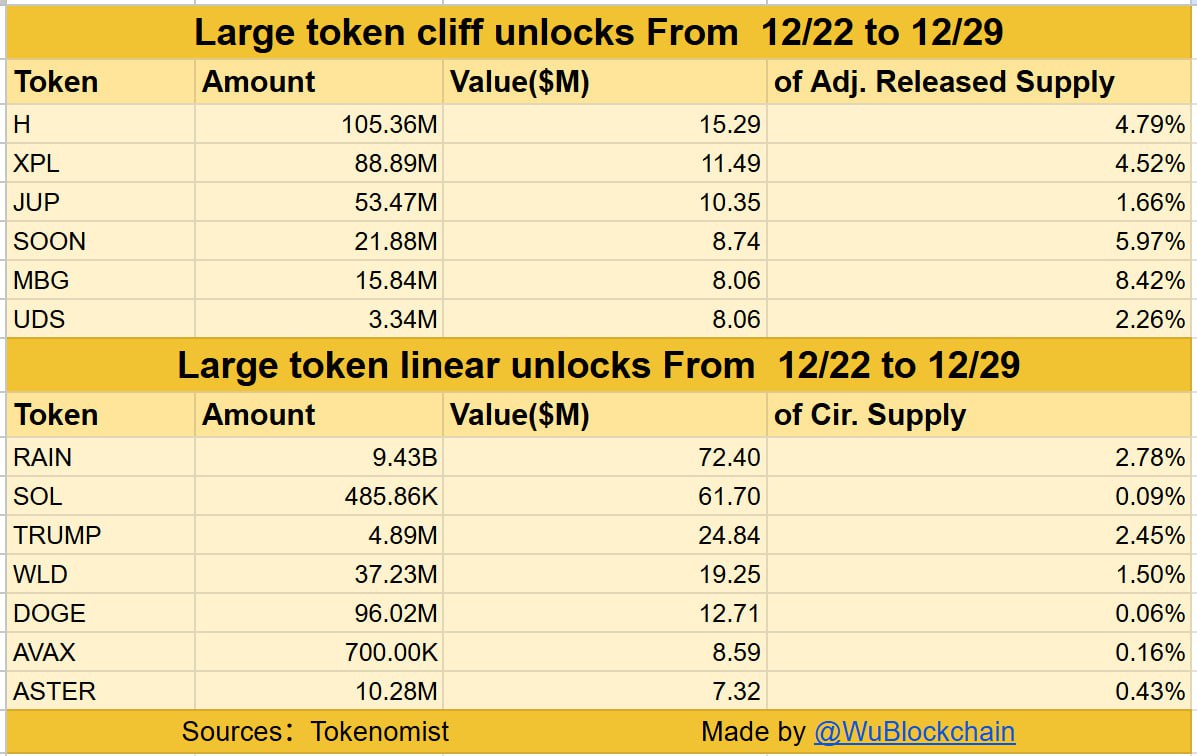

According to data from Tokenomist, tokens worth $268 million will unlock between Dec 22–29.

The releases include large one-time cliff unlocks, as well as daily linear vesting across several projects. Humanity (H) and Plasma (XPL) take the lead on the cliff unlocks, while RAIN and Solana drive the linear releases.

The largest cliff unlocks are from Humanity and Plasma

Humanity has the biggest cliff unlock of the week at 105.36 million tokens, worth about $15.29 million. At 4.79%, this is the biggest single unlock by value for the week for Humanity’s adjusted released supply.

Plasma comes in with 88.89 million tokens worth about $11.49 million. This accounts for 4.52% of Plasma’s adjusted released supply. Combined, the two projects make up approximately $26.78 million in unlocks for the week-just shy of 40% of the total weekly cliff unlock value.

Both of these cliff unlocks are more than $5 million, which Tokenomist termed a large single unlock. Timing could add some selling pressure as new supply hits the market.

Jupiter and SOON add to weekly unlocks

For Jupiter, 53.47 million tokens are scheduled to unlock, valued at $10.35 million. This accounts for 1.66% of JUP’s adjusted released supply.

SOON has an unlock of 21.88 million tokens worth $8.74 million. That represents 5.97% of SOON’s adjusted released supply, the largest percentage-wise among the top four projects. The bigger percentage could mean more market impact relative to SOON’s circulating supply.

MBG and UDS complete the cliff unlocks with approximately $8.06 million each. MBG will unlock 15.84 million tokens, or 8.42% of its adjusted released supply. UDS has 3.34 million tokens, or 2.26% of its supply.

RAIN and Solana lead linear unlocks

RAIN is the most popular linear unlock, with 9.43 billion tokens released so far this week. At $72.40 million, this was the biggest daily linear release by value and accounted for 2.78% of RAIN’s circulating supply.

Solana is next, with 485,860 tokens worth $61.70 million that will eventually be unlocked. Because of the quantity, this represents the lowest percentage of all tracked unlocks, at 0.09% of SOL’s total circulating supply.

TRUMP has 4.89 million tokens worth $24.84 million for linear release, or 2.45% of circulating supply. In the Worldcoin (WLD) release, 37.23 million tokens will be released, worth $19.25 million, or 1.50% of the circulating supply.

Other projects with forthcoming releases

Other notable projects with forthcoming releases include Dogecoin, which plans to schedule 96.02 million tokens worth about $12.71 million, or approximately 0.06% of the large circulating supply. Avalanche plans 700,000 tokens worth approximately $8.59 million, representing 0.16% of circulating supply.

Aster rounds out the linear releases with 10.28 million tokens worth $7.32 million-about 0.43% of circulating supply. According to CoinMarketCap, more unlocks are coming. OG has the next 12.31 million tokens worth $10.05 million, about 1.23% of the total tokens locked.

The Masters of Trivia is facing a larger unlock of 22 million tokens worth $52.83 million, or about 4.40% of the total locked tokens. River has 1.85 million tokens valued at $10.38 million, or about 1.85% of the locked supply.

Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program