Sui Price Forecast: Sui rebounds amid Bitwise spot ETF application, market recovery

- Sui gains over 6% on Friday as the broader market mood improves.

- Bitwise filed an S-1 application with the US SEC for the Sui spot ETF on Thursday.

- Derivatives data indicate a rise in retail activity with a buy-side dominance.

Sui (SUI) ticks higher by 6% at press time on Friday, as the broader cryptocurrency market recovers. Bitwise filed an official application to the US Securities and Exchange Commission (SEC) to list a SUI-focused Exchange Traded Fund (ETF) on Thursday. Against this backdrop, retail demand for Sui has increased amid positional buildup and rising bullish interest in the derivatives market.

Retail demand inflates amid market recovery, Bitwise ETF

The risk-on sentiment in the broader cryptocurrency market has improved, as the US CPI reading of 2.7% in November came in lower than expectations of 3.1%. The chances of the US Federal Reserve (Fed) cutting interest rates next year have increased as inflation approaches the central bank's 2% target.

Furthermore, Bitwise, a global crypto asset management company, filed an S-1 application with the US SEC on Thursday to list a SUI spot ETF. This joins the wait with Grayscale’s application to convert its SUI-focused trust into an ETF. A potential green light to list the SUI spot ETFs could boost institutional inflows.

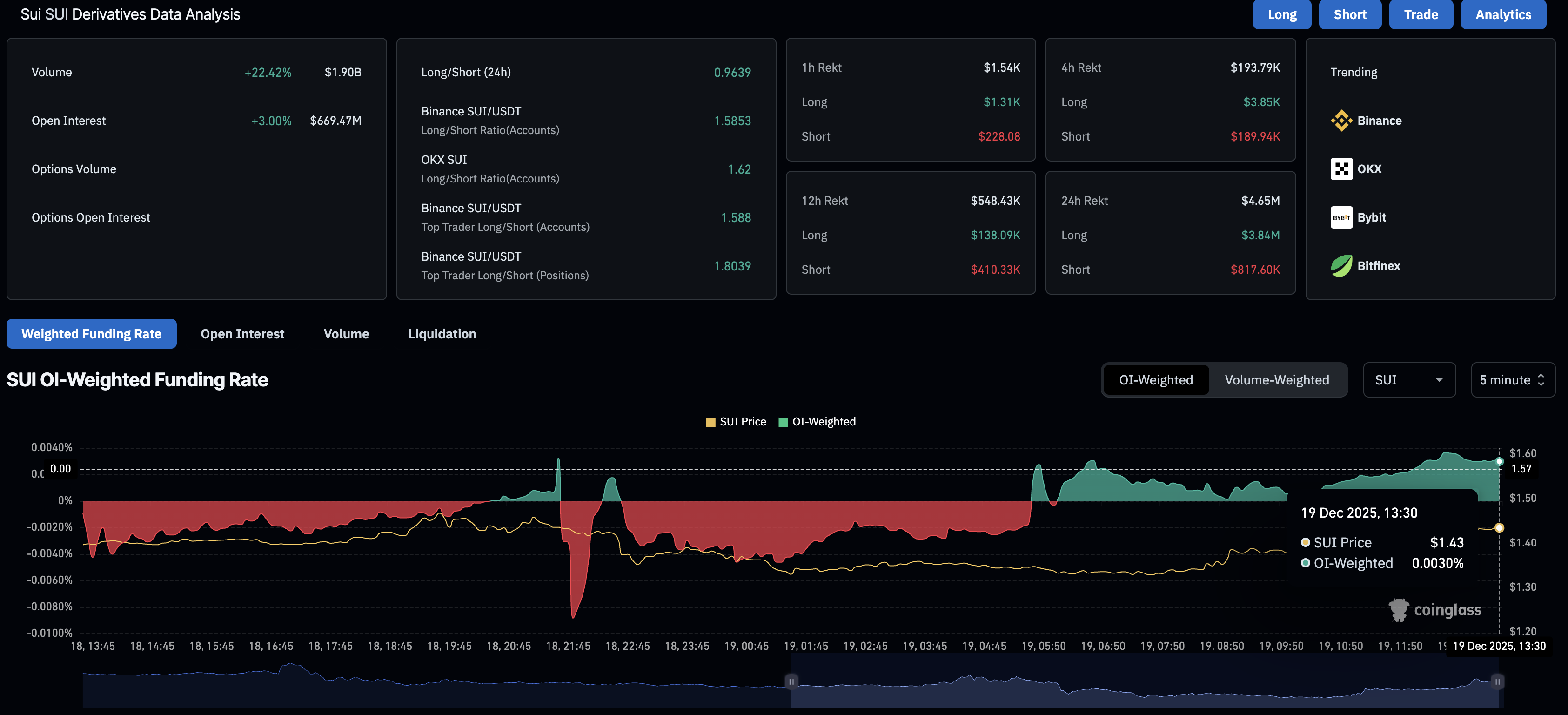

In this context, CoinGlass data shows that risk exposure in SUI derivatives has increased, with futures Open Interest (OI) at $669.47 million, up 3% in the last 24 hours. This indicates that traders are building new positions, anticipating further recovery.

Additionally, the OI-weighted funding rate stands at $0.0030%, reflecting the bullish incline in the positional buildup.

Sui’s recovery within a range could face minor snags

Sui bounces back from the $1.30 support zone, which has remained intact since late November. This reversal in SUI after a steady decline since last week could extend an upcycle within a larger consolidation range, with the upper ceiling at the $1.73–$1.76 resistance zone.

However, the declining 50-period and 200-period Exponential Moving Averages (EMAs) on the 4-hour chart at $1.49 and $1.64, respectively, could serve as minor resistances.

Still, the momentum indicators on the 4-hour chart suggest a sudden decline in selling pressure. The Relative Strength Index (RSI) at 46 approaches the midline after bouncing from the oversold zone on Thursday.

Meanwhile, the Moving Average Convergence Divergence (MACD) crosses above its signal line, signaling a bullish shift in momentum.

If Sui breaks below $1.30, it would nullify the range formation and potentially target the $1.00 psychological support level.