Why Americans May Have Less Money For Crypto In 2026

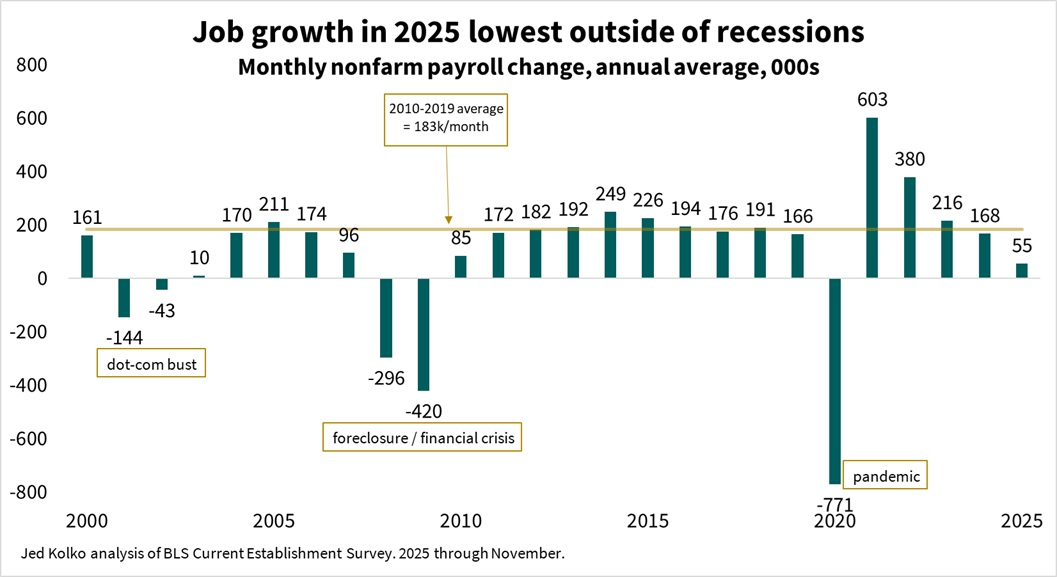

US economic data is flashing early warning signs for risk assets and crypto. The latest labor figures suggest household income growth may weaken heading into 2026.

That trend could reduce retail investment flows, especially into volatile assets like crypto. In the short term, this creates a demand problem rather than a structural crisis.

US Labor Data Signals Slower Disposable Income Growth

The latest Nonfarm Payrolls report showed modest job creation alongside a rising unemployment rate. Wage growth also slowed, pointing to weaker income momentum for households.

Disposable income matters for crypto adoption. Retail investors typically allocate surplus cash, not leverage, to risk assets.

When wages stagnate and job security weakens, households cut discretionary spending first. Speculative investments often fall into that category.

US Job Growth Over the Years. Source: X/Jed Kolko

US Job Growth Over the Years. Source: X/Jed Kolko

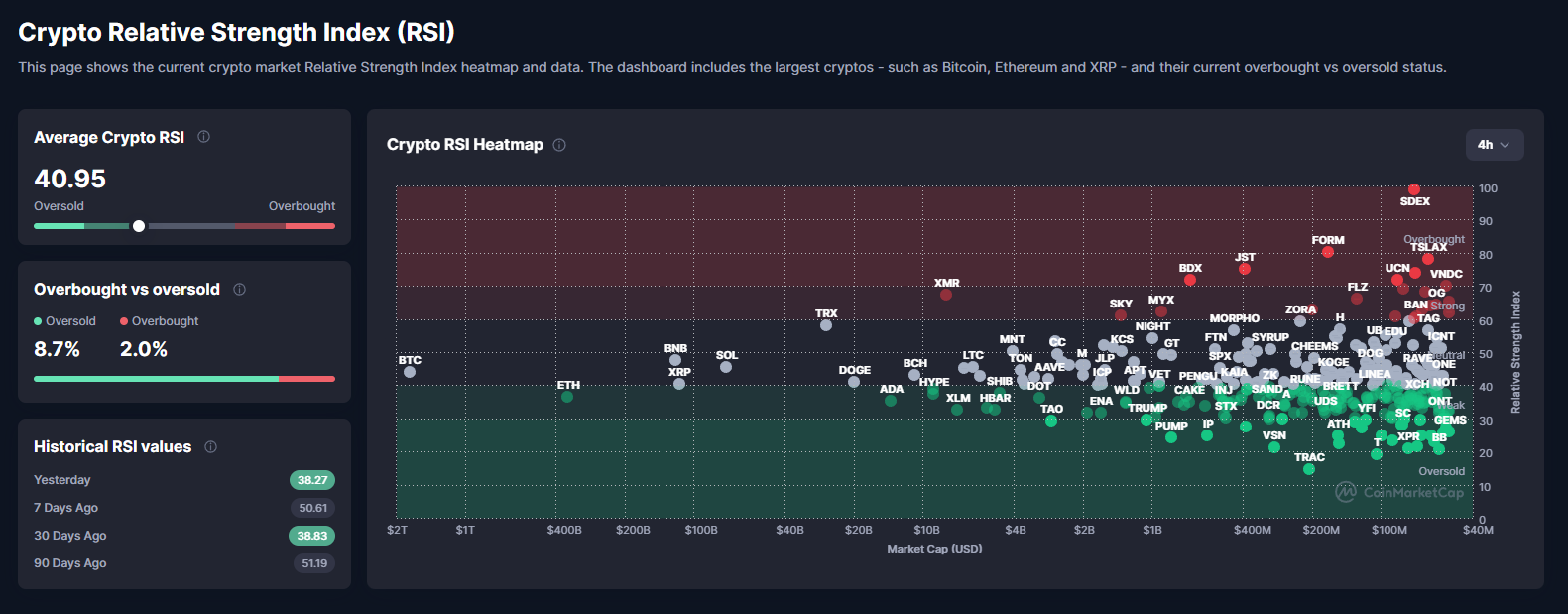

Retail Investors Are Most Exposed And Altcoins Could Feel It First

Retail participation plays a larger role in altcoin markets than in Bitcoin. Smaller tokens rely heavily on discretionary retail capital chasing higher returns.

Bitcoin, by contrast, attracts institutional flows, ETFs, and long-term holders. That gives it deeper liquidity and stronger downside buffers.

If Americans have less money to invest, altcoins tend to suffer first. Liquidity dries up faster, and price declines can persist longer.

Retail investors may also be forced to exit positions to cover expenses. That selling pressure weighs more heavily on smaller-cap tokens.

Average Crypto RSI Remains Near Oversold Levels. Source: CoinMarketCap

Average Crypto RSI Remains Near Oversold Levels. Source: CoinMarketCap

Lower Income Does Not Mean Lower Prices, But It Changes The Driver

Asset prices can still rise even when incomes weaken. That typically happens when monetary policy becomes more supportive.

A cooling labor market gives the Federal Reserve room to cut rates. Lower rates can boost asset prices through liquidity rather than household demand.

For crypto, that distinction matters. Rallies driven by liquidity are more fragile and sensitive to macro shocks.

Institutions Face Their Own Headwinds From Japan

Retail weakness is only part of the picture. Institutional investors are also becoming more cautious.

The Bank of Japan’s potential rate hikes threaten global liquidity conditions. They risk unwinding the yen carry trade that has supported risk assets for years.

When borrowing costs rise in Japan, institutions often reduce exposure globally. Crypto, equities, and credit all feel the impact.

The main risk is not collapse, but thin demand. Retail investors may step back due to weaker income growth. Institutions may pause as global liquidity tightens.

Altcoins remain the most vulnerable in this environment. Bitcoin is better positioned to absorb the slowdown.

For now, crypto markets appear to be transitioning. From retail-driven momentum to macro-driven caution.

That shift could define the early months of 2026.