Ripple Price Forecast: XRP on-chain activity hints at a steady downtrend amid low retail demand

- XRP edges lower to around $2.30, moving in tandem with major crypto assets.

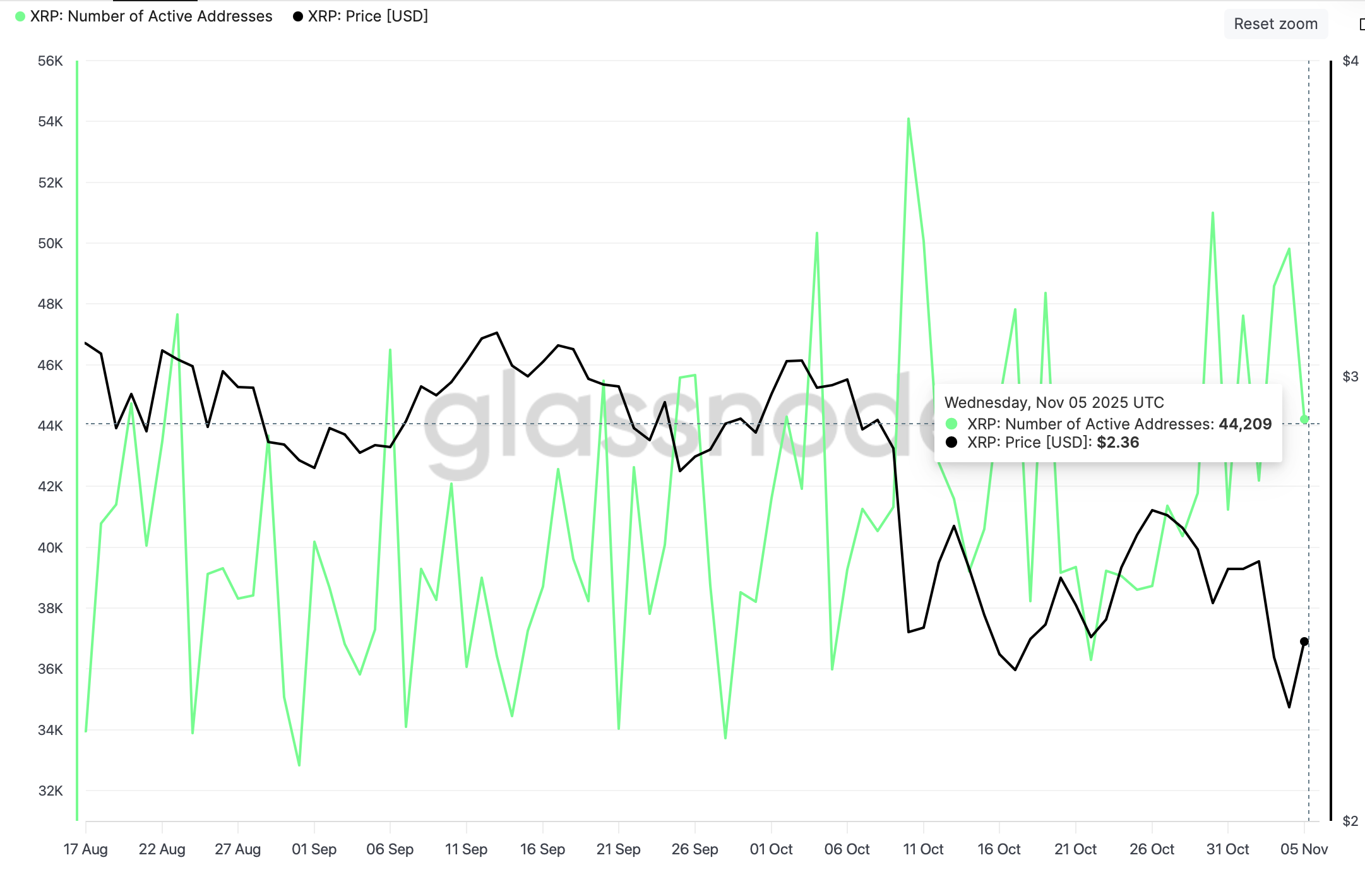

- Active addresses on the XRP Ledger average 44K, down from 54K in mid-October as investors retreat to the sidelines.

- The number of new addresses joining the XRP Ledger is down 60% since Sunday to 4,770, signaling a decline in adoption.

Ripple (XRP) is retreating to around $2.30 at the time of writing on Thursday, largely weighed down by bearish sentiment in the broader cryptocurrency market. Suppressed retail demand, declining on-chain and early profit-taking are among the factors hindering a steady recovery.

XRP deepens correction as network activity shrinks

The XRP Ledger (XRP) has experienced a significant decline in on-chain activity, with daily unique addresses falling to approximately 54,000 on Wednesday, from 44,000 on October 10. The 18.5% decline, coinciding with a price cascade from $2.84 to around $2.30, suggests reduced user engagement. In other words, investors are not convinced that XRP has bottomed and are retreating to the sidelines.

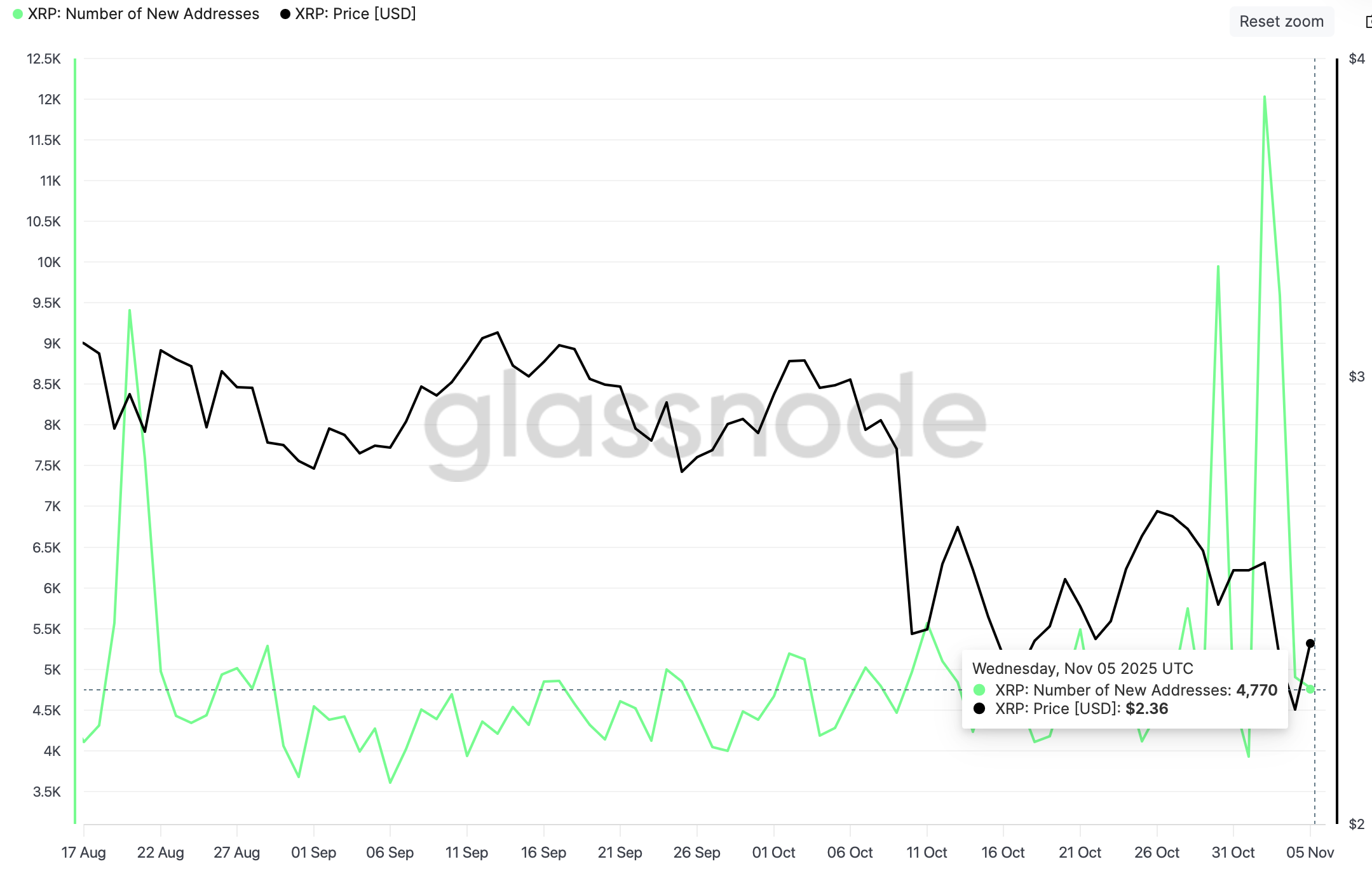

The number of new addresses created on the XRPL has been erratic, leading to spikes followed by short pullbacks. Glassnode's data highlights a 60% decline to 4,770 as of Wednesday from approximately 12,000 on Sunday.

The sudden spike on Sunday could be due to the stablecoin RLUSD, which recently reached $1 billion in market capitalisation, according to CoinGecko. Still, overall activity on the XRPL remains low as adoption momentum slows and demand for XRP declines.

-1762438474880-1762438474880.png)

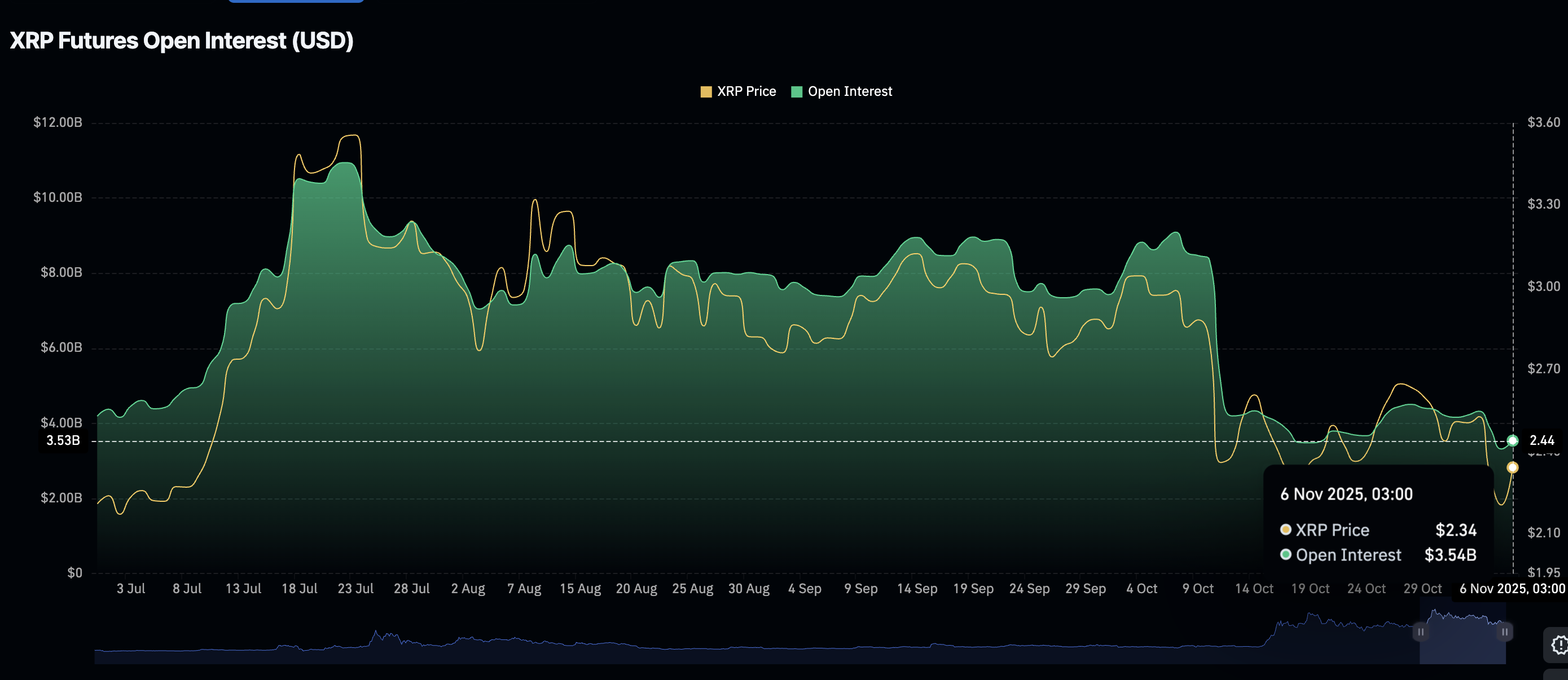

XRP has also experienced a sharp decline in futures OI to $3.54 billion on Thursday, from $4.33 billion on Monday and $9.09 billion on October 7. This steady decline suggests that risk-off sentiment remains prevalent. Traders are likely staying on the sidelines due to a lack of conviction in XRP's ability to sustain recovery.

Ripple's valuation hits $40 billion

Ripple announced on Wednesday that it had raised $500 million in funding, bringing its total valuation to $40 billion. According to CNBC, Ripple said that the funding was necessary to support new initiatives as it deepens relationships and partnerships with financial institutions.

The blockchain company has been on an expansion drive, acquiring businesses that complement its core business globally.

Monica Long, president of Ripple, stated in an interview on Wednesday that the company "will continue to look at where new opportunities arise," primarily in crypto custody, prime brokerage and corporate treasury management.

Long commended crypto companies seeking public listing. However, Long clarified that Ripple is "focused on an IPO right now. We have the balance sheet, the liquidity to be growing and making moves on M&A and other big strategic partnerships. We will continue to remain private."

Technical outlook: XRP eyes short-term stability

XRP is trading at around $2.30, down over 2.5% at the time of writing. The path of least resistance is downward based on the Relative Strength Index (RSI), which is at 40 and declining on the daily chart. Lower RSI readings indicate that bearish momentum is increasing.

An incoming Death Cross pattern could accelerate the pullback.

A Death Cross is a bearish pattern, which occurs when a shorter-term moving average crosses below a longer-term one. From the daily chart below, the 50-day EMA at $2.60 is on the verge of crossing below the 200-day EMA at $2.59, bolstering the bearish outlook.

Still, if bulls seek exposure by buying the dip, XRP could resume the uptrend, targeting highs above the 200-day EMA at $2.59.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.