Nearly $6 Billion in Bitcoin and Ethereum Options Expire Ahead of September CPI

Around $6 billion in Bitcoin and Ethereum options are set to expire today, putting market resilience to the test as open interest and trader positioning hit new records.

This key event may reshape price action for the largest cryptocurrencies, with heightened volatility possible ahead.

Options Expiry in Focus: Scale and Sentiment

Crypto derivatives markets face a pivotal moment as options expiry arrives during a period of subdued volatility and keen anticipation.

The outcome could signal the prevailing sentiment for Bitcoin, Ethereum, and wider digital assets as the market prepares for key macroeconomic events.

On October 24, $5.86 billion in options tied to Bitcoin and Ethereum reach maturity at 8:00 UTC on Deribit.

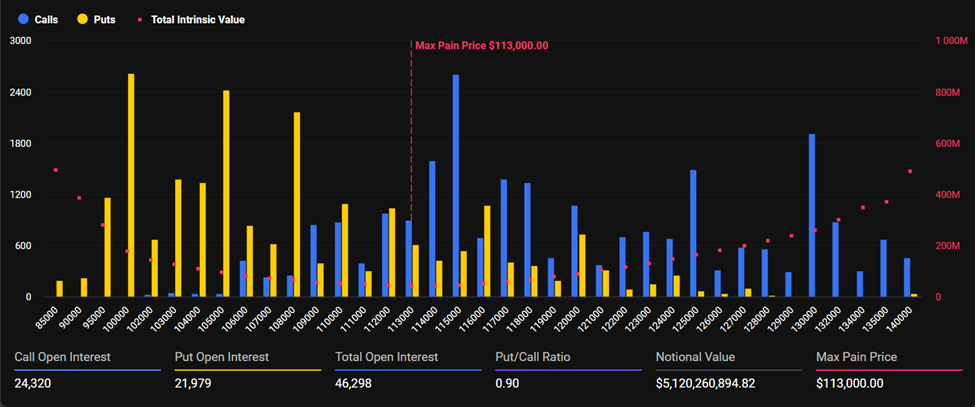

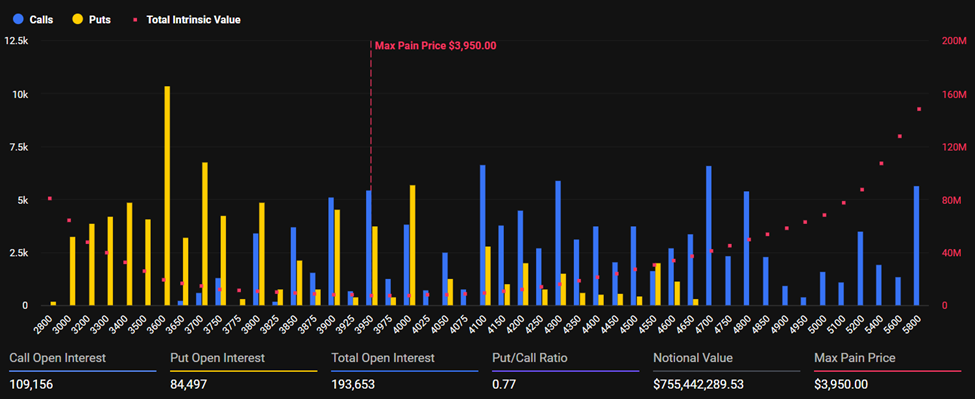

Official exchange data shows $5.1 billion in Bitcoin options and $754 million in Ethereum options expiring, representing tens of thousands of contracts.

Bitcoin Expiring Options. Source: Deribit

Bitcoin Expiring Options. Source: Deribit

The ‘max pain’ points, where most contracts expire worthless, are $113,000 for Bitcoin and $3,950 for Ethereum. These levels guide trader expectations at settlement.

Current put-to-call ratios stand at 0.90 for Bitcoin and 0.77 for Ethereum. This suggests cautious optimism toward the upside, though near-term uncertainty remains as traders manage risk.

Ethereum Expiring Options. Source: Deribit

Ethereum Expiring Options. Source: Deribit

Market Calm, Macro Triggers, and Positioning

Volatility has cooled across crypto markets following recent turbulence. Implied volatility stands near 40 for Bitcoin and 60 for Ethereum, showing a pause in wild price action.

Deribit analysts highlight that traders are maintaining exposure into expiry, reflecting that confidence has not faded. This is seen with calls above $120,000 gaining traction, while puts at $100,000 attracting attention.

“Volatility is cooling off… but calm doesn’t last forever. After last week’s chaos, BTC vol is chilling around 40 and ETH around 60. The panic’s gone, for now,” wrote analysts at Amberdata.

Sentiment in the options market is nuanced, with short-dated puts commanding premiums earlier this week as traders hedged risks.

Yet, strong demand for long-dated Ethereum calls extending into 2026 shows optimism about the asset’s long-term prospects.

Meanwhile, this major options expiry event coincides with major macroeconomic developments, including key US inflation data (CPI) and the Federal Open Market Committee (FOMC) meeting.

“…one headline, one surprise, and vol could explode all over again,” Amberdata analysts warned.

Traders must consider potential catalysts as they evaluate risk and opportunity after expiry.

Historically, options expiry has contributed to short-term price swings and volatility spikes. However, conditions tend to stabilize after 8:00 UTC as traders adjust to the new market environment.