Monero and Zcash thrive amid $14 billion Bitcoin seizure, Japan mulls crypto insider trading ban

- The US Department of Justice confirmed the largest-ever crypto seizure of 127,271 Bitcoin from Cambodia’s Prince Group.

- Japan is structuring a potential ban on crypto insider trading.

- Privacy coins hold their ground as increasing regulatory oversight boosts demand for privacy, helping to navigate market volatility.

Privacy coins such as Monero (XMR) and Zcash (ZEC) are among the tokens trading in the green at press time on Wednesday as the broader cryptocurrency market faces the heat of renewed tariff discussions between the world's two largest economies. The short-term catalysts helping Monero and Zcash hold their ground are the $14 billion in Bitcoin seized by the US Department of Justice and Japan’s efforts to ban crypto-related insider trading.

Crypto regulations oversight tightens from the East and the West

The US Department of Justice has achieved what’s being called the largest crypto seizure ever, of 127,271 Bitcoin, in a case against Chen Zhi, founder of Prince Group in Cambodia. Zhi, a UK and Cambodian national, was indicted for conspiring in money laundering and wire fraud.

Prince Group, now flagged as a transnational criminal operation, specialized in the “Pig butchering scam,” which involves honey trapping individuals to swipe funds or crypto.

According to Elliptic, a blockchain analytics and crypto compliance agency, the seized Bitcoin traces back to a theft from LuBian, a Bitcoin mining agency operating from China and Iran in 2020. Elliptic added, “It remains unclear how the bitcoins came to be in US custody. It’s also unclear who 'stole' the bitcoins from Chen/LuBian or whether a theft really took place.”

On the opposite side of the world, Japan is working out a strategy to ban crypto-related insider trading, according to a Nikkei Asia report on Tuesday. With the new rules in motion, Japan’s Securities and Exchange Surveillance Commission regulator could investigate and legally penalize individuals or institutions involved in crypto insider trading.

By the end of 2025, Japan’s Financial Services Agency could propose a regulatory framework with potential amendments to its primary regulation, the Financial Instruments and Exchange Act.

With regulatory oversight increasing in the US and Japan, large wallet investors in the crypto market could shift to privacy coins like Monero or Zcash to preserve financial privacy.

Privacy coins in the green, retail interest remains divided

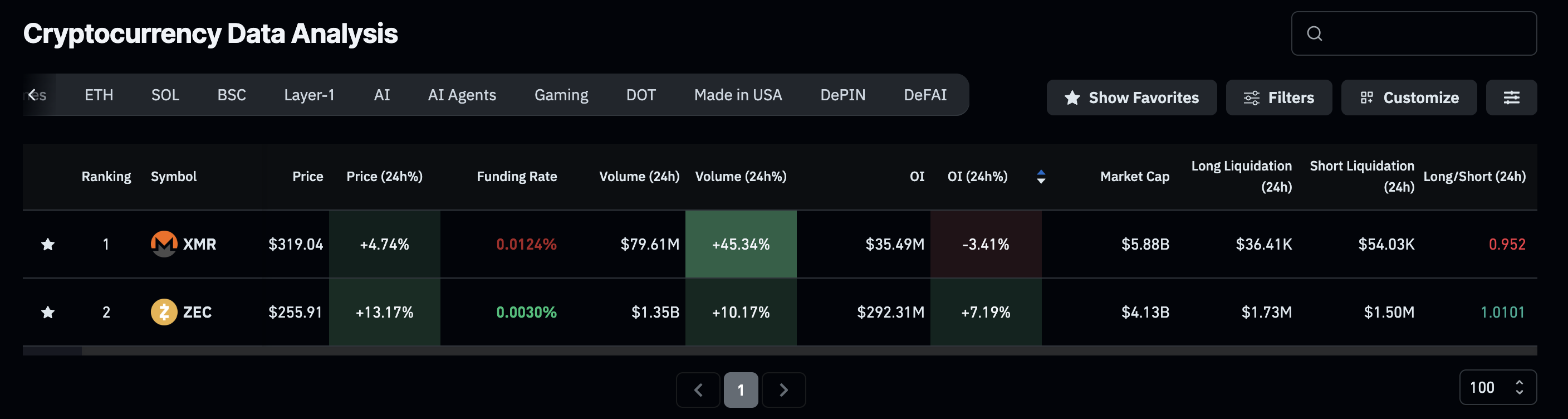

The retail interest in privacy coins, Monero and Zcash, remains divided, with traders more confident in the Zcash rally. According to CoinGlass data, the futures Open Interest (OI) of Monero has dropped by over 3% in the last 24 hours, reaching $35.49 million. At the same time, the Zcash futures OI has increased by 7% reaching $292.31 million. Typically, a surge in OI, which represents the notional value of all outstanding derivatives contracts, indicates that traders are building long positions.

Privacy coins Open Interest. Source: CoinGlass

Additionally, the size difference in the OI pool of both privacy coins corroborates the larger retail interest towards Zcash.

Monero extends the uptrend for the fifth consecutive day, bouncing off the 100-day Exponential Moving Average (EMA) at $295. At the time of writing, XMR trades above $320 as the rebound seeks to overcome the 14% loss from Friday.

The short-term recovery brings a positive shift to the momentum indicators on the daily chart as the Relative Strength Index (RSI) at 56 has crossed above the midline. Additionally, the Moving Average Convergence Divergence (MACD) approaches its signal line for a potential crossover, which could suggest rise in bullish momentum.

The immediate resistance to the largest privacy coin, valued at $5.88 billion in market capitalization, lies at the $345 mark, which has been capping the price since mid-June. A clean push above this level could extend the XMR rally to the June 3 high at $372.

XMR/USDT daily price chart.

On the flip side, the uptrending 50-day, 100-day, and 200-day EMAs could act as dynamic support levels at $300, $295, and $283, respectively.

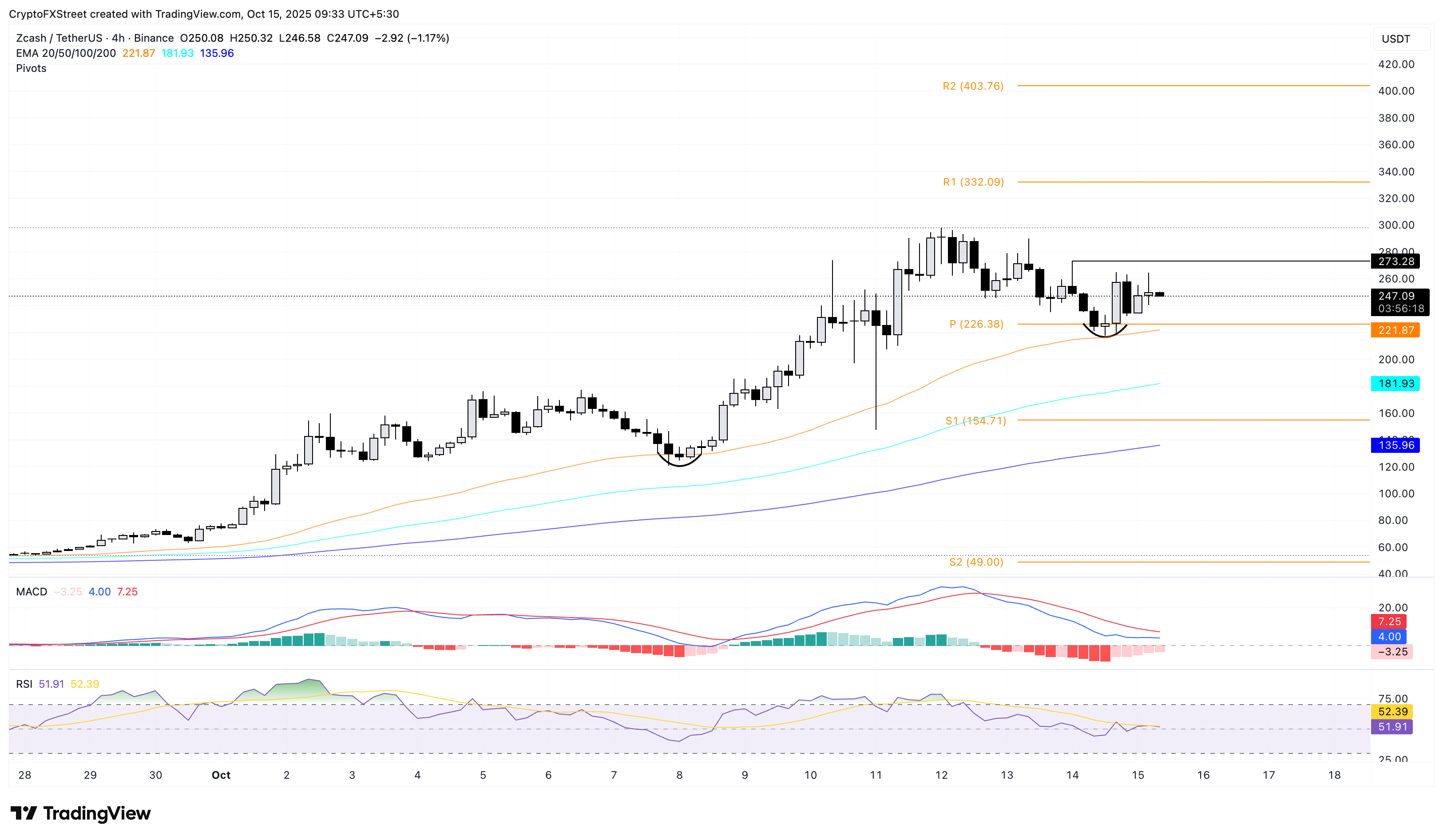

Meanwhile, Zcash makes a bullish turnaround from the 50-period EMA on the 4-hour chart, which extends the bullish trend for the second time this month. At the time of writing, ZEC takes a sideways shift between the Pivot Point level at $226 and Tuesday's peak of $273. A decisive close beyond these boundaries could decide the upcoming uptrend.

If ZEC crosses above $273, it could target the $300 psychological level, followed by the R1 Pivot Point level at $332.

ZEC/USDT daily price chart.

On the downside, a break below the Pivot Point level at $226 and the 50-period EMA at $222 could lead the Zcash price to test the 100-period EMA near $182.