Bitcoin OG Sends Another 100 BTC to Kraken After $160 Million Short

Bitcoin is showing signs of recovery after Friday’s sharp decline, triggered by comments from US President Donald Trump regarding new tariffs on China. The remarks sent shockwaves through global markets, with risk assets—including cryptocurrencies—experiencing heightened volatility. BTC plunged to as low as $103K before rebounding, leaving traders and analysts assessing whether this correction marks the beginning of a deeper retracement or just another shakeout.

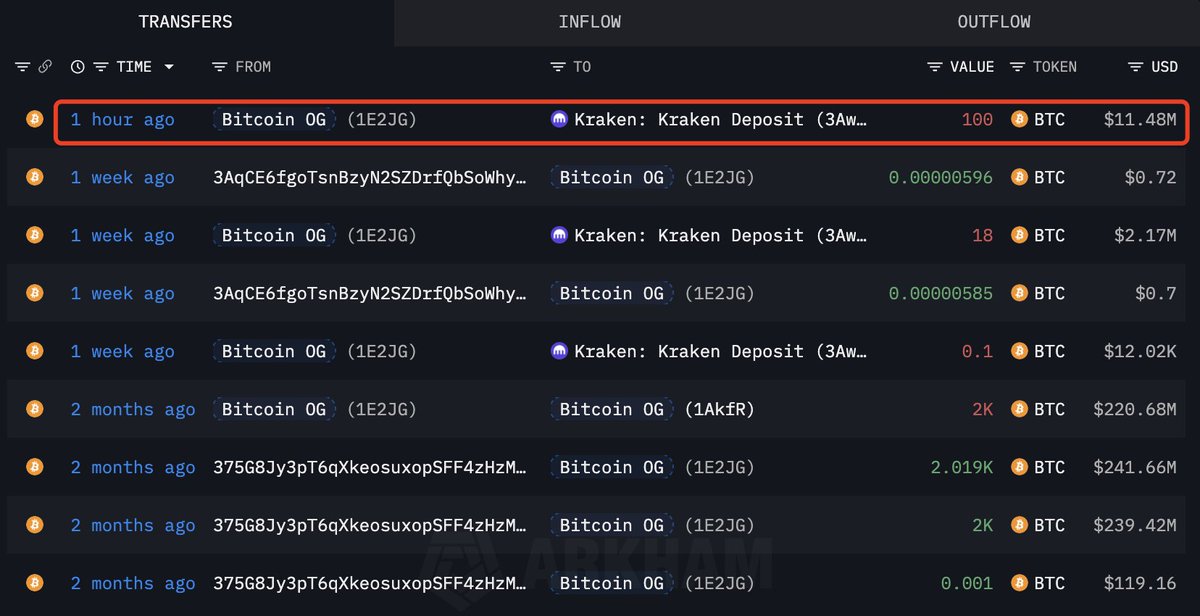

Adding intrigue to the situation, a mysterious whale, known by many as a “BitcoinOG,” profited more than $160 million in just 30 hours during the crash. The trader reportedly executed large short positions on both Bitcoin and Ethereum, perfectly timing the market’s downturn. Now, in a surprising twist, this same entity is doubling down. Lookonchain data shows that the trader has opened additional short positions totaling 1,423 BTC—worth approximately $161 million at current prices.

The move has sparked widespread speculation across the crypto community. While some see it as a calculated hedge anticipating further downside, others interpret it as a potential market manipulation attempt. Regardless, Bitcoin’s ability to recover amid such heavy short positioning will be a key test of market resilience in the days ahead.

Bitcoin OG Moves Another 100 BTC: A Signal or a Setup?

According to data from Lookonchain, the mysterious trader known as “Bitcoin OG” has just deposited another 100 BTC—worth approximately $11.48 million—into Kraken within the past hour.

Depositing BTC to exchanges like Kraken often signals a potential intent to sell or to use the coins as collateral for derivatives trading. Given that this trader has already built a massive short position—currently estimated at 1,423 BTC ($161 million)—this additional transfer may suggest that the individual is either increasing leverage or preparing for further downside. It’s a classic playbook move: send BTC to an exchange ahead of shorting or market-making activity.

However, such transactions can also act as psychological catalysts, amplifying fear across the market. When large wallets move funds after volatile events, it often triggers panic among retail traders, who interpret it as a prelude to another sell-off.

The coming days will therefore be crucial. If Bitcoin holds above $113K–$115K despite these bearish signals, it could indicate that selling pressure is being absorbed by strong hands. Conversely, failure to maintain this support could trigger another cascade of liquidations toward the $108K–$110K zone. In short, the market is entering a decisive phase—where Bitcoin’s resilience will either confirm recovery or pave the way for another sharp leg down.

Price Faces Resistance as Recovery Slows

Bitcoin’s daily chart shows the market struggling to regain momentum after last week’s dramatic sell-off. Following the drop to $103K, BTC rebounded sharply but now faces resistance near the $117,500 level — a critical zone that previously acted as both support and resistance throughout August and September.

The price is currently trading around $114,300, sitting just below the 50-day moving average (blue line), while the 100-day (green) and 200-day (red) moving averages remain slightly below, supporting the current structure around $112K and $107K, respectively. This alignment suggests that BTC remains in a medium-term uptrend, but the current consolidation could define the next major move.

If Bitcoin manages to close above $117,500, it could confirm a bullish continuation toward $122K and eventually retest the $125K level. Conversely, failure to break through resistance may trigger renewed selling pressure, potentially dragging the price back toward $110K or even $107K.

Momentum indicators show that buyers are cautious, with limited follow-through after each rally attempt. For now, Bitcoin’s outlook remains neutral to slightly bullish—but traders should watch for confirmation of direction around the $117.5K mark, which will likely determine whether the next leg is a recovery or another corrective wave.

Featured image from ChatGPT, chart from TradingView.com