XRP Whales Are Selling: $50 Million Exiting Wallets Every Day

On-chain data shows the 30-day netflow of the XRP whales has remained deep negative recently, a sign that the asset is under persistent selling pressure.

XRP Whale Flow Is At A Negative $50 Million Per Day At The Moment

As explained by CryptoQuant community analyst Maartunn in a new post on X, XRP whales have been offloading coins recently. “Whales” refer to the big-money investors who hold significant amounts in their wallets and carry some influence in the market.

The behavior of these key investors can often be worth keeping an eye on, as even if it may not always directly correlate with the asset’s trajectory, it can still be revealing about how the influential entities are feeling about the cryptocurrency.

There are many ways to track the behavior of the XRP whales, with one such being the metric cited by Maartunn: the Whale Flow. This indicator measures the net amount of coins that’s entering into or exiting out of the wallets of this cohort.

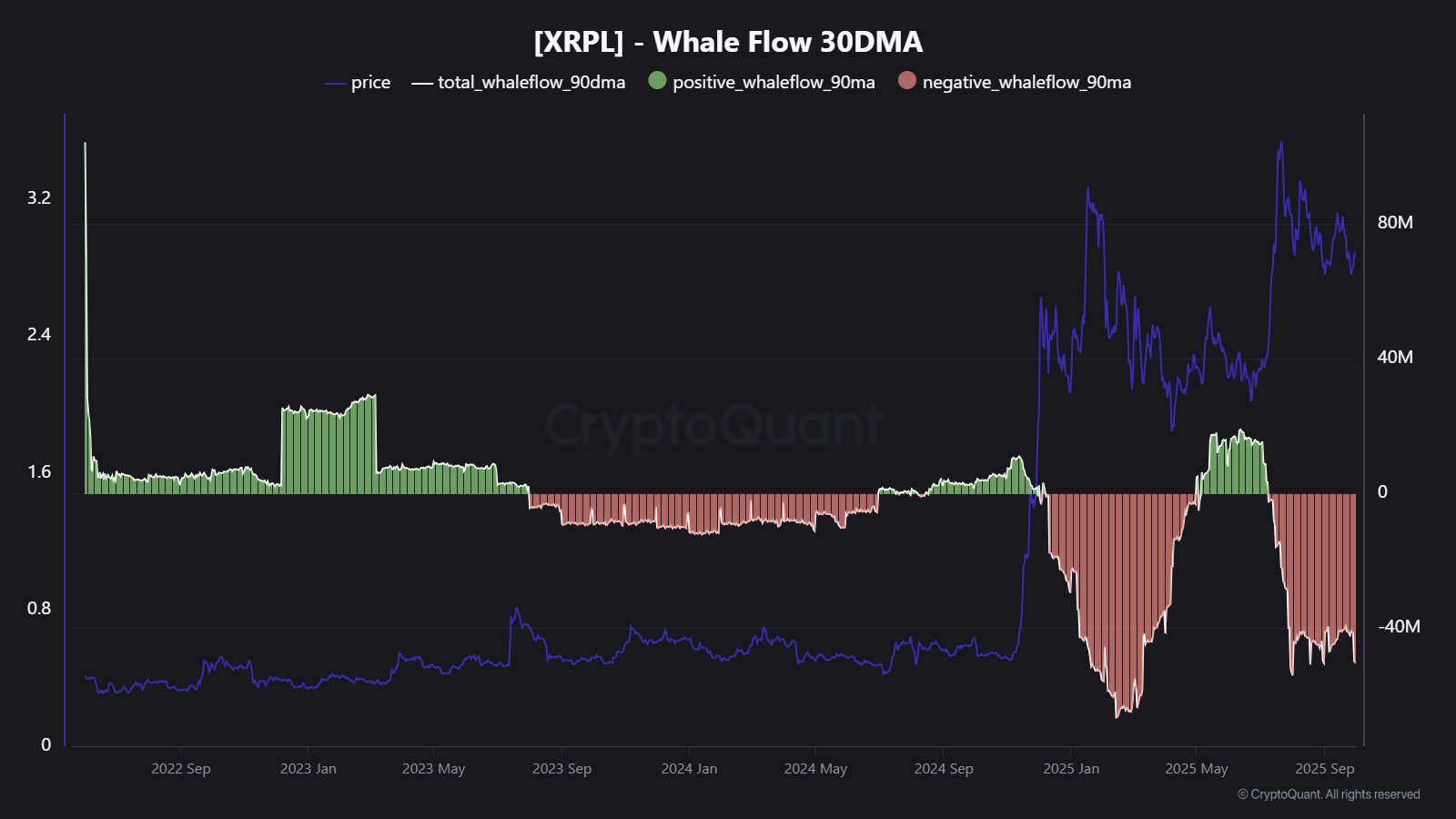

Below is the chart shared by the analyst that shows the trend in the 30-day moving average (MA) of the XRP Whale Flow over the last few years:

As is visible in the above graph, the 30-day MA XRP Whale Flow plunged to a highly negative value in July as the coin reached its top above $3.6. This suggests that the large holders took the opportunity of the rally to participate in profit-taking.

Interestingly, since this plummet in the indicator, its value has remained at a similarly red value until today, meaning that the whales have only continued to apply selling pressure.

At present, the metric is sitting at a negative value of $50 million per day, meaning that whales have been withdrawing an average of $50 million every day for the past month. This could be a reason why the cryptocurrency hasn’t seen any big rally recently, while Bitcoin and other coins have been flying.

In some other news, analyst Ali Martinez has identified a price level that could help turn XRP around. As the below chart shared by Martinez in an X post shows, the coin has seemingly been trading inside a Parallel Channel over the last couple of months.

A Parallel Channel is a technical analysis (TA) consolidation pattern that forms when an asset trades between two parallel trendlines. The lower level of the pattern acts as a support line. From the chart, it’s visible that in the case of this XRP Parallel Channel, it’s situated at $2.73.

The analyst has noted that if this support level holds, the coin could see a rebound to the upper level at $3.10.

XRP Price

At the time of writing, XRP is trading around $0.745, down more than 11% over the last week.