Long-Term Holders Sell 295K Bitcoin In 30 Days: Demand Keeps The Market Stable

Bitcoin has entered a phase of heightened volatility and uncertainty, with the market showing signs of indecision after weeks of strong momentum. The leading cryptocurrency continues to trade just below its all-time high near $126,000, with bulls and bears now locked in a battle to determine the next major move. Some analysts believe Bitcoin is preparing to break through resistance and enter price discovery, targeting new record highs. Others, however, warn of a potential short-term correction, arguing that market euphoria may have reached unsustainable levels.

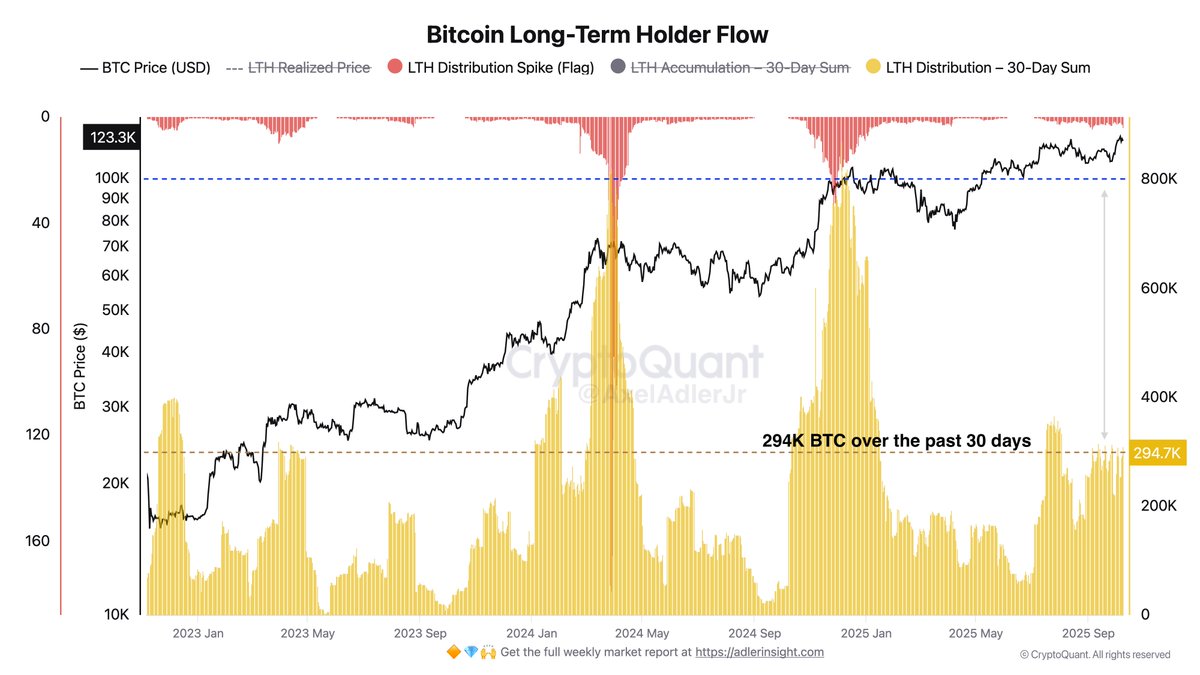

According to onchain data, long-term holders have started taking profits, a behavior often seen during key inflection points in the market. While this wave of distribution has not yet reached extreme levels, it does highlight a gradual transfer of coins from seasoned investors to newer participants — a dynamic that can precede increased volatility.

Despite this selling activity, the broader market structure remains intact, with institutional demand and ETF inflows continuing to provide support. As the week unfolds, Bitcoin’s ability to hold above the $120,000 support zone will be crucial. A decisive move in either direction could set the tone for the next major trend, shaping sentiment across the entire crypto market.

Long-Term Holders Selling Momentum Builds

Top analyst Axel Adler shared key onchain data showing that Long-Term Holders (LTHs) have sold 295,000 BTC over the past 30 days, averaging around 9,800 BTC per day. While this level of selling represents elevated activity, Adler points out that it is not extreme compared to the distribution peaks seen in May and December 2024, when over 800,000 BTC were sold. Historically, such selling phases have accompanied profit-taking events during major bullish runs — not necessarily signaling the end of a cycle, but rather a rotation of supply between experienced holders and new market participants.

Adler explains that this flow remains compatible with a bullish market structure, provided that demand continues to absorb the coins being sold. Current data supports this view: inflows from institutional investors and ETF-related buying are offsetting much of the selling pressure. This balance suggests that while LTHs are realizing gains, the market remains structurally healthy, with strong demand sustaining prices above key support zones.

The coming days could prove decisive for Bitcoin’s direction. Many analysts are watching whether BTC can reclaim the $125,000 resistance and push into price discovery territory. If buying momentum holds and the distribution remains well absorbed, Bitcoin could be gearing up for its next expansive move — one that could define the next phase of this cycle and set new all-time highs. However, failure to maintain current levels could trigger a temporary cooling phase before the broader trend resumes.

Key Support Around $120K Holds Firm

Bitcoin is currently trading near $121,975, consolidating after a volatile week marked by sharp movements above and below the $122,000 level. The 4-hour chart shows that BTC remains in a short-term corrective phase following its rejection near the $126,000 all-time high, but the broader structure continues to favor the bulls as long as price holds above $120,000.

The 50-period moving average (blue line) is now acting as immediate support, providing a potential rebound zone if buying pressure returns. Below that, the 117,500 level — highlighted as a major horizontal support — remains the key level to watch. A breakdown below this point could open the door to deeper retracements toward $114,000, where the 200-period moving average lies.

On the upside, Bitcoin needs to reclaim $123,000–$124,000 with strong volume to confirm renewed bullish momentum. A breakout above $125,000 would likely invalidate the correction and signal the start of a new leg toward price discovery.

BTC is consolidating within a healthy range after a strong rally. As long as buyers continue defending the current support area, the market structure remains bullish — setting the stage for another potential push toward new all-time highs in the coming sessions.

Featured image from ChatGPT, chart from TradingView.com