Retail Investors Return to Binance As Bitcoin Hits New All-Time High

Bitcoin has surged to a new all-time high, reaching $126,000, before entering a short consolidation phase as traders await confirmation of a breakout into uncharted territory. The move marks another milestone in Bitcoin’s relentless uptrend, fueled by optimism across both institutional and retail segments. However, the market now faces a critical test — whether bulls can sustain momentum above this key psychological level and push the price toward higher valuations.

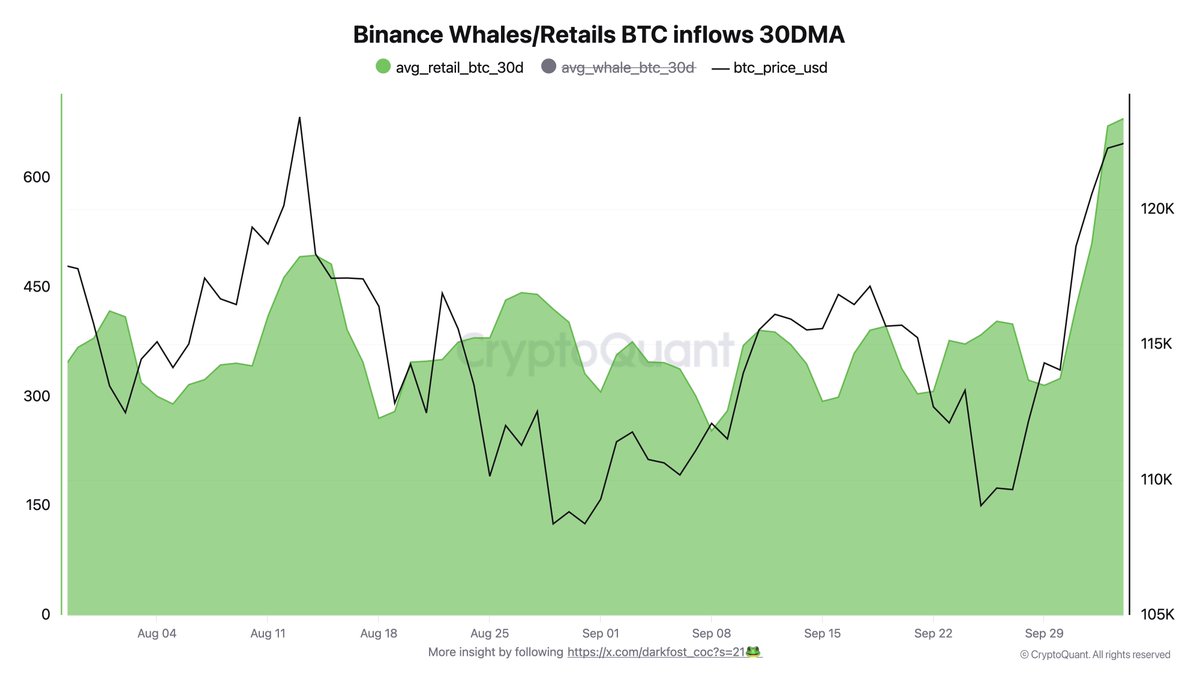

Top analyst Darkfost shared new data suggesting a notable behavioral shift among smaller investors. According to on-chain flows, BTC inflows to Binance from addresses holding less than 1 BTC have risen sharply, signaling a resurgence of retail activity. This category of investors had been largely dormant during earlier phases of the rally, when institutional demand dominated price action.

The renewed participation of retail traders suggests that confidence is returning to the market, a common characteristic seen in late-stage bullish phases. While the total volume from these smaller addresses remains modest compared to institutional flows, their growing activity often amplifies volatility and momentum. With Bitcoin consolidating just below its record highs, the coming days could define whether this retail revival fuels the next leg of the rally or triggers short-term profit-taking.

Retail Activity Returns As Institutions Hold Steady

According to Darkfost, the latest onchain data reveals a clear resurgence of retail participation in the Bitcoin market. He highlights that the monthly average of BTC inflows to Binance from wallets holding less than 1 BTC has climbed to levels not seen in months. While the total transferred volume from this group remains relatively small compared to institutional flows, the trend marks a meaningful behavioral shift among smaller investors who are re-entering the market as Bitcoin trades around its new all-time high.

This renewed retail activity comes after months of low engagement, when market dynamics were largely dictated by institutional players and corporate treasuries steadily accumulating Bitcoin. Darkfost notes that while large holders maintain a disciplined, long-term accumulation strategy, retail traders are showing signs of classic cyclical behavior — responding quickly to price surges and momentum rather than long-term value metrics.

Interestingly, this divergence between institutional accumulation and retail speculation often defines key stages in Bitcoin’s market cycles. Historically, retail re-entry near previous highs tends to increase volatility but also strengthens liquidity and market depth, allowing for larger price expansions.

Institutional and treasury demand continues to provide structural support, while the revival of retail enthusiasm adds fuel to Bitcoin’s bullish momentum. If both forces remain aligned, the combination could set the stage for an extended move higher — but analysts also warn that excessive retail euphoria can precede short-term corrections. In either case, the return of smaller investors underscores renewed confidence in Bitcoin’s long-term narrative and the broader market recovery underway.

Price Consolidation Below $125K

Bitcoin is currently trading around $124,100, consolidating just below its recent all-time high at $125,000. The chart shows that BTC has entered a brief cooling phase after a sharp 15% rally from the $109,000 region earlier this month. Despite minor retracements, the overall market structure remains strongly bullish, with price action comfortably above the 50-day and 200-day moving averages, indicating sustained upward momentum.

The $125,000 level is now acting as a psychological barrier and short-term resistance. A clean breakout and daily close above this mark would confirm continuation into price discovery, potentially targeting $130,000–$135,000 in the coming weeks. On the downside, the $117,500 zone — the previous resistance and now a confirmed support level — remains a key area to watch if volatility increases.

The broader sentiment stays bullish as both institutional and retail demand grow in parallel. With whale selling pressure easing and smaller investors becoming more active, Bitcoin’s short-term trend appears healthy, setting the stage for another breakout attempt if buyers maintain control above $120,000.

Featured image from ChatGPT, chart from TradingView.com