Pi Network Price Forecast: PI hibernates as CEXs outflow surge, DEX launch goes muted

- Pi Network consolidates above the $0.2565 support level for the eleventh consecutive day.

- Centralized Exchanges record outflows of nearly 13 million PI in the last 24 hours.

- The launch of DEX and other DeFi features on Pi Network’s testnet goes muted.

Pi Network (PI) price holds steady in a consolidation phase for the eleventh consecutive day, above the $0.2565 support level. Despite the recent net outflows of nearly 13 million PI tokens from Centralized Exchanges (CEXs) in the last 24 hours and the announcement of Decentralized Finance (DeFi) features on Pi Testnet after the Token2049 event, Pi Network struggles to gain traction.

Pi Network’s DeFi expansion goes under the radar

Pi Network’s co-founder, Nicolas Kokkalis, reactivated his X account on Friday, posting the launch of Pi Decentralized Exchange (DEX), AMM Liquidity Pools, and Token Creation Tools, which are coming live on Pi Testnet. This marks the next step in smart contract development on the Pi Network, aligning with the ongoing update to its foundation blockchain, Stellar, to its latest version, protocol 23.

The launch of such DeFi features expands the Pi Network’s utility to real-world use cases, from just a mobile mining cryptocurrency. However, its testnet launch failed to uplift the investors' sentiment, while PI price expands its consolidation.

Declining CEXs' reserves struggle to limit selling pressure

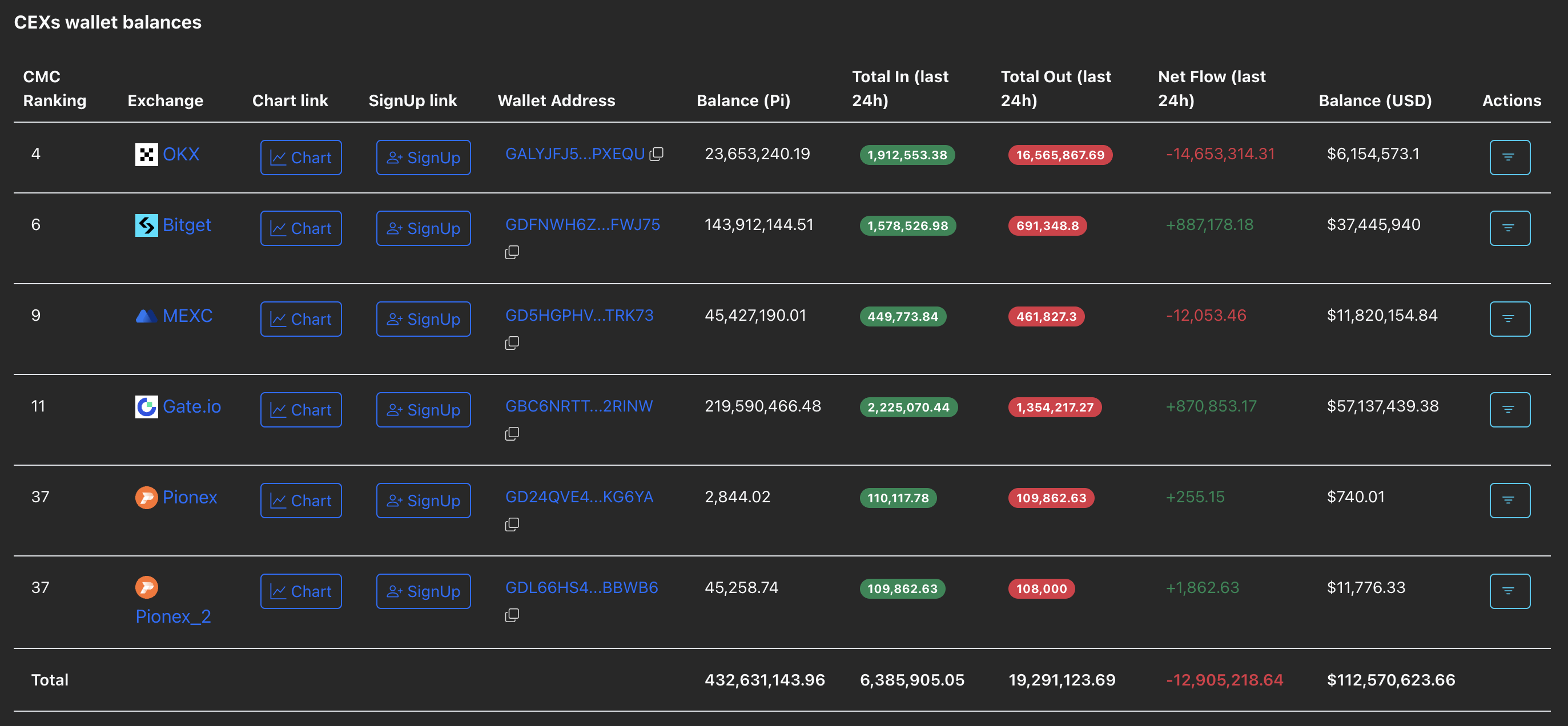

A decline in CEX wallet balance signals a potential decrease in selling pressure, which could foster consolidation or the next potential price surge. PiScan data shows a net outflow of 12.90 million PI tokens in the last 24 hours, which accounts for nearly 3% of the 432.63 million PI supply available on CEXs.

CEXs' wallet balances. Source: PiScan

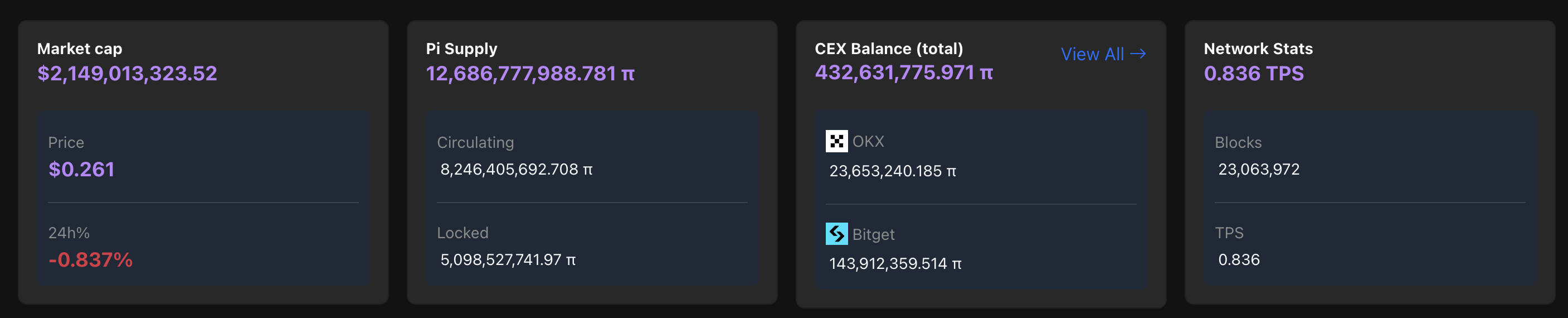

Still, the majority of the tokens held off-exchanges, the risk of a supply dump persists. Based on the PiScan data, the CEXs' wallet balances account for only 5.24% of the PI circulating supply, which is 8.24 billion tokens.

Pi Network data. Source: PiScan

Downside risk looms over the PI consolidation phase

Pi Network holds above the $0.2600 level at the time of writing on Monday, extending the sideways shift following a 6% decline on September 26. The consolidation phase is at risk of a downside release as the trend momentum and retail interest decline.

The technical indicators on the daily chart suggest a slowdown as the Relative Strength Index (RSI) at 29 moves flat at the oversold boundary line. Still, the Moving Average Convergence Divergence (MACD) converges with its signal line, offering a bullish perspective if a crossover occurs, which would indicate a rise in trend momentum.

A potential bounce back in PI from the $0.2565 support could test the previous week’s high at $0.2796, followed by the $0.3000 round figure.

PI/USDT daily price chart.

Looking down, if PI slips below the $0.2565 level, it could extend the decline to the $0.2000 round figure.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.